Central Bank Apprentice Mock Test - 7 - Bank Exams MCQ

30 Questions MCQ Test - Central Bank Apprentice Mock Test - 7

If k is the largest possible real number such that p4 + q4 = (p2 + kpq + q2)(p2 – kpq + q2), then the value of k is

A and B entered into partnership with capitals in the ratio 4 : 5. After 3 months, A withdrew 1/4 of his capital and B withdrew 1/5 of his capital. The gain at the end of 10 months was Rs 760. A’s share in this profit is?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

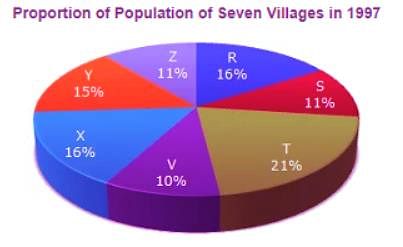

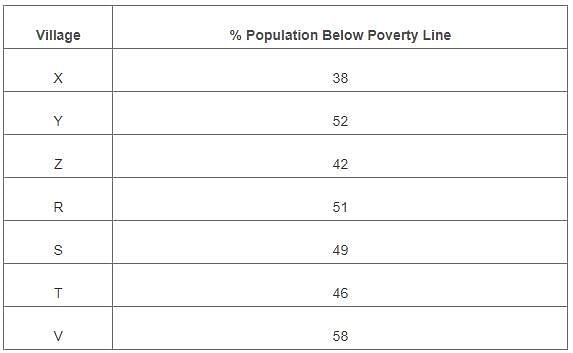

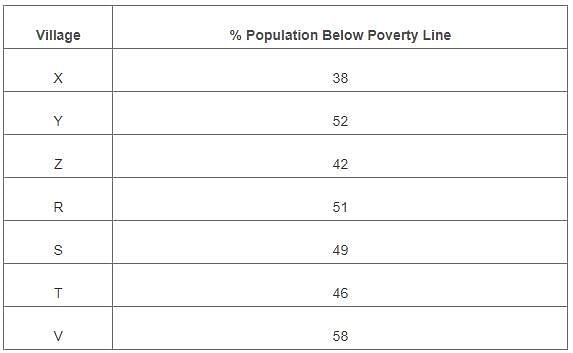

Study the following pie-chart and the table and answer the questions based on them.

Q. If the population of village R in 1997 is 32000, then what will be the population of village Y below poverty line in that year?

Statement: The local hospital has announced the opening of a new wing dedicated to cancer treatment.

Inference:

I. The hospital is expanding its facilities.

II. The hospital has a shortage of staff.

III. The new wing will only treat patients with cancer.

Direction: Study the following information and answer the given questions carefully.

Q is to the south of P. A is to the west of B, which is to the west of C. D is to the south of B. P is to the west of A.

A is to the _____ of D.

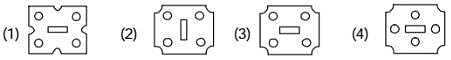

Direction: If a Paper (Transparent Sheet) is folded in a manner and a design or pattern is drawn. When unfolded this paper appears as given below in the answer figure. Choose the correct answer figure given below.

A piece of paper is folded and cut as shown below in the question figures. From the given answer figures, indicate how it will appear when opened.

Question Figure

Answer figure

Direction: Read the following passage carefully and answer the questions that follow each passage. Your answer to these questions should be based on the passage only.

Every successful man fails at some time. Failure tells you about your weaknesses, shortcomings, lack of preparations, lack of efforts. So if you can manage to learn from it contributes to lasting success. Extract the lesson to learn from failure and try again with redoubled vigor. Facing failure makes one strong, more wise and more resolute, spurs them on to greatest efforts. There is not failure in truth, save from within; unless we are beaten there, We are bound to succeed. Failures not only tell us that we couldn't prepare ourselves up to the level of success and with more hard work. Failures are the stepping stones of success. Every successful man has failed, not once but several times, in their life, but they analyzed the things in real perspective and tried again with more vigor and zeal and achieved success.

Q. What does failure teach, besides letting us know our shortcomings?

1. We couldn't prepare ourselves up to the level of success

2. It tells us that we still need to learn

3. We learn from mistakes

Which of the above statements is/are correct?

Direction: Read the following passage carefully and answer the questions that follow each passage. Your answer to these questions should be based on the passage only.

Every successful man fails at some time. Failure tells you about your weaknesses, shortcomings, lack of preparations, lack of efforts. So if you can manage to learn from it contributes to lasting success. Extract the lesson to learn from failure and try again with redoubled vigor. Facing failure makes one strong, more wise and more resolute, spurs them on to greatest efforts. There is not failure in truth, save from within; unless we are beaten there, We are bound to succeed. Failures not only tell us that we couldn't prepare ourselves up to the level of success and with more hard work. Failures are the stepping stones of success. Every successful man has failed, not once but several times, in their life, but they analyzed the things in real perspective and tried again with more vigor and zeal and achieved success.

Q. What does help us to come out of the failure?

'Integrated Circuits' belonged to which of the following generation of Computers?

What is a crucial requirement for a power of attorney to be valid for banking transactions ?

What is a common feature associated with Cash Back Offers on credit cards ?

What is one of the promotional concepts introduced to encourage the usage of credit cards ?

What is one way to make a payment on a credit card if the full amount cannot be paid on or before the due date ?

What is one of the essential steps involved in the credit card issuing process ?