Test: Analysis of Financial Statements- Case Based Type Questions - Commerce MCQ

12 Questions MCQ Test - Test: Analysis of Financial Statements- Case Based Type Questions

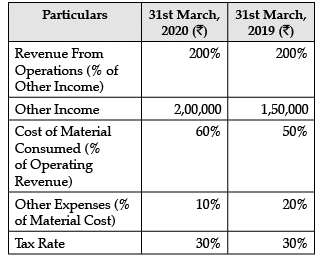

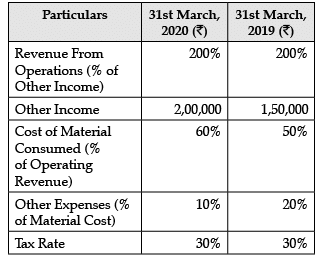

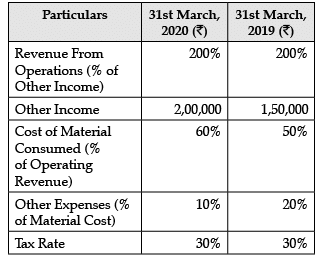

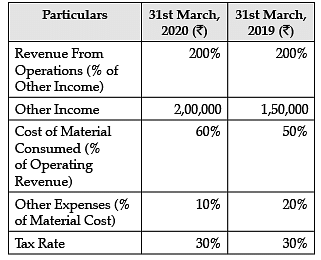

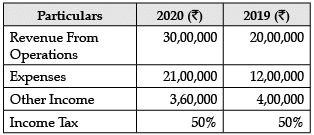

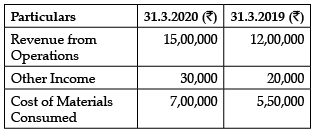

Read the following information and answer the given questions:

The following data is available from Pitambar Ltd.

Q. What is the Net Profit after Tax in March 2020?

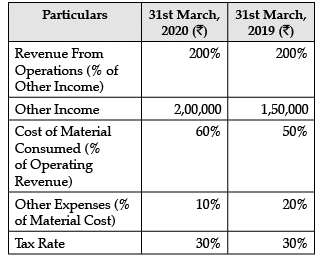

Read the following information and answer the given questions:

The following data is available from Pitambar Ltd.

Q. What is the percentage of the Total Revenue from Revenue from operations in 2019?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

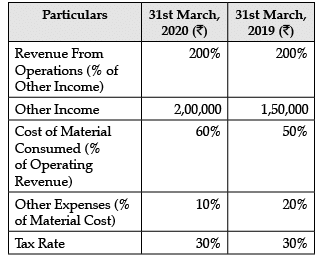

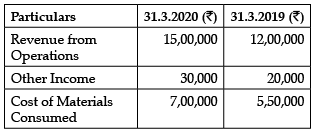

Read the following information and answer the given questions:

The following data is available from Pitambar Ltd.

Q. What is the revenue from operations on 31st March, 2020?

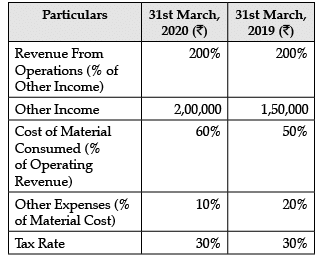

Read the following information and answer the given questions:

The following data is available from Pitambar Ltd.

Q. What is the value of the tax paid by the firm in 2019?

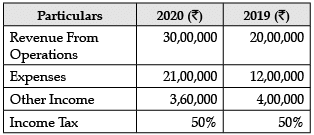

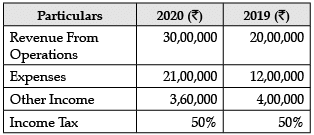

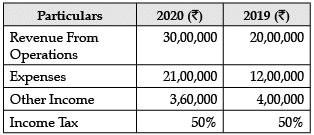

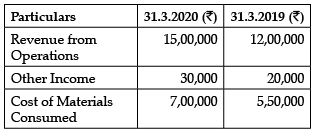

Read the following information and answer the given questions:

Following information are taken from the books of Agarwal Pvt Ltd.:

Q. What is the percentage change in the tax paid?

Read the following information and answer the given questions:

Following information are taken from the books of Agarwal Pvt Ltd.:

Q. What is the percentage change in the profit earned after tax?

Read the following information and answer the given questions:

Following information are taken from the books of Agarwal Pvt Ltd.:

Q. What is the value of absolute change in the Total Revenue?

Read the following information and answer the given questions:

Following information are taken from the books of Agarwal Pvt Ltd.:

Q. The absolute change in the Expenses is:

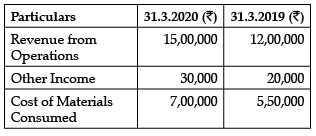

Read the following information and answer the given questions:

Following is the data given of Lalit Ltd.

Q. What is the percentage change in the Total Expenses?

Read the following information and answer the given questions:

Following is the data given of Lalit Ltd.

Q. What is the percentage change in the Total Revenue earned?

Read the following information and answer the given questions:

Following is the data given of Lalit Ltd.

Q. What is the percentage change in the Revenue from operations?

Read the following information and answer the given questions:

Following is the data given of Lalit Ltd.

Q. What is the change in the profit before tax?