Central Bank Apprentice Mock Test - 2 - Bank Exams MCQ

30 Questions MCQ Test - Central Bank Apprentice Mock Test - 2

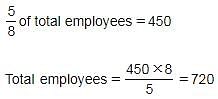

In 2020, 37.50% of the total employees of a company paid income tax. If 450 employees of the company did not pay tax, what is the total number of employees in the company?

You are given a question and two statements I and II. You have to decide whether the data provided in the statements are sufficient to answer the question.

On which date of month was Harish born in February 2000?

Statements:

I. Harish was born on an even date of the month.

II. Harish’s birth date was a prime number.

I. Harish was born on an even date of the month.

II. Harish’s birth date was a prime number.

Two letters are randomly chosen from the word MILK. Find the probability that the letters are L and K.

Direction: Read the following information carefully and answer the questions that follow.

A blacksmith has five iron articles A, B, C, D and E each having a different weight.

I. A weight is twice as much as of B.

II. B weight is four and half times as much as of C.

III. C weight is half times as much as of D.

IV. D weight is half as much as of E.

V. E weight is less than A but more than C.

Q. E is heavier than which of the following two articles?

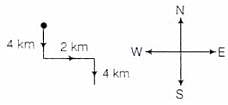

If a man on the moped starts from a point and rides 4km south, then turns left and rides 2km, then turn again to the right to ride 4km more, towards which direction is he moving?

A word given in capital letters is followed by four answer words. Out of this only one can be formed by using the letters of the given word. Find out that word:

INTELLIGENCE

Direction: Read the following passages carefully and answer the question that follows.

Regardless of how the state's feedback control law is designed, it is almost always necessary to implement it, using estimates of the state obtained from an observer. Hence, it is necessary to insure so that the desirable properties of the state feedback design do not vanish when the state estimate are used. It is proven in linear system theory courses that the command response is unaffected by the presence of the observer. However, the response to initial conditions will affect the system output. It is suggested that the observed poles should be made faster than the state feedback poles by an amount that depends upon the level of measurement noise. These conclusions are generally based upon transient time response properties of the system, and not on feedback properties such as robustness margins, We now present a procedure for tuning an observer so that, under appropriate conditions, the feedback properties of a state feedback design are recovered.

Q. On what basis suggestions are given?

Direction: Read the following passages carefully and answer the question that follows.

Regardless of how the state's feedback control law is designed, it is almost always necessary to implement it, using estimates of the state obtained from an observer. Hence, it is necessary to insure so that the desirable properties of the state feedback design do not vanish when the state estimate are used. It is proven in linear system theory courses that the command response is unaffected by the presence of the observer. However, the response to initial conditions will affect the system output. It is suggested that the observed poles should be made faster than the state feedback poles by an amount that depends upon the level of measurement noise. These conclusions are generally based upon transient time response properties of the system, and not on feedback properties such as robustness margins, We now present a procedure for tuning an observer so that, under appropriate conditions, the feedback properties of a state feedback design are recovered.

Q. What is proved in linear system courses?

How are interest payments typically made on fixed deposits ?

What is one of the key requirements for opening a Term Deposit Account ?

What option is available to account holders upon maturity of a term deposit ?

In what scenario can fixed deposits be accepted as a surety for issuing loans ?

What happens if a term deposit is renewed after 14 days from the date of maturity ?

How does the length of one's credit history affect credit scoring ?

Why should individuals be cautious about closing old accounts and opening new ones ?

What factor contributes to a favorable credit score ?

What is identified as one of the common credit problem ?

What is a common factor that can lead to a negative credit score ?

Which action can result in cheque bounces/dishonors ?

How are disbursements typically managed in the case of constructing a house ?