Central Bank Apprentice Mock Test - 4 - Bank Exams MCQ

30 Questions MCQ Test - Central Bank Apprentice Mock Test - 4

What is the total surface area of a cuboid whose length, breadth and height are 10 cm, 8 cm and 5 cm respectively?

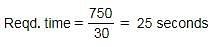

In how many seconds can a 750-meter-long train cross an electric pole while running at 30 m/s?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

A sum of Rs. 8000 is borrowed at 5% p.a. compound interest and paid back in 3 equal annual instalments. What is the amount of each instalment?

Among Anil, Bibek, Charu, Debu and Eswar, Eswer is taller than Debu but not as fat as Debu. Charu is taller than Anil but shorter than Bibek. Anil is fatter than Debu but not as fat as Bibekk. Eswer is thinner than Anil. Who is the thinnest person?

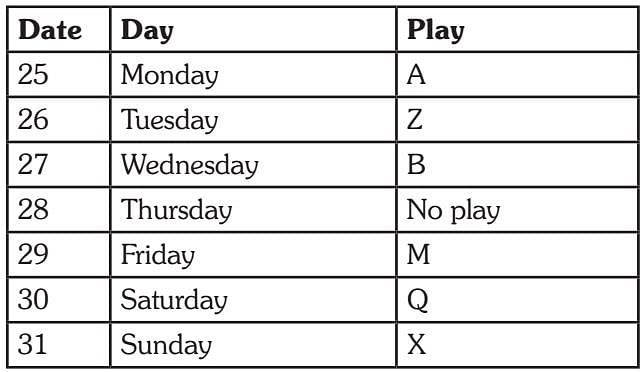

Direction: Study the following information to answer the given questions:

(i) Six plays are to be organized from Monday to Sunday – one play each day with one day when there is no play. ‘No play’ day is not Monday or Sunday.

(ii) The plays are held in sets of 3 plays each in such a way that 3 plays are held without any break, i.e. 3 plays are held in such a way that there is no ‘No play’ day between them but immediately before this set or immediately after this set it is ‘No play’ day.

(iii) Play Z was held on 26th and play X was held on 31st of the same month.

(iv) Play B was not held immediately after play A (but was held after A, not necessarily immediately) and play M was held immediately before Q.

(v) All the six plays were held in the same month.

Q. Which date was a ‘No play’ day?

Direction: Read the following passages carefully and answer the question that follows.

The harbor was abuzz. People were wandering here and there, screwing their eyes up to the horizon, checking to see if the ship had arrived. Not just any ship of course there were plenty of those to be seen on the waters, bobbing elegantly but this was the "Tuscany", from America. Nothing to boast of as far as the ship itself was concerned. Just the cargo she carried. Finally, a ship arrived, slowly, painstakingly, with two men, seen as little specks on the deck.

Q. 'Screwing their eyes upto the horizon' means?

Direction: Read the following passages carefully and answer the question that follows.

The harbor was abuzz. People were wandering here and there, screwing their eyes up to the horizon, checking to see if the ship had arrived. Not just any ship of course there were plenty of those to be seen on the waters, bobbing elegantly but this was the "Tuscany", from America. Nothing to boast of as far as the ship itself was concerned. Just the cargo she carried. Finally, a ship arrived, slowly, painstakingly, with two men, seen as little specks on the deck.

People were wandering here and there explains ?

1. People were eagerly waiting for ship to arrive at the harbour

2. People were waiting for cargo carried by the ship.

Q. Which of the statement are true ? select the code given below .

What is the purpose of bookmarks in the context of web browsing?

What is the primary business activity of a bank ?

What is the primary eligibility requirement for individuals applying for Home Improvement Loans ?

What is the maximum loan amount provided for furnishing a house/flat ?

What is the margin requirement for new cars while availing Auto/Vehicle Loans ?

What is the maximum moratorium period allowed by banks for repayments or collections ?

Who are some of the eligible individuals for personal loans ?

What type of loans vary in amount depending on the schemes developed by each bank and the target group?