Test: Trial Balance and Rectification of Errors- Case Based Type Questions - SSC CGL MCQ

12 Questions MCQ Test - Test: Trial Balance and Rectification of Errors- Case Based Type Questions

A brief-case purchased for Rs.800 for the son of a partner was debited to General Exp. A/c with Rs.80. In the rectifying entry, Drawings A/c should be debited with:

Wages paid to a worker making additions to machinery amounting to Rs. 5,000 were debited to the Wages account. Identify the type of error.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Purchased goods from Gopal for Rs.3,600 but was recorded in Gopal’s A/c as Rs.6,300. In the rectifying entry, Gopal’s A/c will be debited with :

Trial balance is prepared to check

Rent paid to the landlord amounting to Rs.500 was credited to Rent A/c with Rs.5,000. In the rectifying entry, Rent A/c will be debited with :

Purchased goods from Gopal for Rs.3,600 but was recorded as Rs.6,300 to the debit of Gopal. In the rectifying entry, Gopal’s A/c will be credited with :

Sohan returned goods to us amounting Rs.4,200 but was recorded as Rs.2,400 in his account. In the rectifying entry, Sohan’s A/c will be credited with :

The Company incorrectly recorded a deposit of daily credit sales of Rs. 4,500 as Rs. 5,400. What is the appropriate entry, the company should follow regarding the error of Rs. 900?

Read the following hypothetical Case Study and answer the given questions:

An accountant while balancing his books on 31st December 2016 found that there was a difference of ₹270 in the trial balance. Being required to prepare the final accounts he placed the difference to a newly opened Suspense A/c, which was carried forward to the next year when the following errors were discovered:

Salary for the month of March was posted twice ₹155.

Interest on investment collected by the bankers, were posted directly in concerned accounts through the pass book, but no entry was made in the bank column of the cash book ₹75.

Rent of ₹350 received from Ashok credited both to Rent Account and Ashok Account.

A purchase of a chair from Karnal Furniture Mart for ₹65 has been entered in the purchase book as ₹56.

Old Machinery sold to the proprietor Keshav for ₹400 was entered in the Sales Book as sale to Kishore.

Cash Purchases from Ajay ₹189 were recorded in Cash Book as well as in Purchases Book and posted from both.

Closing Stock has been undervalued by ₹300.

The Profit & Loss Account disclosed a net profit of ₹15,000 for the year ended 31st March 2016.

Q. What will be the journal entry for the balance of Profit and Loss Adjustment Account?

Read the following hypothetical Case Study and answer the given questions:

An accountant while balancing his books on 31st December 2016 found that there was a difference of ₹270 in the trial balance. Being required to prepare the final accounts he placed the difference to a newly opened Suspense A/c, which was carried forward to the next year when the following errors were discovered:

Salary for the month of March was posted twice ₹155.

Interest on investment collected by the bankers, were posted directly in concerned accounts through the pass book, but no entry was made in the bank column of the cash book ₹75.

Rent of ₹350 received from Ashok credited both to Rent Account and Ashok Account.

A purchase of a chair from Karnal Furniture Mart for ₹65 has been entered in the purchase book as ₹56.

Old Machinery sold to the proprietor Keshav for ₹400 was entered in the Sales Book as sale to Kishore.

Cash Purchases from Ajay ₹189 were recorded in Cash Book as well as in Purchases Book and posted from both.

Closing Stock has been undervalued by ₹300.

The Profit & Loss Account disclosed a net profit of ₹15,000 for the year ended 31st March 2016.

Q. What will be the rectification entry of the salary for the month of march posted twice?

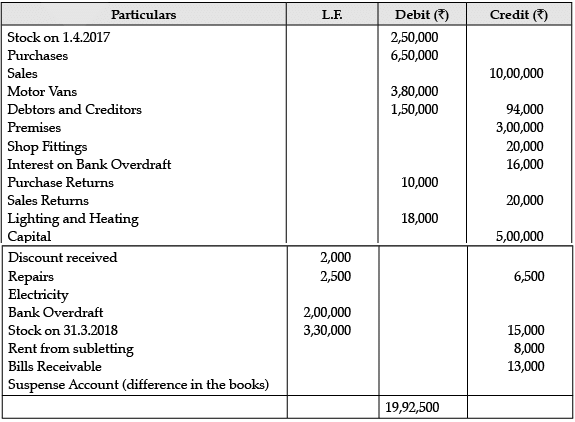

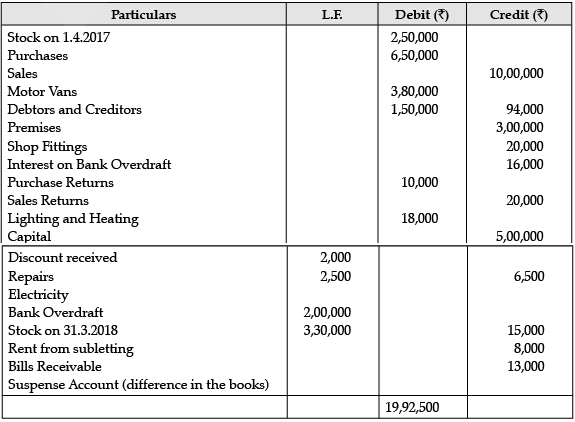

Read the following hypothetical Trial Balance extracted from the books of M/s Ravilal and Company and answer the given questions:

In the books of M/s Ravilal and Company

Trial Balance as on 31/3/2018

Q. Which of the following items appears on the wrong side of the trial Balance?

Read the following hypothetical Trial Balance extracted from the books of M/s Ravilal and Company and answer the given questions:

In the books of M/s Ravilal and Company

Trial Balance as on 31/3/2018

Q. What should be the actual total in the rectified Trial Balance?