Test: Indian Economy and Indian Financial System - 1 - Bank Exams MCQ

30 Questions MCQ Test - Test: Indian Economy and Indian Financial System - 1

What is the two-stage reporting process for an Indian company receiving FDI through the automatic route?

What is the impact of increasing production costs in the boom phase on the fixed-income category?

Which of the following elements are not taken into account when determining 'Owned Funds'?

What is the fundamental purpose of the Depositories Act, 1996 in India from an economic standpoint?

When did Infrastructure Investment Trusts (InvITs) commence operations in India?

Which of the following explains the ineligibility of non-scheduled banks' in gaining membership of clearing houses?

The government's approach to addressing developmental issues in India involved what specific interventions and policy measures?

What are the economic consequences of the integration of financial markets on the global economy?

What is the specific clause in Chapter III-F of the RBI Act, 1934 that outlines the provision of information to the Monetary Policy Committee (MPC) members?

What is the prescribed time period for the issuance of government securities in the financial market as per the financial regulatory framework?

What is the name of the indicator that shows the relationship between nominal GDP and money supply?

The Prime Minister dedicated Digital Banking Units (DBU) across districts to the nation. These DBU will further financial inclusion and enhance banking experience for citizens. The government aims to provide maximum services with minimum infrastructure, and all of this will happen digitally without involving any paperwork. It will also simplify the banking procedure while also providing a robust and secure banking system. Recently, the Reserve Bank of India (RBI) also issued guidelines on ‘Establishment of DBUs

In which types of centres can SCBs open DBUs in without seeking permission from the RBI?

The Prime Minister dedicated Digital Banking Units (DBU) across districts to the nation. These DBU will further financial inclusion and enhance banking experience for citizens. The government aims to provide maximum services with minimum infrastructure, and all of this will happen digitally without involving any paperwork. It will also simplify the banking procedure while also providing a robust and secure banking system. Recently, the Reserve Bank of India (RBI) also issued guidelines on ‘Establishment of DBUs

What are the specific features and functionalities available to customers at the self-service zone of a DBU?

The Prime Minister dedicated Digital Banking Units (DBU) across districts to the nation. These DBU will further financial inclusion and enhance banking experience for citizens. The government aims to provide maximum services with minimum infrastructure, and all of this will happen digitally without involving any paperwork. It will also simplify the banking procedure while also providing a robust and secure banking system. Recently, the Reserve Bank of India (RBI) also issued guidelines on ‘Establishment of DBUs

In the context of financial technology, what is a Digital Banking Unit (DBU)?

What is the basis for determining the interest rates according to the classical theory of interest?

What does the interpretation of the term "foreign exchange" in the context of the FEMA, 1999, as per the provisions of Section 2(n) include?

Which among the following options is not considered as a program to tackle legacy non-performing assets (NPAs)?

Which of the following factors is not deemed to be a cause of non-performing assets (NPAs)?

What are the three fundamental characteristics that define the concept of interest?

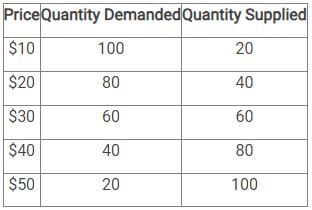

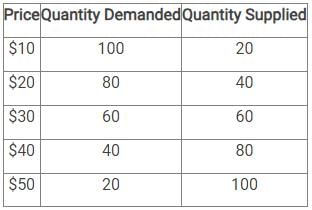

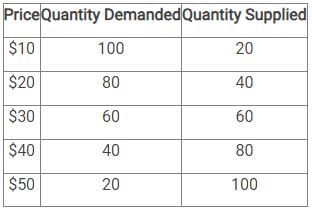

If the price is $10, what is the excess demand in the market?

At what price will the market be in equilibrium?

If the price is $25, what is the quantity supplied in the market?

What is the tenor of financial assistance typically offered by DFIs in India?

The Reserve Bank of India (RBI) has issued a note on Central Bank Digital Currency (CBDC). CBDC pilot launched by the RBI in retail segment has components based on blockchain technology. RBI has identified 9 banks for phase-wise participation in the retail pilot project. Like cash, the CBDC will not earn any interest and can be converted to other forms of money, like deposits with banks. Other steps being taken by RBI for full operationalisation of CBDC include expanding the scope of the pilots gradually to include more banks, users and locations based on feedback received during the pilots.

Among the following options, which bank is not included in RBI’s CBDC pilot project initiative?

The Reserve Bank of India (RBI) has issued a note on Central Bank Digital Currency (CBDC). CBDC pilot launched by the RBI in retail segment has components based on blockchain technology. RBI has identified 9 banks for phase-wise participation in the retail pilot project. Like cash, the CBDC will not earn any interest and can be converted to other forms of money, like deposits with banks. Other steps being taken by RBI for full operationalisation of CBDC include expanding the scope of the pilots gradually to include more banks, users and locations based on feedback received during the pilots.

Which of the following characteristic is not a feature of a central bank digital currency (CBDC)?

The Reserve Bank of India (RBI) has issued a note on Central Bank Digital Currency (CBDC). CBDC pilot launched by the RBI in retail segment has components based on blockchain technology. RBI has identified 9 banks for phase-wise participation in the retail pilot project. Like cash, the CBDC will not earn any interest and can be converted to other forms of money, like deposits with banks. Other steps being taken by RBI for full operationalisation of CBDC include expanding the scope of the pilots gradually to include more banks, users and locations based on feedback received during the pilots.

What is the fundamental dissimilarity between currency and money in economic domain?

What is the rationale for the foreign exchange market operating around the clock, as per financial regulations?

What was the innovative accounting system created by the Sumerians that revolutionized early civilization's economic transactions?

Which chapter in the Reserve Bank of India Act, 1934, outlines the provisions of the central banking activities?

Recently, World Bank postulated that Digital markets work differently than traditional physical markets. The winner-take-all markets of the digital economy prompt 'winners' to resort to certain actions that discourage competition, the Standing Committee on Finance, chaired by Jayant Sinha, said in its report. The committee interacted with Indian representatives of foreign big tech companies like Amazon, Apple, Facebook, Google, Netflix, Twitter, and Uber, as well as representatives of domestic companies like PayTM, MakeMyTrip, Zomato, Ola, Swiggy, Flipkart, etc., to identify competition concerns.

In which year did the World Bank decide to stop publishing the 'Ease of Doing Business' reports due to "data irregularities"?