Central Bank Apprentice Mock Test - 5 - Bank Exams MCQ

30 Questions MCQ Test - Central Bank Apprentice Mock Test - 5

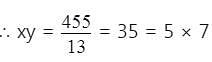

The HCF and LCM of two numbers are 13 and 455 respectively. If one of the number lies between 75 and 125, then, that number is :

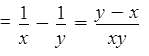

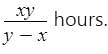

A pipe can fill a tank in ‘x’ hours and another pipe can empty it in‘y’ (y > x) hours. If both the pipes are open, in how many hours will the tank be filled ?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

If + = x , - = ÷ , x = + , ÷ = - , then which is the correct equation out of the following ?

Find the odd number / letters / word from the given alternative.

Direction: In each question below is given a statement followed by two courses of action numbered I and II. You have to assume everything in the statement to be true and on the basis of the information given in the statement, decide which of the suggested courses of action logically follow(s) for pursuing.

Statement: A large number of people in ward X of the city are diagnosed to be suffering from a fatal malaria type.

Course of action:

I. The city municipal authority should take immediate steps to carry out extensive fumigation in ward X.

II. The people in the area should be advised to take steps to avoid mosquito bites.

Direction: Read the following passages carefully and answer the question that follows.

The ancient Harappan Civilization emerged, flourished and collapsed under a steadily weakening monsoon, according to new research findings, that scientists say, provide the strongest evidence yet to link its risk and fall to changing climate. A team of scientists has combined multiple sets of date to show that weakening monsoon and reduced river water initially stimulated intensive agriculture and urbanisation, but later precipitated the decline and collapse of the subcontinent's earliest cities. The scientist said their research also suggests that a larger river, summed to be the mythical Saraswati, which once watered the Harappan Civilization's heartland between the suggests it was a glacier fed river with origins in the Himalyas. The findings appear today in the US Journal Proceedings of the National Academy of Science

Q. What task the team of scientists was assigned to?

Direction: Read the following passages carefully and answer the question that follows.

The ancient Harappan Civilization emerged, flourished and collapsed under a steadily weakening monsoon, according to new research findings, that scientists say, provide the strongest evidence yet to link its risk and fall to changing climate. A team of scientists has combined multiple sets of date to show that weakening monsoon and reduced river water initially stimulated intensive agriculture and urbanisation, but later precipitated the decline and collapse of the subcontinent's earliest cities. The scientist said their research also suggests that a larger river, summed to be the mythical Saraswati, which once watered the Harappan Civilization's heartland between the suggests it was a glacier fed river with origins in the Himalyas. The findings appear today in the US Journal Proceedings of the National Academy of Science

Q. What was the controversy in the passage?

What is the other name for 'transistor computer'?

What historical origin is associated with the term "customer" ?

What defines a customer from a banking perspective ?

What category of bank customers, includes individuals who are considered non-competent to contract due to their age?

Which category of bank customers, may consist of individuals who are in charge of managing the assets and affairs of a deceased person?

Which category of bank customers could potentially involve individuals who are residing outside their home country?

What is the preferable type of bank account to open for a minor ?

Who is considered the natural guardian of a Hindu minor ?

Under what circumstances can a court appoint a guardian for a minor ?

What is a notable benefit for prompt repayment of the loan ?

What is a key factor that may lead to a difference in the quality of appraisal in retail loans ?