Test: Class 12 Accountancy: CBSE Sample Question Papers- Term I (2021-22) - Class 12 MCQ

30 Questions MCQ Test - Test: Class 12 Accountancy: CBSE Sample Question Papers- Term I (2021-22)

Gain / loss on revaluation at the time of change in profit sharing ratio of existing partners is shared by(i)_____ whereas in case of admission of a partner it is shared by (ii)________ .

Calculate the amount of second & final call when Abhijit Ltd, issues equity shares of ₹10 each at a premium of 40% payable on Application ₹3, on Allotment ₹5, on First Call ₹2.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Anish Ltd. issued a prospectus inviting applications for 2,000 shares. Applications were received for 3,000 shares and pro-rata allotment was made to the applicants of 2,400 shares. If Dhruv has been allotted 40 shares, how many shares he must have applied for?

Ambrish Ltd offered 2,00,000 equity shares of ₹10 each, of these 1,98,000 shares were subscribed. The amount was payable as ₹3 on application, ₹4 an allotment and balance on first call. If a shareholder holding 3,000 shares has defaulted on first call, what is the amount of money received on first call?

What will be the correct sequence of events?

(i) Forfeiture of shares.

(ii) Default on calls.

(iii) Re-issue of shares.

(iv) Amount transferred to capital reserve. options:

Arun and Vijay are partners in a firm sharing profits and losses in the ratio of 5:1.

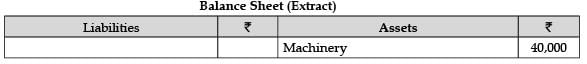

If the value of machinery reflected in the balance sheet is overvalued by 33 x 1/3 %, find out the value

of Machinery to be shown in the new Balance Sheet:

Which of the following is true regarding salary to a partner when the firm maintains fluctuating capital accounts?

At the time of reconstitution of a partnership firm, recording of an unrecorded liability will lead to:

E, F and G are partners sharing profits in the ratio of 3:3:2. According to the partnership agreement, G is to get a minimum amount of ₹80,000 as his share of profit every year and any deficiency on this account is to be personally borne by E. The net profit for the year ended 31st March, 2021 amounted to ₹3,12,000. Calculate the amount of deficiency to be borne by E?

At the time of admission of a partner, what will be the effect of the following information?

Balance in Workmen Compensation Reserve ₹40,000. Claim for workmen compensation ₹45,000.

In the absence of partnership deed, a partner is entitled to an interest on the amount of additional capital advanced by him to the firm at a rate of:

Revaluation of assets at the time of reconstitution is necessary because their present value may be different from their:

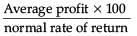

If average capital employed in a firm is ₹8,00,000, average of actual profits is ₹1,80,000 and normal rate of return is 10%, then value of goodwill as per capitalization of average profits is:

In which of the following situation Companies Act, 2013 allows for issue of shares at discount?

As per Section 52 of Companies Act, 2013, Securities Premium Reserve cannot be utilised for:

Net Assets minus Capital Reserve is:

Kalki and Kumud were partners sharing profits and losses in the ratio of 5:3. On 1st April, 2021 they admitted Kaushtubh as a new partner and new ratio was decided as 3:2:1.

Goodwill of the firm was valued as ₹3,60,000. Kaushtubh couldn’t bring any amount for goodwill. Amount of goodwill share to be credited to Kalki and Kumud Account’s will be:

Sarvesh, Sriniketan and Srinivas are partners in the ratio of 5:3:2. If Sriniketan’s share of profit at the end of the year amounted to ₹1,50,000, what will be Sarvesh’s share of profits?

Seeta and Geeta are partners sharing profits and losses in the ratio 4 : 1. Meeta was the manager who received a salary of ₹4,000 p.m. in addition to a commission of 5% on net profits after charging such commission. Profit for the year is ₹6,78,000 before charging salary. Find the total remuneration of Meeta.

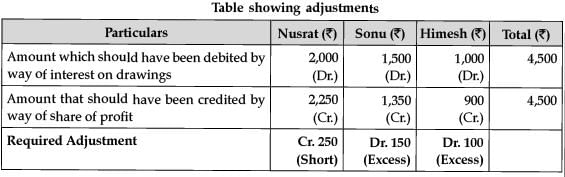

Nusrat, Sonu and Himesh are partners sharing profits and losses in the ratio of 5 : 3 : 2. The partnership deed provides for charging interest on drawings @ 10% p.a. The drawings of Nusrat, Sonu and Himesh during the year ending March 31, 2015 amounted to ₹20,000, ₹ 15,000 and ₹10,000 respectively. After the final accounts have been prepared, it was discovered that interest on drawings has not been taken into consideration. In the adjusting entry:

Rekha and Rahul are partners in a firm sharing profits and losses in the ratio of 5 : 3. Rihan is admitted in the firm for 1/5th share of profits. He is to bring in ₹20,000 as capital and ₹ 4,000 as his share of goodwill. Which journal entry reflects the correct accounting treatment if the amount of goodwill is fully withdrawn.

Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R).

Assertion (A): A firm that produces high value added products has less goodwill.

Reason (R): A firm that produces high value added products is able to earn more profits.

In the context of the above statements, which one of the following is correct?

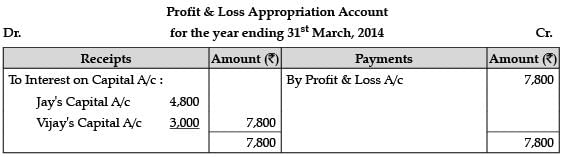

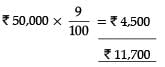

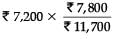

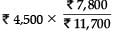

On 1st April, 2013, Jay and Vijay entered into partnership for supplying laboratory equipment to government school situated in remote and backward areas. They contributed capitals of ₹80,000 and ₹50,000 respectively and agreed to share the profits in the ratio of 3 : 2. The partnership deed provided that Interest on Capital shall be allowed at 9% per annum. During the year, the firm earned a profit of ₹7,800. Net Profit of the firm after appropriations is:

A and B are partners. The net divisible profits as per Profits and Loss Appropriation Account is ₹2,50,000. The total interest on partner’s drawing is ₹4,000. A’s salary is ₹4,000 per quarter and B’s salary is ₹40,000 per annum. Find out the net profit/loss earned during the year.

Kajal, Neerav and Aisha are partners in a firm sharing profits in the ratio of 3 : 2 : 1. They decided to admit Rajan, their landlord as a partner in the firm. Rajan brought sufficient amount of capital and his share of goodwill premium. The accountant of the firm passed the entry of rent paid for the building to Rajan in 'Profit and Loss Appropriation Account'. Choose the correct option for the approach of accountant.

Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): When firm’s assets are not adequate to meet its liabilities, private assets of the partners can be used to meet the firm’s liabilities.

Reason (R): Partnership firm has a separate legal entity.

In the context of the above two statements, which of the following is correct?

The subscribed capital of a company is ₹80,00,000 and the nominal value of the share is ₹100 each. There were no calls-in-arrears till the final call was made. The final call money was received made on 77,500 shares only. The balance in the calls in arrear amounted to ₹62,500. The final call on share will be:

When a company issues shares at a premium, the amount of premium should be received by the company:

Madhu and Neha were partners in a firm sharing profits and losses in the ratio of 3:5. Their fixed capitals were ₹4,00,000 and ₹6,00,000 respectively. On 1st Jan, 2016, Tina was admitted as a new partner for 1/4th share in the profits. Tina acquired her share of profit from Neha. Tina brought ₹4,00,000 as her capital which was to be kept fixed like the capitals of Madhu and Neha. Calculate the goodwill of the firm on Tina's admission and choose the correct option.

Traders Ltd. had its capital of ₹50,000 divided into ₹10 per share. On 1st October, 2020 shares were issued at par. Amount was payable ₹7.50 per share on application and remaining on allotment. In Nov., 2020 allotment was made. Shareholders of 1,000 shares did not pay his allotment money of ₹2.50 per share and on 31st January, 2021 these shares were forfeited. The following entry will be passed:

Share Capital A/c Dr. ₹X

To Share Forfeiture A/c ₹Y

To Share Allotment A/c ₹Z

Here X, Y, and Z are:

= ₹7,200

= ₹7,200

= = 80,000

= = 80,000