Test: Insurance Industry - 2 - Banking Exams MCQ

10 Questions MCQ Test - Test: Insurance Industry - 2

Which of the following insurance type is under life insurance?

The insurance in which the number of employees and their dependents are insured under a single policy is known as _______.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Which among the following is a life insurance policy in which the amount is payable only at the death of the policy holder?

Which of the following types of insurance usually requires higher premium?

Which amongst the following denotes a type of insurance?

- Life insurance

- Health insurance

- Liability insurance

What type of insurance will apply if a family member has broken his/her leg in an accident while on vacation in Singapore?

What is a type of life insurance policy that provides coverage for a certain period of time, or a specified “term” of years?

Which is the following does not belong to the main products of life insurance?

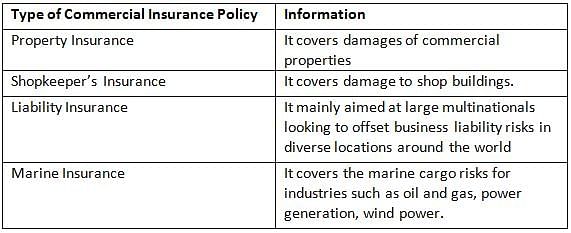

Which of the following is type of Commercial Insurance Policy?

Which among the following is correct regarding the Unit Linked Insurance Plans?