Central Bank Apprentice Mock Test - 3 - Bank Exams MCQ

30 Questions MCQ Test - Central Bank Apprentice Mock Test - 3

The average of X natural numbers is 20. If 40 is added to the first number and 4 is subtracted from the last number, the average becomes 22. What is the value of X?

If the difference between the downstream speed and upstream speed of a boat is 8 km/hr, what is the speed of stream?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

If it is possible to make a meaningful word with the 2nd, the 3rd, the 4th and the 6th letter of the word STRATEGIC; then which of the following will be the 2nd letter of the word? If no such word can be made, mark ‘X’ as your answer. If more than one such word can be made, mark ‘M’ as your answer.

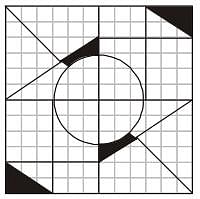

Which answer figure will complete the pattern in the question figure?

Direction: Read the following passages carefully and answer the question that follows.

Knowledge means knowing the things in an appropriate and better way. A man of knowledge can understand the circumstances more wisely, so can decide the things favorably. Knowledge inspired. confidence and courage to act at a right time. A man of knowledge possesses immense influence in society. He has the capacity to lead the society, mold the society in a positive direction and keeps away the society from the many social evils. A man of knowledge can turn the sleeping people into a thundering force. Whatever the inventions and discoveries are seen today. from needle to the jet planes. are the result of proper use of knowledge. Human being is the only creature who can use his brain wisely, rationally, selectively and can do wonders.

Q. What sort of life a man of knowledge can lead?

Direction: Read the following passages carefully and answer the question that follows.

Knowledge means knowing the things in an appropriate and better way. A man of knowledge can understand the circumstances more wisely, so can decide the things favorably. Knowledge inspired. confidence and courage to act at a right time. A man of knowledge possesses immense influence in society. He has the capacity to lead the society, mold the society in a positive direction and keeps away the society from the many social evils. A man of knowledge can turn the sleeping people into a thundering force. Whatever the inventions and discoveries are seen today. from needle to the jet planes. are the result of proper use of knowledge. Human being is the only creature who can use his brain wisely, rationally, selectively and can do wonders.

Q. What is the reformative activity of a man of knowledge according to the given passage?

Under what circumstances is the interest on overdue bank deposits exempt from Income Tax ?

How is the disbursement process structured for the purchase of a plot and subsequent construction ?

How is disbursement managed in the case of purchasing a flat, particularly for a new flat ?

What is one of the primary eligibility requirements for individuals applying for Home Loans ?

What is the key factor determining the disbursement of a loan in the case of purchasing a flat and constructing it?