Central Bank Apprentice Mock Test - 1 - Bank Exams MCQ

30 Questions MCQ Test - Central Bank Apprentice Mock Test - 1

Anil can complete a work in 50 days and Hari can destroy it in 100 days. If both of them are working together, in how many days will the work be completed?

In how many ways 5 girls and 3 boys be seated in a row, so that no two boys are together?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

A cricket pitch is about 364 cm. In meters it is equal to

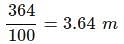

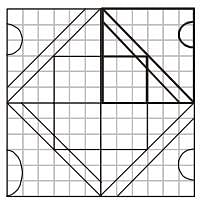

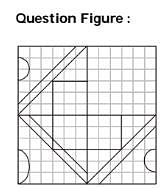

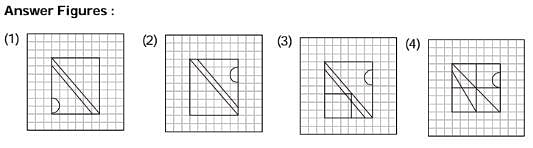

Which answer figure will complete the pattern in the question figure?

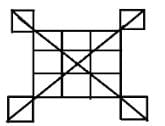

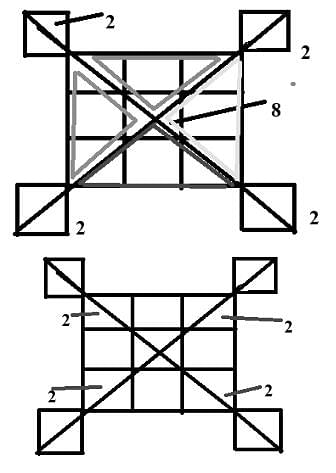

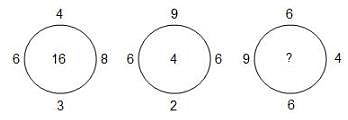

Which of the following will replace the question mark (?) in the problem given below?

Direction: Read the following passages carefully and answer the question that follows.

When young, a little crab looks quits unlike its parents. As it grows older, it drops its outer converting time and again and grown into new one. With each new coat it comes to look more and more like its its parents, until finally it appears in a shell with its legs and claws just like its parents. When this stage is reached, it continues to drop its covering several times, but the change is seen in its size, not in its form. While the old shell is being made ready to come off, there is a new shell formatting over the flesh of the crab's underneath, but it is quits soft and flexible until the old one has been dropped.

Q. This story is mainly about ?

Direction: Read the following passages carefully and answer the question that follows.

When young, a little crab looks quits unlike its parents. As it grows older, it drops its outer converting time and again and grown into new one. With each new coat it comes to look more and more like its its parents, until finally it appears in a shell with its legs and claws just like its parents. When this stage is reached, it continues to drop its covering several times, but the change is seen in its size, not in its form. While the old shell is being made ready to come off, there is a new shell formatting over the flesh of the crab's underneath, but it is quits soft and flexible until the old one has been dropped.

Q.The form of a grown-up crab ?

Which type of clientele is required to submit a certified true copy of the IT returns of the last 2 years while opening a bank account?

What is one of the indicators of a good credit score ?