CUET Accountancy Previous Year Solved Paper 5 (30 August 2022 Slot-2) - Humanities/Arts MCQ

30 Questions MCQ Test - CUET Accountancy Previous Year Solved Paper 5 (30 August 2022 Slot-2)

As per Receipts and Payments Account for the year ended on March 31, 2020, subscriptions received were Rs. 2,50,000 subscriptions outstanding on 1-04-2019 Rs. 50,000. Subscriptions received in advance as on 31-3-2020 are Rs. 30,000. Subscription for the year 2019-20 will be:

At the time of admission of a new partner general reserve appearing in the old balance sheet is transferred to ________.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

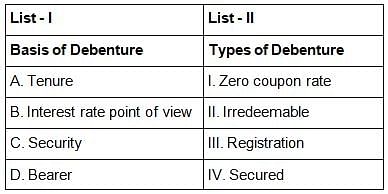

Match List - I with List - II.

Choose the correct answer from the options given below:

On retirement of a partner, the retiring partner’s capital account will be credited with _______.

Journal entry of be passed for unrecorded assets for preparing Revaluation A/C at the time of Retirement of a partner will be ______.

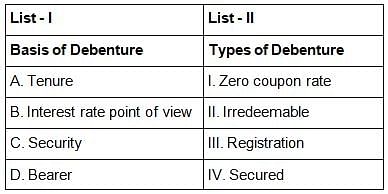

Match List - I with List - II

Choose the correct answer from the options given below:

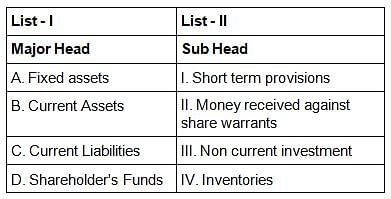

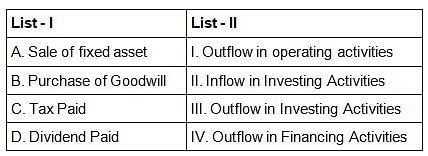

Match List - I with List - II.

Choose the correct answer from the options given below:

At the time of retirement of a Partner the remaining gaining partners should compensate the ________.

If a partner retires in the middle of the year his/her share of profit from the date of last balance sheet till the date of retirement will be transferred to: ________

If debentures are converted into equity shares, it is a/an: __________

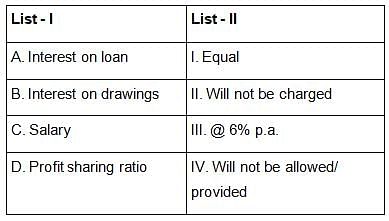

Match List - I with List - II in context of not having partnership deed.

Choose the correct answer from the options given below:

What is the correct sequence of allotment of shares

A. Allotment money received

B. Inviting applications from investors

C. Allotment Due

D. Application money Received

E. Share Call Money Due

Choose the correct answer from the options given below:

What is the correct sequence of types of capital in company’s Balance sheet while preparing notes to accounts.

A. Issued Capital

B. Subscribed and fully paid up capital

C. Share forfeited Balance

D. Authorised Capital

E. Subscribed but not fully paid up capital

Choose the correct answer from the options given below:

Identify the correct sequence to find out profit after tax while preparing comparative income statement

A. Deduct expenses

B. Find out total revenue by adding other incomes to revenue from operations

C. Find out profit after tax

D. Deduct tax

E. Calculate profit before tax

Choose the correct answer from the options given below:

If net profit made during the year are Rs. 50,000 and the bills receivables have decreased by Rs. 10,000 during the year then the cash flow from operating activities will be:

The capital accounts of partners will always show a ______ balance under fixed capital account method

Aman and Mohan, partners of a firm decided to dissolve the business on 31-03-22. The firm decided to pay realisation expenses of Rs. 1,000 on behalf of Mohan. Rs. 1,000 will be debited to

Common size analysis is also known as

Calculate the amount of yearly interest payable on 9% debentures (10,000 debentures of Rs. 100) issued as collateral security.

If the net profit earned during the year is Rs. 1,00,000 and the amount of Bills receivables in the beginning and the end of the year is Rs. 20,000 and Rs. 40,000 respectively, then cash flow from operating activities will be:

Sale of copy rights are considered as a part of

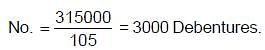

Romi Ltd. purchased building worth Rs. 1,50,000 machinery worth Rs. 1,40,000 and furniture worth Rs. 10,000 from xyz co. and took over its liabilities of Rs. 20,000 for a purchase consideration of Rs. 3,15,000. They paid the purchase consideration by issuing 12% debentures of Rs. 100 each at a premium of 5%. What will be the number of debentures issued by Romi Ltd.

Securities premium Reserve can be utilised ______.

A. to return excess money received on application

B. to write off preliminary expenses

C. to issue partly paid bonus shares

D. for premium paid on Redemption of Debentures or preference shares

E. for buy back of shares

Choose the correct answer from the options given below:

What are different types of debentures from the view point of registration

A. Convertible

B. Bearer

C. Redeemable

D. Secured

E. Registered

Choose the correct answer from the options given below:

Identify the steps in preparation of final accounts of not for profit organisation (NPO)

A. Prepare Balance Sheet of NPO

B. Prepare Income and Expenditure Account from Receipts and payment Account

C. Prepare Receipts and payment Account

D. Adjust outstanding/prepaid expenditure/Income and determine surplus/Deficit

E. Prepare cash book

Choose the correct answer from the options givenbelow:

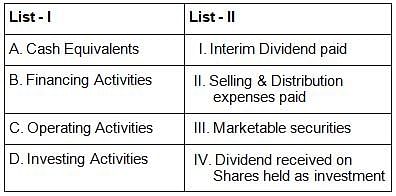

Match List - I with List - II in context g cashflow statement

Choose the correct answer from the options given below:

Identify the limitations of financial statements:

A. Can be biased

B. Report on stewardship function

C. Aggregate information

D. Only interim reports

E. Basis of fiscal policies

Choose the correct answer from the options given below:

What are the different types of liquidity ratios

A. Interest coverage ratio

B. Current ratio

C. Inventory turnover ratio

D. Gross profit ratio

E. Acid test ratio

Choose the correct answer from the options given below:

Identify the components of equity:

A. Money received against share warrants

B. Working capital

C. Share capital

D. Reserves & surplus

E. Cash Revenue from operations

Choose the correct answer from the options given below:

Identify the correct sequence of current assets in company’s Balance sheet?

A. Bills Receivables

B. Cash & cash equivalents

C. Short term loans & advances

D. Inventories

E. Current investments

Choose the correct answer from the options given below: