Test: Inventories - 3 - CA Foundation MCQ

30 Questions MCQ Test - Test: Inventories - 3

The amount of purchase if

Cost of goods sold is Rs.80,700

Opening stock Rs.5,800

Closing stock Rs.6,000

Average Stock = Rs 12,000. Closing stock is Rs 3,000 more than opening stock. The value of closing stock = ______.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Goods purchased Rs 1,00,000. Sales Rs 90,000. Margin 20% on cost. Closing Stock = ?

A company is following weighted average cost method for valuing its inventory. The details of its purchase and issue of raw-materials during the week are as follows:

1.12.2005 opening stock 50 units value Rs.

2,200. 2.12.2005 purchased 100 units @Rs.47.

4.12.2005 issued 50 units.

5.12.2005 purchased 200 units @Rs.48.

The value of inventory at the end of the week and the unit weighted average costs is

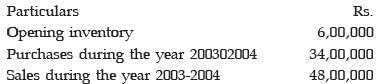

The books of T Ltd. revealed the following information:

Q.On March 31, 2004, the value of inventory as per physical stock-taking was Rs.3,25,000.

The company’s gross profit on sales has remained constant at 25%. The management of the company suspects that some inventory might have been pilfered by a new employee.

What is the estimated cost of missing inventory?

The books of B Ltd. revealed the following information:

Q.On March 31, 2005, the value of inventory as per physical stock-taking was Rs.3,25,000.

The company’s gross profit on sales has remained constant at 25%. The management of the company suspects that some inventory might have been pilfered by a new employee.

What is the estimated cost of missing inventory

C Ltd. recorded the following information as on March 31, 2005:

Q.It is noticed that goods worth Rs.30,000 were destroyed due to fire. Against this, the insurance company accepted a claim of Rs.20,000.The company sells goods at cost plus 33 1/3 %. The value of closing inventory, after taking into account the above transactions is,

If the goods purchased are in transit, then the journal entry at the end of the period will be

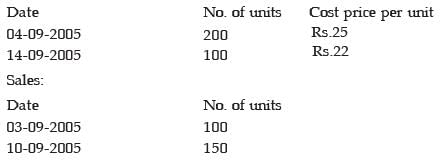

D Company, a dealer in cosmetics, records its inventory under first-in-first-out method, so as to minimize accumulation of outdated stock. The opening stock as on September 01, 2005 is 150 units at the rate of Rs.20 per unit. The purchases and sales made during the month are:

Purchases:

With effect from September 01, 2005, the company decided to change the method of inventory valuation from the FIFO method to LIFO method. The change in the value of inventory consequent upon the change in the method of valuation is

E Ltd., a dealer in second-hand cars has the following five vehicles of different models and makes in their stock at the end of the financial year 2004-2005:

Q.The value of stock included in the balance sheet of the company as on March 31, 2005 was

On April 07, 2005, i.e, a week after the end of the accounting year 2004-05, a company undertook physical stock verification. The value of stock as per physical stock verification was found to be Rs.35,000.

The following details pertaining to the period April 01, 2005 to April 07, 2005 are given:

I. Goods costing Rs.5,000 were sold during the week.

II. Goods received from consignor amounting to Rs.4,000 included in the value of stock.

III. Goods earlier purchased but returned during the period amounted to Rs.1,000.

IV. Goods earlier purchased and accounted but not received Rs.6,000.

After considering the above, the value of stock held as on March 31, 2005 was

While finalizing the current year’s profit, the company realized that there was an error in the valuation of closing stock of the previous year. In the previous year, closing stock was valued more by Rs.50,000. As a result

The total cost of goods available for sale with a company during the current year is Rs.12,00,000 and the total sales during the period are Rs.13,00,000. If the gross profit margin of the company is 33 1/3% on cost, the closing inventory during the current year is

A company follows weighted average cost method for the valuation of its inventory. The details of purchase and issue of raw-materials pertaining to the company during the week April 01, 2006 to April 07, 2006 are as follows:

The value of inventory at the end of the week under weighted average method is

Consider the following information pertaining to G & Sons as on March 31, 2005:

As per physical inventory taken on March 31, 2005 the closing inventory was Rs.20,90,000.

Gross profit on sales has remained constant at 25%. The management of the firm suspects that some inventory might have been taken away by a new employee. The estimated cost of missing inventory on the close of the financial year and the cost of goods sold during the year, respectively are

S Ltd. follows perpetual inventory system. On March 31 of every year, the company undertakes physical stock verification. On March 31, 2004, the value of stock as per the records differed from the value as per the physical stock. On scrutiny, the following differences were noticed:

Goods purchased for Rs.10,000 were received and included in the physical stock but no entry was made in the books.

Goods costing Rs.30,000 were sold and entered in the books but the stock is yet to be delivered.

Goods worth Rs.5,000 are returned to the suppliers but is omitted to be recorded.

If the inventory is valued in the books at Rs.1,50,000, the value of the physical inventory is

Consider the following data pertaining to H Ltd. for the month of March 2005:

The company made purchases amounting Rs. 3,30,000 on credit. During the month of March 2005, the company paid a sum of Rs.3,50,000 to the suppliers. The goods are sold at 25% above the cost. The sales for the month of March 2005 were

Consider the following data pertaining to a company for the month of March 2005:

The sales of the company during the month are

Consider the following data pertaining to N Ltd. for the month of March 2005:

Q.If the company uses weighted average method for inventory valuation, the value of inventory as on March 31, 2005 is

O Ltd. maintains the inventory records under perpetual system of inventory. Consider the following data pertaining to inventory of O Ltd. held for the month of March 2005:

Q.If the company sold 32 units on March 24, 2005, closing inventory under FIFO method is

Consider the following data pertaining to R Ltd. for the month of June 2004:

Q.If the gross profit is 20% of net sales, the gross sales for the month of June 2004 is

Consider the following for Q Co. for the year 2005-06:

Q.Closing stock of goods for the year 2005-06 was

Consider the following data pertaining to credit purchases made by K Ltd., a dealer in electronic goods, for the month of March 2005:

On March 22, 2005, the company purchased from LM Stationers on credit for office use 10 dozens of carbon papers at the rate of Rs.35 per dozen and 10 dozens of ball pens at the rate of Rs.25 per dozen.

At the time of making payment on March 31, 2005, the suppliers have allowed a cash discount of 10% on the above purchases.

The total of purchases for the month of March 2005, was

Hindustan Ltd. has furnished the following details :

Q.What is the value of closing stock using FIFO method :

Hindustan Ltd. has furnished the following details :

Q.Using the information given in the problem, the value of issues using FIFO method :

Hindustan Ltd. has furnished the following details :

Q.Using the information given in problem, the value of closing stock as per LIFO method :

Hindustan Ltd. has furnished the following details :

Q.Using the information given in problem, the value of closing stock as per weighted average method :

Hindustan Ltd. has furnished the following details :

Q.Using the information given in problem, the value of issues using weighted average method :