Test: Tax Questions - UCAT MCQ

10 Questions MCQ Test - Test: Tax Questions

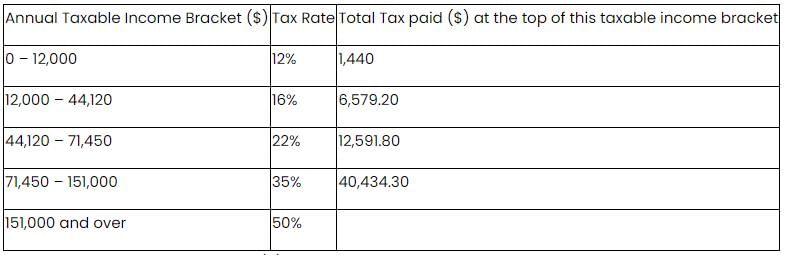

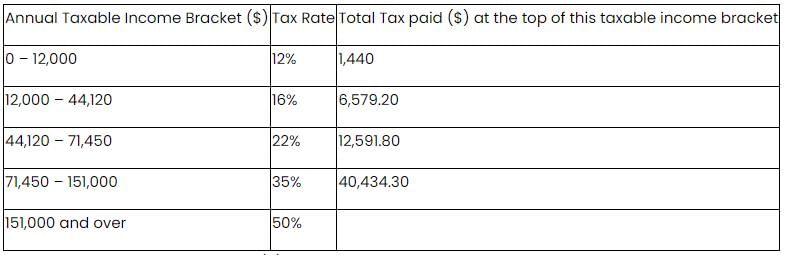

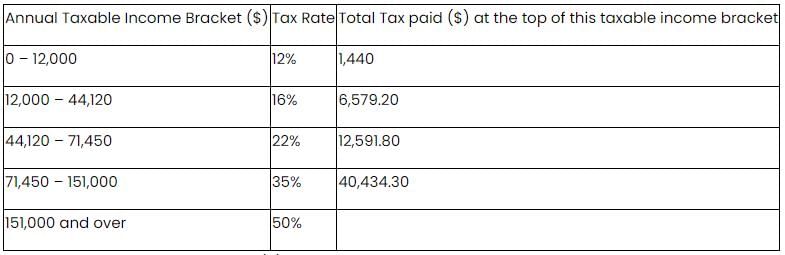

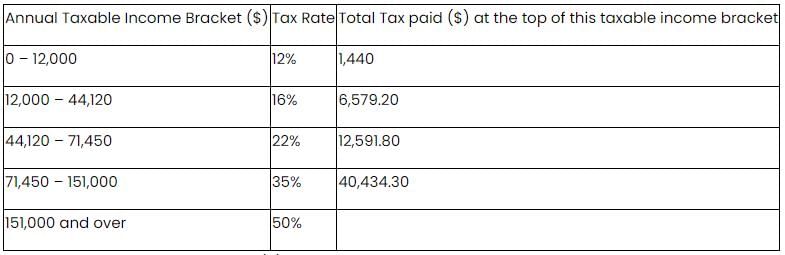

The table shows the total tax paid ($) on annual taxable income.

For example, a person with an annual taxable income of $30,000 will pay $1,440 plus 16% of ($30,000 – $12,000).

Q. Nathan’s annual taxable income is $50,000. What, to the nearest %, is the average rate of income tax he pays over the entirety of his salary?

The table shows the total tax paid ($) on annual taxable income.

For example, a person with an annual taxable income of $30,000 will pay $1,440 plus 16% of ($30,000 – $12,000).

Q. One year, the lower and upper bounds of each income tax bracket increase by 10%. As a result, how does the amount of tax Mel pays annually on her salary of $38,000 change?

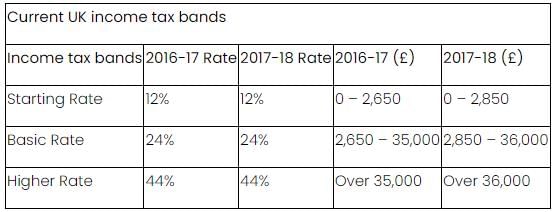

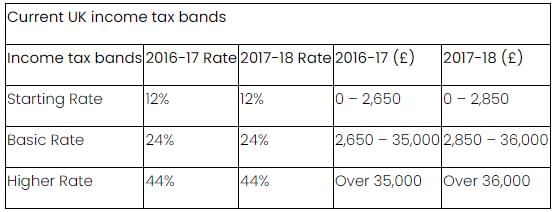

UK income tax allowances, rates and bands

In order to calculate the amount received from income after tax, you need to know:

- the allowances – income tax is not deducted from these

- the bands into which income is allocated

- the different rates at which income tax will be deducted from the bands

For example, in 2016-17, someone aged 45 earning £20,000 per year, will:

- have a tax-free allowance of £7,050

- pay tax at 12% on £2,650

- and pay tax at 24% on the remaining £10,300

Q. How much would a 30-year-old with an annual salary of £41,000 pay in income tax during the tax year 2016-17?

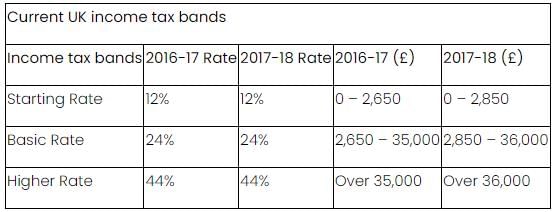

UK income tax allowances, rates and bands

In order to calculate the amount received from income after tax, you need to know:

- the allowances – income tax is not deducted from these

- the bands into which income is allocated

- the different rates at which income tax will be deducted from the bands

For example, in 2016-17, someone aged 45 earning £20,000 per year, will:

- have a tax-free allowance of £7,050

- pay tax at 12% on £2,650

- and pay tax at 24% on the remaining £10,300

Q. What would the monthly tax deduction be from the salary of a 62-year-old earning £17,500 during the 2017-18 tax year?

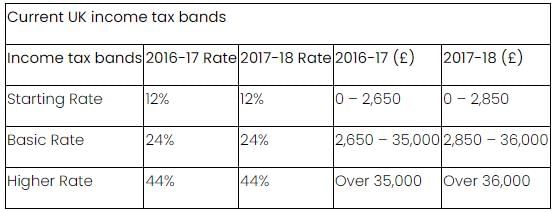

UK income tax allowances, rates and bands

In order to calculate the amount received from income after tax, you need to know:

- the allowances – income tax is not deducted from these

- the bands into which income is allocated

- the different rates at which income tax will be deducted from the bands

For example, in 2016-17, someone aged 45 earning £20,000 per year, will:

- have a tax-free allowance of £7,050

- pay tax at 12% on £2,650

- and pay tax at 24% on the remaining £10,300

Q. How much would a 52-year-old with an annual salary of £43,000 pay in income tax during the tax year 2017-18?

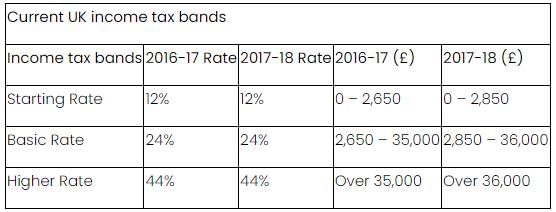

UK income tax allowances, rates and bands

In order to calculate the amount received from income after tax, you need to know:

- the allowances – income tax is not deducted from these

- the bands into which income is allocated

- the different rates at which income tax will be deducted from the bands

For example, in 2016-17, someone aged 45 earning £20,000 per year, will:

- have a tax-free allowance of £7,050

- pay tax at 12% on £2,650

- and pay tax at 24% on the remaining £10,300

Q. How much would a 76-year-old with an annual salary of £47,200 pay in income tax during the tax year 2016-17?

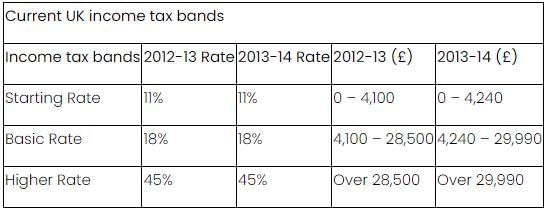

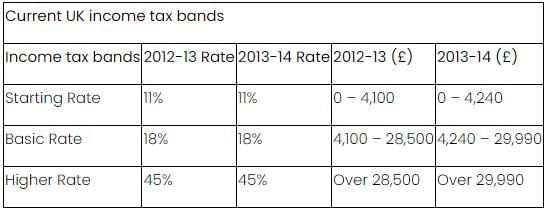

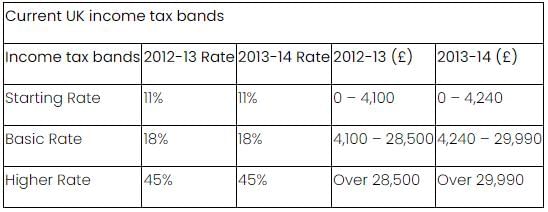

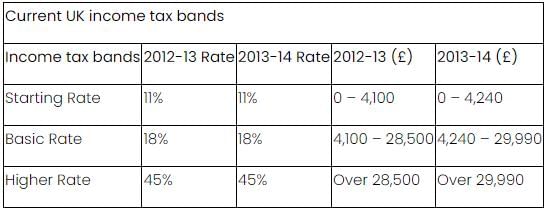

UK income tax allowances, rates and bands

In order to calculate the amount received from income after tax, you need to know:

- the allowances – income tax is not deducted from these

- the bands into which income is allocated

- the different rates at which income tax will be deducted from the bands

For example, in 2013-14, someone aged 57 earning £20,000 per year, will:

- have a tax-free allowance of £6,290

- pay tax at 11% on £4,240

- and pay tax at 18% on the remaining £9,470

Q. Two colleagues at a supermarket both earn £21,000 per year. Given that one is 44 and the other is 66, what is the difference in their income tax contributions in 2012-13?

UK income tax allowances, rates and bands

In order to calculate the amount received from income after tax, you need to know:

- the allowances – income tax is not deducted from these

- the bands into which income is allocated

- the different rates at which income tax will be deducted from the bands

For example, in 2013-14, someone aged 57 earning £20,000 per year, will:

- have a tax-free allowance of £6,290

- pay tax at 11% on £4,240

- and pay tax at 18% on the remaining £9,470

Q. To the nearest £0.01, what is the average monthly income tax contribution of a 21-year-old who earns £5,309 during the 2012-13 tax year?

UK income tax allowances, rates and bands

In order to calculate the amount received from income after tax, you need to know:

- the allowances – income tax is not deducted from these

- the bands into which income is allocated

- the different rates at which income tax will be deducted from the bands

For example, in 2013-14, someone aged 57 earning £20,000 per year, will:

- have a tax-free allowance of £6,290

- pay tax at 11% on £4,240

- and pay tax at 18% on the remaining £9,470

Q. During the 2013-14 tax year, Martin, who is 61-years-old, receives a taxable £2,500 bonus. How much more does he pay in income tax compared to what would have been deducted from his £25,000 salary alone?

UK income tax allowances, rates and bands

In order to calculate the amount received from income after tax, you need to know:

- the allowances – income tax is not deducted from these

- the bands into which income is allocated

- the different rates at which income tax will be deducted from the bands

For example, in 2013-14, someone aged 57 earning £20,000 per year, will:

- have a tax-free allowance of £6,290

- pay tax at 11% on £4,240

- and pay tax at 18% on the remaining £9,470

Q. As the 2013-14 tax year begins, Jean’s annual salary is raised from £33,000 to £35,000. Compared with the previous year, how much more does he end up paying in income tax, given that he is 39 years-old?