CA-CPT Question Paper December (Session 1) - 2017 - CA CPT MCQ

30 Questions MCQ Test - CA-CPT Question Paper December (Session 1) - 2017

A trader purchased goods for Rs.4,000 at a trade discount of 5%. As he paid the amount immediately, a cash discount of Rs.100 was also allowed. In this case, Purchases A/c is debited by

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Some of the goods purchased for trading are used for the construction of business premises. The account to be credited is___________

The assets that can be converted into cash within a short period (i.e. 1 year or less) are known as

Starting with the Debit balance as per Cash Book, cheques deposited but not cleared will be

Increase in the value of Assets Rs.1,00,000 Decrease in the value of Liabilities Rs.50,000.Then owner's equity will

Net profit before charging manager's commission is Rs.49,500 and the manager is to be allowed a commission of 10% on the profit after charging such commission. Commission amount will be___

Goods costing Rs.8,000 were destroyed by fire. Insurance company accepted a claim of Rs.5,000. The amount to be credited to Purchases / Trading A/c will be___

Capital introduced at the beginning by ram rs. 13,000 further capital introduced during the year rs 3,000. Drawings rs 4,000 and closing is rs 20,000. The amount of net pro it will be

Rent paid on 1st October, 2016 for the year to 30th September, 2017 was Rs.1,50,000 and rent paid on 1st October, 2017 for the year to 30th September, 2018 was Rs.1,80,000. Rent paid, as shown in the Profit and Loss account for the year ended 31st December 2017, would be:

The purpose of accommodation bill is:

On 15.02.17 X draws a bill on Y for 30 days. Y accepted the bill on 18.02.17. The maturity date of the bill will be:

For mutual accommodation of Mita and Rita, Rita accepted a bill drawn on her by Mita for Rs.7,500. The said bill is discounted by Mita at Rs.7,400 and remitted l/3rd of the proceeds to Rita. To honour the bill, the amount to be paid by Mita to Rita on the due date will be

Ram draws a bill on Rahim for Rs.15,000. The bill was discounted with Bank at Rs.14,900. On the due date the bill was dishonoured and the noting charges amounted to Rs.50. What is the amount to be debited by Bank to Ram's account?

G draws a bill on R. G endorses the bill to S. On the due date the bill is dishonoured. On dishonour, which account is credited in the books of G?

600 boxes of goods are consigned at a cost of Rs.250 each. Consignor's expenses amounted A o to Rs.3,000. l/6th of the boxes are still in transit. 3/5th of the boxes received consignee are sold at Rs.300 each. The value goods in transit will be

MN of Mumbai sent out goods costing Rs.4,00,000 to QR of Delhi on consignment basis. Consignee is paid an ordinary commission of 2% and a delcredere commission of 3% on sales. The entire goods were sold by consignee for Rs.5,00,000. However, the consignee could recover Rs.4,92,000 from the trade receivables. In the books of consignee, the commission to be transferred to Profit & Loss A/c will be____

Mr. Mehta sent 1,000 shirts costing Rs.400 each to Mr. Kehta on consignment basis. Mehta paid Rs.20,000 as expenses. Kehta sold 900 shirts at Rs.500 each. His selling expenses amounted to Rs.15,000. Find the value of closing inventory.

P & Q entered into a joint venture. P purchased 5,000 units of goods at Rs.30 each. Q sold Rs.4,800 units at Rs.50 each. The remaining goods were taken over by Q at a value of Rs.5,000. P is allowed a commission of 2% on purchases and Q is allowed a commission of 1% on sales. Find the share of Q in the profit of joint venture.

Mukesh and Vimal entered into a Joint Venture. Mukesh purchased goods for Rs.36,000 and paid Rs.3,900 as expenses. Vimal purchased goods for Rs.17,000 and paid Rs.3,000 as expenses. Entire goods were sold for Rs.65,000. They share profits and losses in the ratio of 2:1. The final remittance to Mukesh will be_______

Which of the following expenses is not included in the acquisition cost of a plant and equipment?

A machinery was purchased for Rs.6,00,000 on 1.04.2012 and paid Rs.30,000 on its installation. It is estimated that the useful life of the machinery is 10 years and its scrap value is Rs.20,000. The amount of depreciation to be charged for the year ending 31.03.2017 will be____

The book value of a machinery on 1.04.16 was Rs.70,000. Depreciation is charged at 10% p.a. under W.D.V Method on 31st March every year. The machine was sold for Rs.60,000 on 1.08.17. Calculate the Profit / Loss on sale of machinery

The objectives of providing depreciation on an asset are

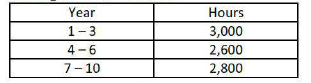

A machine is purchased for Rs.3,00,000. Its estimated working life is 28,000 hours, the Scrap value is Rs.20,000. Anticipated pattern of working hours are as follows:

Depreciation for the 8th year is_

A sales return of Rs.2,000 has been wrongly posted to the credit of Purchase Returns account, but has been correctly posted to the customer's account. The effect on the tri balance will be

While finalizing the current year's profit, the company realized that there was an error in the valuation of closing inventory of the previous year. In the previous year, closing inventory was valued more by Rs.50,000. As a result.

An amount of Rs.500 received from a customer has been debited to his account. This error is classified a s ________ .

Under sales on return or approval basis, the ownership of goods is passed only

Goods were sent to a customer on Sale or Return basis at cost +30%. The invoice price is Rs.6,500. At the end of the year market value of the goods is 5% less than the cost. Closing inventory is valued at