Test: Indian Economy and Indian Financial System - 3 - Bank Exams MCQ

30 Questions MCQ Test - Test: Indian Economy and Indian Financial System - 3

The slope of the LM curve depends on the?

Which section of The Reserve Bank of India Act, of 1934 deals with transactions in foreign exchange?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

What is the full form of LIBOR?

Which of the following are investment intermediaries?

An economy in which the government makes all the important decisions about production and distribution is known as a?

Which of the following statements is not true about the capital market?

Which of the following forms a part of the informal sector of the Indian Financial System?

A microfinance loan is given to a household having an annual household income of?

Government securities are issued in which of the following?

Does protectionism take the form of?

What is the cash withdrawal limit from Points of Sale (PoS) terminals using debit cards and open-system prepaid cards issued by banks?

Redirection: The launch of the Udyam Registration Portal is one of the recent efforts made by the government to boost the ease of doing business for MSMEs. Micro Small-Enterprises Cluster development program (MSE-CDP), Prime Minister’s Employment generation program (PMEGP), Scheme of Fund for Regeneration of Traditional Industries, enabling IT ecosystems, hassle-free lending, etc. and many such schemes are used to incentivize to allow them to expand and flourish. In light of the statements above, answer the questions that follow.

Entrepreneurs Memorandum (EM) Part II and Udyog Aadhaar Memorandum (UAMs) of the MSMEs, are replaced by Udyam registration, the new & simplified version of Udyog Aadhaar. Earlier, however, EM- II needed to be filed within:

Redirection: The launch of the Udyam Registration Portal is one of the recent efforts made by the government to boost the ease of doing business for MSMEs. Micro Small-Enterprises Cluster development program (MSE-CDP), Prime Minister’s Employment generation program (PMEGP), Scheme of Fund for Regeneration of Traditional Industries, enabling IT ecosystems, hassle-free lending, etc. and many such schemes are used to incentivize to allow them to expand and flourish. In light of the statements above, answer the questions that follow.

What is the target for Banks for lending to MSMEs as per the Prime Minister’s Task Force on MSMEs?

Redirection: The launch of the Udyam Registration Portal is one of the recent efforts made by the government to boost the ease of doing business for MSMEs. Micro Small-Enterprises Cluster development program (MSE-CDP), Prime Minister’s Employment generation program (PMEGP), Scheme of Fund for Regeneration of Traditional Industries, enabling IT ecosystems, hassle-free lending, etc. and many such schemes are used to incentivize to allow them to expand and flourish. In light of the statements above, answer the questions that follow.

The financial assistance provided for any specific project under the Scheme of the Fund for Regeneration of Traditional Industries shall be subject to a maximum of?

Which of the following is an objective of the FRBM Act, of s2004?

Which of the following statements about financial markets and securities are true?

Which of the following is/are not a correct statement?

(i) SLR is used to controlling the bank’s leverage for credit expansion.

(ii) Banks earn returns on money parked with RBI as CRR.

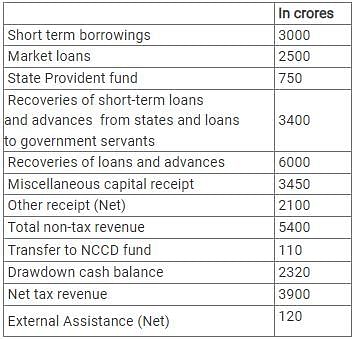

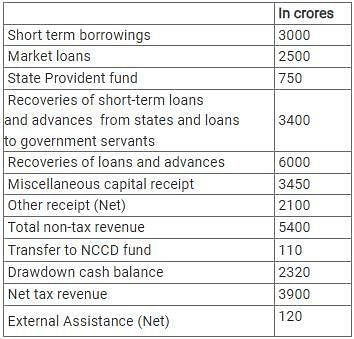

Direction: Study the following data and answer the questions that follow:

Q. What is the amount of the Debt receipt?

Direction: Study the following data and answer the questions that follow:

Q. What are the total receipts?

Which of the following is a correct fact regarding the Reserve Bank of India?

What does the monetary Policy Committee consist of?

Direction: Financial markets are typically defined by having transparent pricing, basic regulations on trading, costs, and fees, and market forces determining the prices of securities that trade.

Financial markets can be found in nearly every nation in the world. Some are very small, with only a few participants, while others – like the Bombay Stock Exchange (BSE) and the forex markets – trade millions of rupees daily. Investors have access to a large number of financial markets and exchanges representing a vast array of financial products. Some of these markets have always been open to private investors; others remained the exclusive domain of major international banks and financial professionals until the very end of the twentieth century.

Q. Call money and certificate of deposits are traded in?

Direction: Financial markets are typically defined by having transparent pricing, basic regulations on trading, costs, and fees, and market forces determining the prices of securities that trade.

Financial markets can be found in nearly every nation in the world. Some are very small, with only a few participants, while others – like the Bombay Stock Exchange (BSE) and the forex markets – trade millions of rupees daily. Investors have access to a large number of financial markets and exchanges representing a vast array of financial products. Some of these markets have always been open to private investors; others remained the exclusive domain of major international banks and financial professionals until the very end of the twentieth century.

Q. Which of the following is not the function of the financial market?

Which of the following statements is not true about the stock exchange?

One difference between a finance lease and an operating lease is that:

Which of the following is not a type of REIT?

Direction: Study the following paragraphs and answer the questions that follow:

The situation of government ownership of banks continued well into the 1990s when the first wave of liberalization ensured that banks were now allowed to be privately owned. While multinational banks were always privately owned, most Indian banks were government owned or owned in a quasi-governmental manner.

Even after liberalization, the RBI or the Reserve Bank of India proceeded cautiously as far as private ownership of the BFSI sector was concerned. However, this did not deter many firms such as the NBFCs or the Non-Banking Financial Companies from operating and indeed, flouting the rules thereby leading to periodic bouts of crises.

Q. The first presidency bank of India is:

Direction: Study the following paragraphs and answer the questions that follow:

The situation of government ownership of banks continued well into the 1990s when the first wave of liberalization ensured that banks were now allowed to be privately owned. While multinational banks were always privately owned, most Indian banks were government owned or owned in a quasi-governmental manner.

Even after liberalization, the RBI or the Reserve Bank of India proceeded cautiously as far as private ownership of the BFSI sector was concerned. However, this did not deter many firms such as the NBFCs or the Non-Banking Financial Companies from operating and indeed, flouting the rules thereby leading to periodic bouts of crises.

Q. How many banks were nationalized in the year 1980?

Direction: Study the following paragraphs and answer the questions that follow:

The situation of government ownership of banks continued well into the 1990s when the first wave of liberalization ensured that banks were now allowed to be privately owned. While multinational banks were always privately owned, most Indian banks were government owned or owned in a quasi-governmental manner.

Even after liberalization, the RBI or the Reserve Bank of India proceeded cautiously as far as private ownership of the BFSI sector was concerned. However, this did not deter many firms such as the NBFCs or the Non-Banking Financial Companies from operating and indeed, flouting the rules thereby leading to periodic bouts of crises.

Q. What is the total number of public sector banks present in India?

Which of the following statements is not true about the primary market?