Test: Recording of Transactions - I: Business Transactions- Case Based Type Questions - SSC CGL MCQ

15 Questions MCQ Test - Test: Recording of Transactions - I: Business Transactions- Case Based Type Questions

Read the following hypothetical Case Study and answer the given questions:

The cash book of Ramesh showed the cash balance of ₹15,000 and a bank balance of ₹25,000 as on 30th April 2019. On the 1st of May, he purchased goods from Ramesh worth ₹12,000 and paid it by cheque. He sold goods on 3rd of May for cash and deposited the proceeds into a bank worth ₹10,000. On the 14th of May, he paid the electricity bill by cheque worth ₹9,000. On the 15th of May from Rashi, he purchased goods worth ₹10,000 at a discount of 20% and sold it to Juhi at a profit of 25%. Both the transactions were on credit. On the 26th of May, he withdrew ₹5,000 for office use. On 29th May, he received 70% of the cash from Juhi and paid 50% of it to Rashi and deposited the remaining in the bank. He also paid ₹1,500 as salaries to his employee on 31st of May. He also had the following transactions:

• He received a telephone bill worth ₹500.

• He withdrew ₹2,500 for his personal use.

• He gave ₹500 from for the cash register to his nephew as a gift.

• Goods worth ₹2,000 were lost due to damages.

Where will the transaction of 1st of May recorded?

Read the following hypothetical Case Study and answer the given questions:

The cash book of Ramesh showed the cash balance of ₹15,000 and a bank balance of ₹25,000 as on 30th April 2019. On the 1st of May, he purchased goods from Ramesh worth ₹12,000 and paid it by cheque. He sold goods on 3rd of May for cash and deposited the proceeds into a bank worth ₹10,000. On the 14th of May, he paid the electricity bill by cheque worth ₹9,000. On the 15th of May from Rashi, he purchased goods worth ₹10,000 at a discount of 20% and sold it to Juhi at a profit of 25%. Both the transactions were on credit. On the 26th of May, he withdrew ₹5,000 for office use. On 29th May, he received 70% of the cash from Juhi and paid 50% of it to Rashi and deposited the remaining in the bank. He also paid ₹1,500 as salaries to his employee on 31st of May. He also had the following transactions:

• He received a telephone bill worth ₹500.

• He withdrew ₹2,500 for his personal use.

• He gave ₹500 from for the cash register to his nephew as a gift.

• Goods worth ₹2,000 were lost due to damages

There will be a contra entry for the transaction on which date?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Read the following hypothetical Case Study and answer the given questions:

The cash book of Ramesh showed the cash balance of ₹15,000 and a bank balance of ₹25,000 as on 30th April 2019. On the 1st of May, he purchased goods from Ramesh worth ₹12,000 and paid it by cheque. He sold goods on 3rd of May for cash and deposited the proceeds into a bank worth ₹10,000. On the 14th of May, he paid the electricity bill by cheque worth ₹9,000. On the 15th of May from Rashi, he purchased goods worth ₹10,000 at a discount of 20% and sold it to Juhi at a profit of 25%. Both the transactions were on credit. On the 26th of May, he withdrew ₹5,000 for office use. On 29th May, he received 70% of the cash from Juhi and paid 50% of it to Rashi and deposited the remaining in the bank. He also paid ₹1,500 as salaries to his employee on 31st of May. He also had the following transactions:

• He received a telephone bill worth ₹500.

• He withdrew ₹2,500 for his personal use.

• He gave ₹500 from for the cash register to his nephew as a gift.

• Goods worth ₹2,000 were lost due to damages

The transaction on the 15th of May will be recorded in ______________.

Read the following hypothetical Case Study and answer the given questions:

The cash book of Ramesh showed the cash balance of ₹15,000 and a bank balance of ₹25,000 as on 30th April 2019. On the 1st of May, he purchased goods from Ramesh worth ₹12,000 and paid it by cheque. He sold goods on 3rd of May for cash and deposited the proceeds into a bank worth ₹10,000. On the 14th of May, he paid the electricity bill by cheque worth ₹9,000. On the 15th of May from Rashi, he purchased goods worth ₹10,000 at a discount of 20% and sold it to Juhi at a profit of 25%. Both the transactions were on credit. On the 26th of May, he withdrew ₹5,000 for office use. On 29th May, he received 70% of the cash from Juhi and paid 50% of it to Rashi and deposited the remaining in the bank. He also paid ₹1,500 as salaries to his employee on 31st of May. He also had the following transactions:

• He received a telephone bill worth ₹500.

• He withdrew ₹2,500 for his personal use.

• He gave ₹500 from for the cash register to his nephew as a gift.

• Goods worth ₹2,000 were lost due to damages

The transaction where he gave cash to his nephew will be recorded as ___________ in the Cash column of the Cash Book.

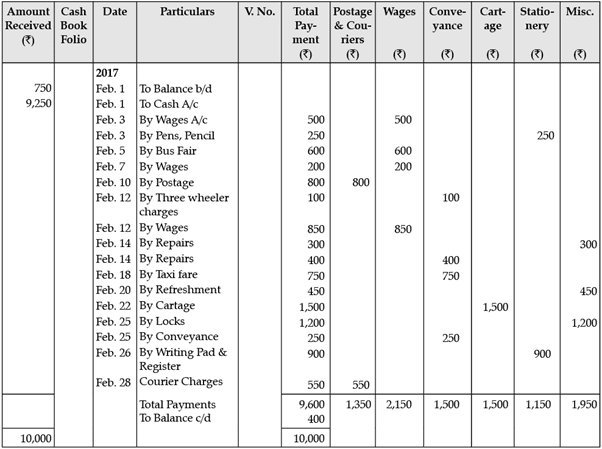

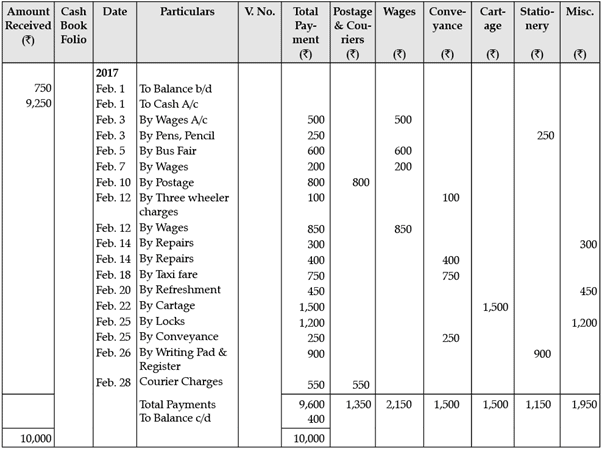

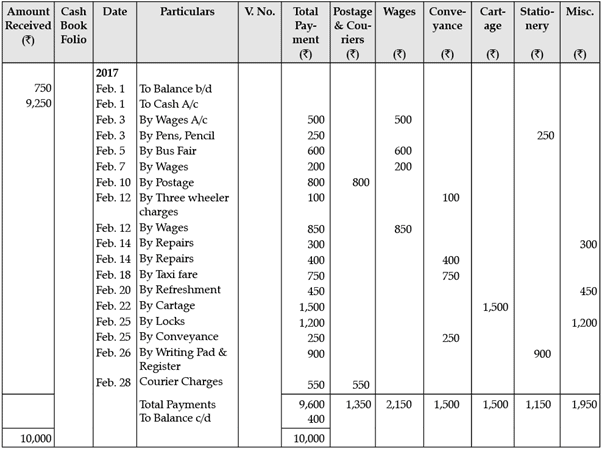

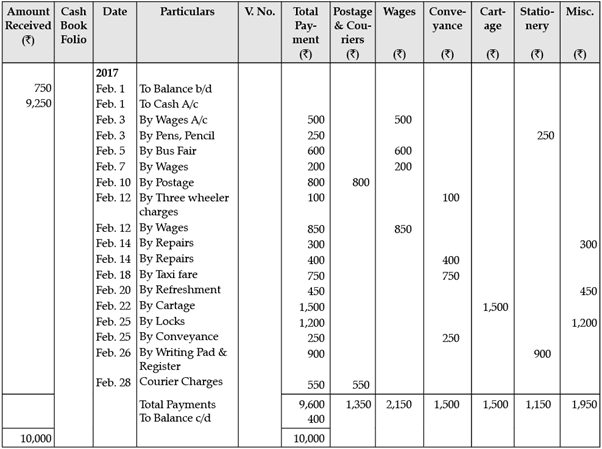

Study the following hypothetical Extract of the Petty Cash Book in the books of Baruah Traders and answer the given questions:

In the Books of Barua Traders Petty Cash Book

What is the amount of the cash to be received by the petty cashier under the imprest system?

Study the following hypothetical Extract of the Petty Cash Book in the books of Baruah Traders and answer the given questions:

In the Books of Barua Traders Petty Cash Book

_________ was the amount paid for writing pad and register on the 26th of February.

Study the following hypothetical Extract of the Petty Cash Book in the books of Baruah Traders and answer the given questions:

In the Books of Barua Traders Petty Cash Book

________ should have been recorded in conveyance and not in wages column of the analytical petty cash book.

Study the following hypothetical Extract of the Petty Cash Book in the books of Baruah Traders and answer the given questions:

In the Books of Barua Traders Petty Cash Book

_________ amount will be given to the petty cashier in the month of March by the main cashier.

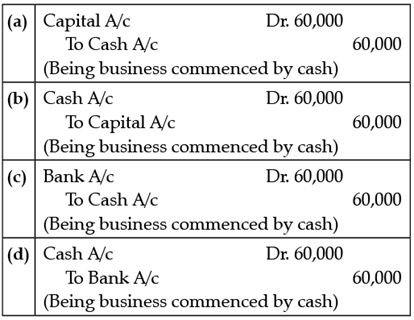

Read the following hypothetical Case Study and answer the given questions:

Mr. Manoj Manohar Lal Started a new business with a cash of ₹60,000 by the name Manohar Lal and Sons on the 1st of March 2020. For the business, he had to purchase furniture on the 2nd of March worth ₹10,000. He decided to buy the goods for cash as well on that day for ₹25,000 and on credit from Jankidas and Sons for ₹50,000. On the 4th of March he was able to sell the goods at ₹60,000 out of which 75% was on credit to different people. On the 5th of March he bought further goods from Kamlesh worth ₹15,000 and on the same day he sold goods at ₹36,000 for cash. On the 8th of March he received 80% of the cash from his debtors and so he paid his creditor Jankidas and Sons ₹40,000. On the 10th of March he sold goods to Hari at ₹30,000 and paid ₹15,000 to Kamesh. Hari paid him ₹18,000 on the 14th of March. On 16th he purchased goods worth ₹14,000 from Sohan out of which he paid ₹8,000 in cash. On the 20th he paid the office rent of ₹1,000 and received commission of ₹750. On the 24th there was a lockdown announced, so he paid salary to his employee of ₹1,200 and told him not to come until things are better. Hari on the same day transferred to his bank account ₹12,000 and he withdrew ₹4,000 for personal use.

What will be the journal entry for the cash introduced by Mr. Manoj Manohar lal to commence his business?

Read the following hypothetical Case Study and answer the given questions:

Mr. Manoj Manohar Lal Started a new business with a cash of ₹60,000 by the name Manohar Lal and Sons on the 1st of March 2020. For the business, he had to purchase furniture on the 2nd of March worth ₹10,000. He decided to buy the goods for cash as well on that day for ₹25,000 and on credit from Jankidas and Sons for ₹50,000. On the 4th of March he was able to sell the goods at ₹60,000 out of which 75% was on credit to different people. On the 5th of March he bought further goods from Kamlesh worth ₹15,000 and on the same day he sold goods at ₹36,000 for cash. On the 8th of March he received 80% of the cash from his debtors and so he paid his creditor Jankidas and Sons ₹40,000. On the 10th of March he sold goods to Hari at ₹30,000 and paid ₹15,000 to Kamesh. Hari paid him ₹18,000 on the 14th of March. On 16th he purchased goods worth ₹14,000 from Sohan out of which he paid ₹8,000 in cash. On the 20th he paid the office rent of ₹1,000 and received commission of ₹750. On the 24th there was a lockdown announced, so he paid salary to his employee of ₹1,200 and told him not to come until things are better. Hari on the same day transferred to his bank account ₹12,000 and he withdrew ₹4,000 for personal use.

For the sale of goods on 4th of March how much will be recorded in the Cash Account.

Read the following hypothetical Case Study and answer the given questions:

Mr. Manoj Manohar Lal Started a new business with a cash of ₹60,000 by the name Manohar Lal and Sons on the 1st of March 2020. For the business, he had to purchase furniture on the 2nd of March worth ₹10,000. He decided to buy the goods for cash as well on that day for ₹25,000 and on credit from Jankidas and Sons for ₹50,000. On the 4th of March he was able to sell the goods at ₹60,000 out of which 75% was on credit to different people. On the 5th of March he bought further goods from Kamlesh worth ₹15,000 and on the same day he sold goods at ₹36,000 for cash. On the 8th of March he received 80% of the cash from his debtors and so he paid his creditor Jankidas and Sons ₹40,000. On the 10th of March he sold goods to Hari at ₹30,000 and paid ₹15,000 to Kamesh. Hari paid him ₹18,000 on the 14th of March. On 16th he purchased goods worth ₹14,000 from Sohan out of which he paid ₹8,000 in cash. On the 20th he paid the office rent of ₹1,000 and received commission of ₹750. On the 24th there was a lockdown announced, so he paid salary to his employee of ₹1,200 and told him not to come until things are better. Hari on the same day transferred to his bank account ₹12,000 and he withdrew ₹4,000 for personal use.

The goods purchased from Kamlesh will be recorded in ____________ Account.

Read the following hypothetical Case Study and answer the given questions:

Mr. Manoj Manohar Lal Started a new business with a cash of ₹60,000 by the name Manohar Lal and Sons on the 1st of March 2020. For the business, he had to purchase furniture on the 2nd of March worth ₹10,000. He decided to buy the goods for cash as well on that day for ₹25,000 and on credit from Jankidas and Sons for ₹50,000. On the 4th of March he was able to sell the goods at ₹60,000 out of which 75% was on credit to different people. On the 5th of March he bought further goods from Kamlesh worth ₹15,000 and on the same day he sold goods at ₹36,000 for cash. On the 8th of March he received 80% of the cash from his debtors and so he paid his creditor Jankidas and Sons ₹40,000. On the 10th of March he sold goods to Hari at ₹30,000 and paid ₹15,000 to Kamesh. Hari paid him ₹18,000 on the 14th of March. On 16th he purchased goods worth ₹14,000 from Sohan out of which he paid ₹8,000 in cash. On the 20th he paid the office rent of ₹1,000 and received commission of ₹750. On the 24th there was a lockdown announced, so he paid salary to his employee of ₹1,200 and told him not to come until things are better. Hari on the same day transferred to his bank account ₹12,000 and he withdrew ₹4,000 for personal use.

The amount deposited by Hari directly in the bank will be recorded in the ____________ account.

Read the following hypothetical Case Study and answer the given questions:

On the 1st of May 2018, Shri Enterprises had a cash balance of ₹12,400 and a bank balance of ₹36,000. Mr. Ganesh, on of the debtors deposited a cheque worth ₹10,000 on the 3rd of May and on 5th May Mr. Suresh was paid via cheque of ₹7,700 for the full settlement of the account of ₹8,000. The cheque received on the 6th worth ₹12,000 from Mr. Xavier was deposited on the 7th of May. On the 8th ₹22,000 was received in cash and ₹8,000 was deposited in the bank. The cheque given by Mr. Xavier was dishonoured and for which ₹20 was paid as the bank charges. On the 20th of May, a bills receivable was discounted worth ₹10,000 at 1% through the bank. On the 26th the proprietor withdrew ₹10,000 from the bank for which he used ₹8,000 for office use.

In which account will the cheque deposited by Mr. Ganesh recorded?

Read the following hypothetical Case Study and answer the given questions:

On the 1st of May 2018, Shri Enterprises had a cash balance of ₹12,400 and a bank balance of ₹36,000. Mr. Ganesh, on of the debtors deposited a cheque worth ₹10,000 on the 3rd of May and on 5th May Mr. Suresh was paid via cheque of ₹7,700 for the full settlement of the account of ₹8,000. The cheque received on the 6th worth ₹12,000 from Mr. Xavier was deposited on the 7th of May. On the 8th ₹22,000 was received in cash and ₹8,000 was deposited in the bank. The cheque given by Mr. Xavier was dishonoured and for which ₹20 was paid as the bank charges. On the 20th of May, a bills receivable was discounted worth ₹10,000 at 1% through the bank. On the 26th the proprietor withdrew ₹10,000 from the bank for which he used ₹8,000 for office use.

The amount recorded as drawings will be __________.

Read the following hypothetical Case Study and answer the given questions:

On the 1st of May 2018, Shri Enterprises had a cash balance of ₹12,400 and a bank balance of ₹36,000. Mr. Ganesh, on of the debtors deposited a cheque worth ₹10,000 on the 3rd of May and on 5th May Mr. Suresh was paid via cheque of ₹7,700 for the full settlement of the account of ₹8,000. The cheque received on the 6th worth ₹12,000 from Mr. Xavier was deposited on the 7th of May. On the 8th ₹22,000 was received in cash and ₹8,000 was deposited in the bank. The cheque given by Mr. Xavier was dishonoured and for which ₹20 was paid as the bank charges. On the 20th of May, a bills receivable was discounted worth ₹10,000 at 1% through the bank. On the 26th the proprietor withdrew ₹10,000 from the bank for which he used ₹8,000 for office use.

___________ is the amount of discount given by Mr. Suresh.