CUET Accountancy Previous Year Solved Paper 4 (30 August 2022 Slot-1) - Humanities/Arts MCQ

30 Questions MCQ Test - CUET Accountancy Previous Year Solved Paper 4 (30 August 2022 Slot-1)

Prepaid Expenses is shown in sub-head of the Balance Sheet under:

Bank overdraft is shown in the liabilities side under the sub-head:

When fixed amount of money is withdrawn quarterly by partners at the beginning of each quarter, for how many months, is interest to be calculated on the total money withdrawn during a year?

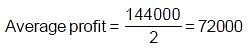

Goodwill at 2 years purchase of 3 years average profit is Rs. 1,44,000. If the firm earned a profit of Rs. 33,000 in the previous year and Rs. 46,000 in the year before that, the 3rd year profit would be:

Losses are shown in the Balance Sheet under the heading:

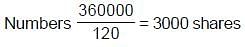

RK and Company purchased a boiler from No Risk Machine Limited for Rs. 3,80,000. As per purchase agreement, Rs. 20,000 were paid in cash and balance by issue of shares of Rs. 100 each at 20% premium. The number of shares issued will be:

Formula for calculating cost of goods sold is:

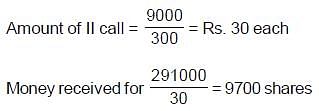

(1) Bank A/C Dr. Rs. 2,91,000

To Equity Share 2nd and Final call Rs. 2,91,00

(Being 2nd and final call money received except for 300 share)

(2) Share Capital A/C. Dr. Rs. 30,000

To Equity Share 1st call Rs. 6,000

To Equity Share 2nd call Rs. 9,000

To Share Forfeiture A/C Rs. 15,000 (300 shares being for fecited)

Based on the above instructions calculate the totalnumber of shares issued by the company were:

Pick the correct statement:

In which situation would Profit and Loss Appropriation A/c be credited?

Proposed dividend is treated as:

Ratio’s that are calculated for measuring the efficiency of operations is:

The balance of Shares Forfeited Account is shown under which head till the Forfeited Shares are re-issued.

The Shares of a Public Limited Company are:

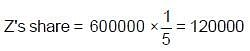

X and Y are partner’s in a firm sharing profits in the ratio of 3 : 2, Z admits in the firm for 1/5th share in

profits. Z brings in Rs. 40,000 capital and required amount of goodwill. The goodwill of the firm was valued at Rs. 6,00,000. The amount of premium brought by Z would be:

Write the sequence of treating losses as per section 48 of the Partnership Act 1932.

A. Close Realisation Account

B. Payout of Partners Capital

C. Pay out of Profits

D. Paid by the partners individually in their profits sharing ratio

Choose the most appropriate answer from the options given below:

In case of dissolution of a firm, assets of the firm shall be applied in following purposes and order

(sequence).

A. Paying to each partner portionately what is due to him on account of capital

B. In paying the debts of the firm to the third party

C. In transferring amount to General Reserves

D. Residue if any to be divided among the partner’s in their profit sharing ratio

E. In paying each partner proportionately what is due to him from the firm for advances (Partner’s Loan)

Choose the most appropriate answer from the options given below:

Government Grant received by Not-for-profit organisation will be shown in:

Identify the right sequence of Cash-flow statement as per Accounting Standards 3.

A. Cash Equivalents

B. Cash Flow from Investing Activity

C. Cash Flow from Operating Activity

D. Cash Flow from Financing Activity

Choose the most appropriate answer from the options given below:

State whether ‘Cash withdrawal from Bank’ will be classified under which kind of activity?

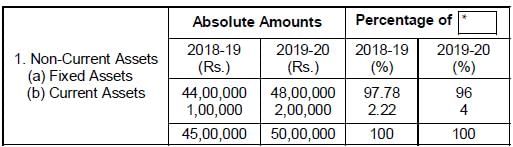

Common size Balance Sheet of XYZ Ltd. as at 31st March 2019 and 2020

The blank space * in the table row is:

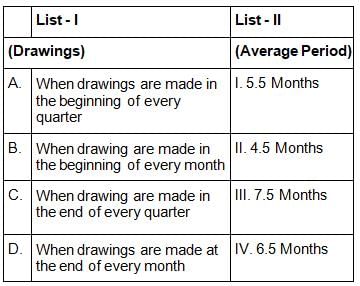

Match List - I with List - II with reference to interest on drawings.

Choose the correct answer from the options given below:

P, Q and R are partner’s in firm sharing profits in the ratio of 3 : 2 : 1. R retires and the balance in his capital account after making necessary adjustments on accounts of reserve and surplus, revaluation of assets and reassessment of liabilities works out of be Rs. 60,000. P and Q agreed to pay him Rs. 75,000 in full settlement of his claim. It implies that Rs. 15,000 is:

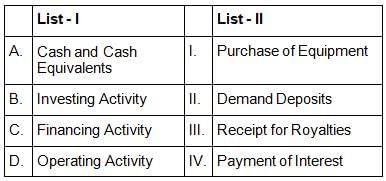

Match List - I with List - II.

Choose the correct answer from the options given below:

Abhishek, Rajat and Vivek are partner’s sharing profits in the ratio 5 : 3 : 2. If Vivek retires the new profit sharing ratio between Abhishek and Rajat will be:

Comparative statements are also known as:

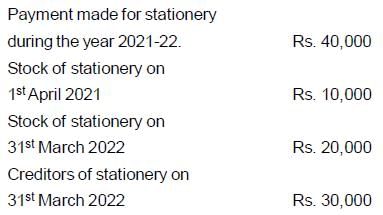

Find out the amount of stationery consumed during the year 2021-22

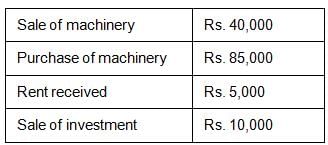

From the following information, find out cash flow from investing activities:

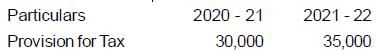

How will you treat the following items while making cash flow statement\

Arrange the below mentioned items/transactions in proper sequence for calculation of Cash Flow from operating activities.

A. Net profit before taxes & extraordinary items

B. Income Tax paid

C. Operating profit before working capital changes

D. Net profit as per statement of Profit & Loss A/c

E. Patents Amortised

Choose the most appropriate answer from the options given below: