Test: NBFCs, Small Finance & Payment Banks - Banking Exams MCQ

10 Questions MCQ Test - Test: NBFCs, Small Finance & Payment Banks

Consider the following statements regarding Non-Banking Financial Companies.

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself.

- NBFCs cannot accept demand deposits.

- Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs.

Which of the above statements is/are correct?

Which of the following is considered as a Non-Banking Financial Company (NBFC)?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

A Non-Banking Financial Company (NBFC) is a company registered under _________.

Which amongst the following are types of NBFCs as defined by RBI?

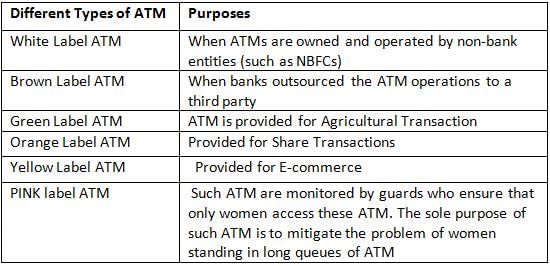

Which of the following ATMs are owned and operated by NBFCs?

What is the new eligibility limit for NBFCs for debt recovery under the SARFAESI Act ?

The appointment of a Banking Ombudsman is made for a period of ________.

The Reserve Bank of India (RBI) has introduced the prompt corrective action (PCA) framework for non-banking financial companies (NBFCs). The PCA framework for NBFCs will come into effect from which month?

Which of the following statements are true in regards NBFC?