Test: Inventories - 2 - CA Foundation MCQ

21 Questions MCQ Test - Test: Inventories - 2

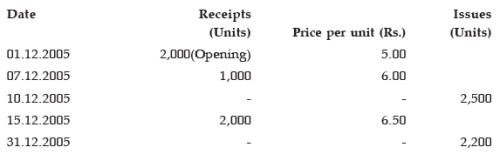

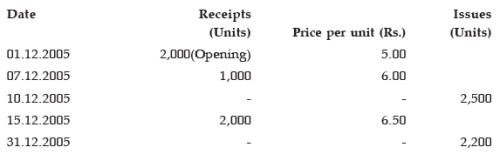

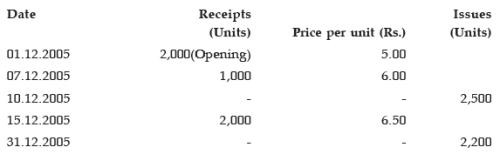

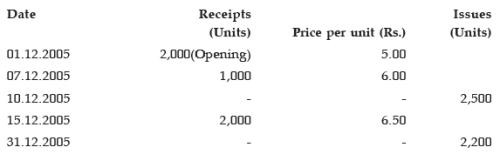

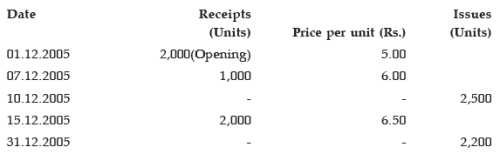

The following are the details supplied by Agni Ltd. in respect of its raw materials for the Month of December, 2005 :

On 31.12.2005, a shortage of 100 units was found

Q.Using the data given in problem, the value of issues in the month of December 2005 using LIFO principle.

The following are the details supplied by Agni Ltd. in respect of its raw materials for the Month of December, 2005 :

On 31.12.2005, a shortage of 100 units was found

Q.Using the data given in problem, the value of closing stock using FIFO principle.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

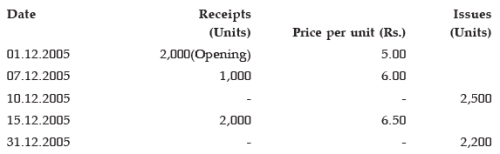

The following are the details supplied by Agni Ltd. in respect of its raw materials for the Month of December, 2005 :

On 31.12.2005, a shortage of 100 units was found

Q.Using the data given in problem, the value of issues in the month of December 2005 using FIFO method.

The following are the details supplied by Agni Ltd. in respect of its raw materials for the Month of December, 2005 :

On 31.12.2005, a shortage of 100 units was found

Q.Using the data given in problem , the value of closing stock using simple average principle.

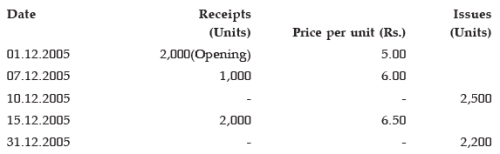

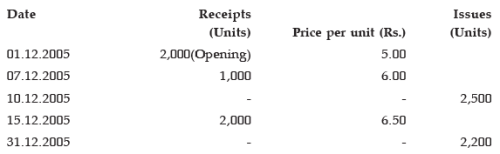

The following are the details supplied by Agni Ltd. in respect of its raw materials for the Month of December, 2005 :

On 31.12.2005, a shortage of 100 units was found

Q.Using the data given in problem, the value of issues in the month of December 2005 using simple average method.

X who was closing his books on 31.03.2006 failed to take the actual stock which he did on 9th April, when it was ascertained by him to be worth Rs 25,000.

It was found that sales are entered in the Sales Day Book on the same day of despatch and the returns inward in the returns book as and when the goods are received back. Purchases are entered in the Purchase Day Book once the invoices are received. Observations -

i. Sales between 31st March and 9th April as per Sales Book are Rs 1,720. Rate of gross profit is 33 1/3 % on cost.

ii. Purchases during the same period as per Purchases Book are Rs 120.

iii. Out of above purchases, goods amounting to Rs 50 were not received until after the stock was taken.

iv. Goods invoiced during the month of March, but goods received only on 4th April, amounted to Rs 100.

You want to find the value of physical stock on 31st March. You start with the value of stock on 9th April.

Q.How would you adjust the observation # 1?

X who was closing his books on 31.03.2006 failed to take the actual stock which he did on 9th April, when it was ascertained by him to be worth Rs 25,000.

It was found that sales are entered in the Sales Day Book on the same day of despatch and the returns inward in the returns book as and when the goods are received back. Purchases are entered in the Purchase Day Book once the invoices are received. Observations -

i. Sales between 31st March and 9th April as per Sales Book are Rs 1,720. Rate of gross profit is 33 1/3 % on cost.

ii. Purchases during the same period as per Purchases Book are Rs 120.

iii. Out of above purchases, goods amounting to Rs 50 were not received until after the stock was taken.

iv. Goods invoiced during the month of March, but goods received only on 4th April, amounted to Rs 100.

You want to find the value of physical stock on 31st March. You start with the value of stock on 9th April.

Q.How would you adjust the observation # 2?

X who was closing his books on 31.03.2006 failed to take the actual stock which he did on 9th April, when it was ascertained by him to be worth Rs 25,000.

It was found that sales are entered in the Sales Day Book on the same day of despatch and the returns inward in the returns book as and when the goods are received back. Purchases are entered in the Purchase Day Book once the invoices are received. Observations -

i. Sales between 31st March and 9th April as per Sales Book are Rs 1,720. Rate of gross profit is 33 1/3 % on cost.

ii. Purchases during the same period as per Purchases Book are Rs 120.

iii. Out of above purchases, goods amounting to Rs 50 were not received until after the stock was taken.

iv. Goods invoiced during the month of March, but goods received only on 4th April, amounted to Rs 100.

You want to find the value of physical stock on 31st March. You start with the value of stock on 9th April.

Q.How would you adjust the observation # 3?

X who was closing his books on 31.03.2006 failed to take the actual stock which he did on 9th April, when it was ascertained by him to be worth Rs 25,000.

It was found that sales are entered in the Sales Day Book on the same day of despatch and the returns inward in the returns book as and when the goods are received back. Purchases are entered in the Purchase Day Book once the invoices are received. Observations -

i. Sales between 31st March and 9th April as per Sales Book are Rs 1,720. Rate of gross profit is 33 1/3 % on cost.

ii. Purchases during the same period as per Purchases Book are Rs 120.

iii. Out of above purchases, goods amounting to Rs 50 were not received until after the stock was taken.

iv. Goods invoiced during the month of March, but goods received only on 4th April, amounted to Rs 100.

You want to find the value of physical stock on 31st March. You start with the value of stock on 9th April.

Q.How would you adjust the observation # 4?

X who was closing his books on 31.03.2006 failed to take the actual stock which he did on 9th April, when it was ascertained by him to be worth Rs 25,000.

It was found that sales are entered in the Sales Day Book on the same day of despatch and the returns inward in the returns book as and when the goods are received back. Purchases are entered in the Purchase Day Book once the invoices are received. Observations -

i. Sales between 31st March and 9th April as per Sales Book are Rs 1,720. Rate of gross profit is 33 1/3 % on cost.

ii. Purchases during the same period as per Purchases Book are Rs 120.

iii. Out of above purchases, goods amounting to Rs 50 were not received until after the stock was taken.

iv. Goods invoiced during the month of March, but goods received only on 4th April, amounted to Rs 100.

You want to find the value of physical stock on 31st March. You start with the value of stock on 9th April.

Q.Value of physical stock on 31st March = _______.

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –

1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.

You want to determine the value of stock on 30th June. You start with physical stock on 23rd June.

Q.What will you do regarding adjustment # 1?

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –

1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.

You want to determine the value of stock on 30th June. You start with physical stock on 23rd June.

Q.What will you do regarding adjustment # 2?

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –

1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.

You want to determine the value of stock on 30th June. You start with physical stock on 23rd June.

Q.Normal Sales = ______.

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –

1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.

You want to determine the value of stock on 30th June. You start with physical stock on 23rd June.

Q.Cost of Normal Sales = _______.

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –

1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.

You want to determine the value of stock on 30th June. You start with physical stock on 23rd June.

Q.What will you do regarding adjustment # 3?

Physical verification of stock was done on 23rd june. the value of stock was rs 4,80,000. following transactions took place between 23rd june and 30th june –

1 . Out of goods sent on consignment, goods costing Rs 24,000 were unsold.

2 . Purchases of Rs 40,000 were made, out of which goods worth Rs 16,000 were delivered on 5th July.

3 . Sales were Rs 1,36,000, which include goods worth Rs 32,000 sent on approval. Half of these goods were returned before 30th June, but no intimation is available regarding the remaining goods. Goods are sold at cost plus 25%. However, goods costing Rs24,000 had been sold for Rs12,000.

You want to determine the value of stock on 30th June. You start with physical stock on 23rd June.

Q.Value of stock on 30th June = ________.

Choose the correct answer(more than one)

Q.Which of the following is false?

Under inflationary conditions, which of the methods will not show highest value of closing stock?

Under inflationary conditions, which of the methods will not show lowest value of closing stock?

Under inflationary conditions, which of the methods will not show greatest value of cost of goods sold?

Under inflationary conditions, which of the methods will not show lowest value of cost of goods sold?