Assertion & Reason Test: Money & Credit - 1 - Grade 10 MCQ

10 Questions MCQ Test - Assertion & Reason Test: Money & Credit - 1

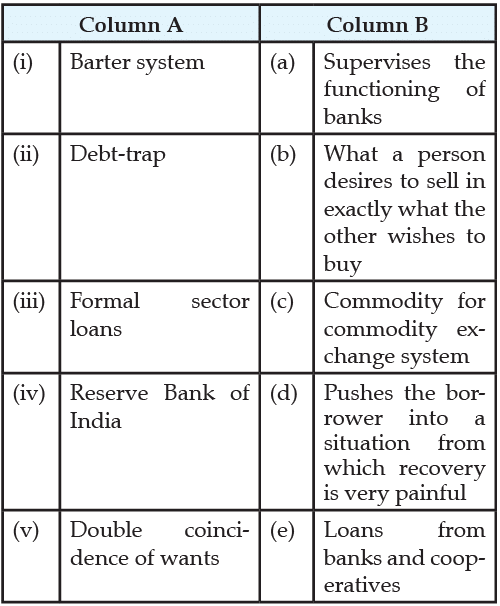

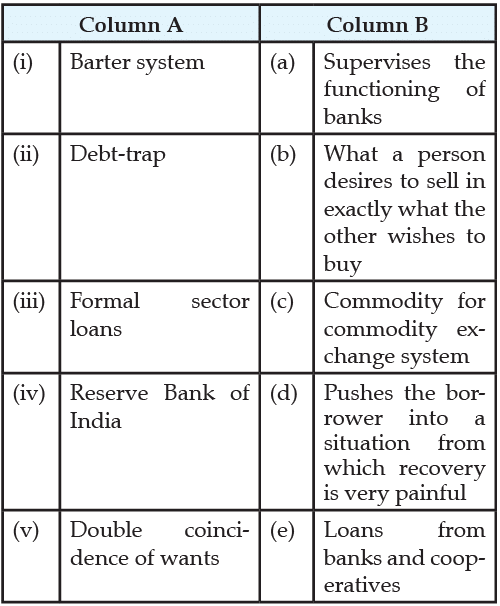

Match the following items given in column A with those in column B:

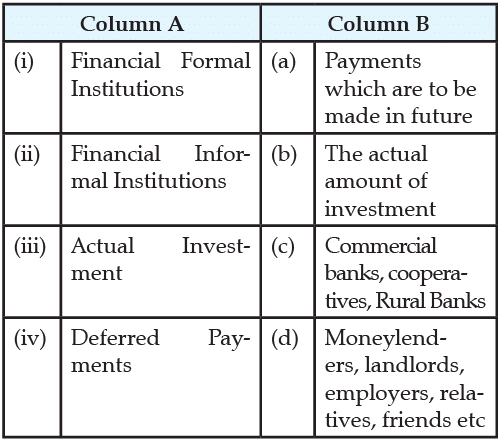

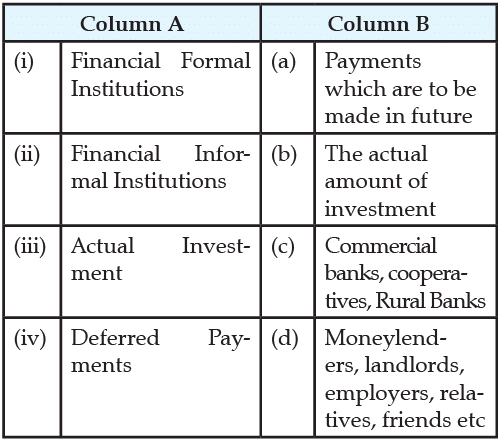

Match the following items given in column A with those in column B:

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Arrange the following in the correct sequence:

(i) Online payment, Debit card, Credit cards

(ii) Precious metal coins (gold, silver, copper)

(iii) Grain and Cattle

(iv) Modern Currency-Paper notes and coins

Analyze the information given below, considering one of the following correct options:

Rita has taken a loan of ₹ 7 lakhs from the bank to purchase a car. The annual interest rate on the loan is 14.5 percent and the loan is to be repaid in 3 years in monthly instalments. The bank retained the papers of the new car as collateral, which will be returned to Rita only when she repays the entire loan with interest. Analyse the loan information given above, considering one of the following correct options.

Analyze the information given below, considering one of the following correct options:

Mohan is an agricultural labourer. There are several months in a year when he has no work and needs credit to meet his daily expenses. He depends upon his employer, the landowner for credit who charges an interest rate of 5 per cent per month. Mohan repays the money by working physically for the landowner on his farmland.

Over the years his debt will –

Analyze the information given below, considering one of the following correct options:

Mahesh is a small farmer. He has taken a loan of ₹2 lakhs from the money leader to meet the expenses of cultivation. The annual interest rate on the loan is very high, so he is unable to repay the loan and he is caught in a debt. He has to sell a part of the land to pay off the debt. Analyse the loan information given above, considering one of the following correct option :

Analyze the information given below, considering one of the following correct options:

Ramu is a shoe manufacturer and he wants to directly exchange shoes for rice without the use of money. Now he will have to look for a rice growing farmer who not only wants to sell rice but also wants to buy the shoes in exchange. Analyse the information given above, considering one of the following correct option:

Analyze the information given below, considering one of the following correct options:

Megha has taken a loan of ₹ 6 lakhs from the bank to purchase a house. The annual interest rate on the loan is 14 percent and the loan is to be repaid in 12 years in monthly installments. Megha had to submit to the bank, documents showing her employment records and salary before the bank agreed to give her the loan. Analyse the loan information given above, considering one of the following correct option :

Analyze the information given below, considering one of the following correct options:

A shopkeeper Sudha has to make a payment to the wholesaler and writes a cheque for a specific amount to the wholesaler. The wholesaler takes this cheque, and deposits it in his own account in the bank. The money is transferred from one bank account to another bank account in a couple of days. The transaction is completed without any payment of cash.

Analyse the information given above, considering one of the following correct option:

In the question given below, there are two statements marked as Assertion (A) and Reason (R). Read the Statements and choose the correct option :

Assertion (A) : No individual or organisation is allowed to issue currency notes in India.

Reason (R) : In India, only RBI issues currency notes on behalf of the Central Government.