Test: Accounting & Financial Management of Banking - 4 - Bank Exams MCQ

30 Questions MCQ Test - Test: Accounting & Financial Management of Banking - 4

Directions: On 1st April 2000, X Ltd purchased a Plant for 45,000. It was estimated that the effective life of the plant will be 10 years and after 10 years its scrap value will be 5000. On 1st April, 2001, the company purchased additional machine for 250000 of which the effective life will be 15 years and scrap value 2,500. On 1st October, 2002, a new machine was purchase for 12,000 of which the scrap value will be 2000 and the effective life 20 years. If the depreciation is provided on straight line method. Then,

Q. Some of the words are given below, identify which of these words describes the nature of depreciation process.

I. Permanent nature

II. Gradual process

III. Restoration

IV. Decline causing

I. Permanent nature

II. Gradual process

III. Restoration

IV. Decline causing

Identify the incorrect fundamental rule of accounting

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Chetan sold goods to Ramesh at a cost of 15% profit, and Ramesh sold goods to Suresh at 20% profit on sales. If the cost of goods to Chetan is Rs 75000 what is the cost of cost to Suresh?

Arrange the following assets in the order of liquidity

I. Bills receivable

II. Prepaid insurance

III. Debtors

IV. Goodwill

V. Closing Stock

I. The future value of an annuity is the value of a group of recurring payments at a certain date in the future.

II. The higher the discount rate, the greater the annuity's future value.

Q. Which of the above statements are NOT true?

The company paid Rs. 12,500 to Raju (supplier of goods)

This transaction was correctly recorded in the cashbook. But while posting to the ledger, Raju's account was debited with Rs. 1250.

Find the type of error occurred here.

Under which method of valuation of work in progress the cost to complete the opening WIP and other completed units are calculated differently?

Amith purchased machinery worth 1,50,000 for cash from Rajesh From the following choose the correct journal entry

Pass the journal entry of the following transaction given below:

Bought goods from K for 20,000 at a trade discount of 10% and cash discount of 2%. He paid 60% immediately.

(I) M Dr. 18,000

To Discount Received 216

To K 7200

To Cash 10,584

(II) M Dr. 18,000

To Discount Received 319

To K 7200

To Cash 10,544

(III) M Dr. 19,000

To Discount Received 216

To K 2200

To Cash 10,584

Consider the following statements and choose the correct answer.

I. Bond price volatility refers to the degree of fluctuation in the premium price of the bond in response to the change in the market price of the foreign market.

II. Bond price has an inverse relationship with the interest rate.

Which of the following statement/s is/are correct regarding the concept of conservatism?

I. Creating provision for doubtful debts valuing closing

II. Valuing closing stock at cost or market value whichever is higher

III. Writing of intangible assets like goodwill

IV. Provision for discount on debtors

From the following options choose the one who is known as deemed assessee.

What would be the total late fee and interest payable by a registered person with an aggregate turnover of ₹ 2.5 crores if they fail to file GSTR-1 and GSTR-3B returns within the due date and make the payment after 20 days, with a tax liability of ₹ 1 lakh?

Match the following List I with List II

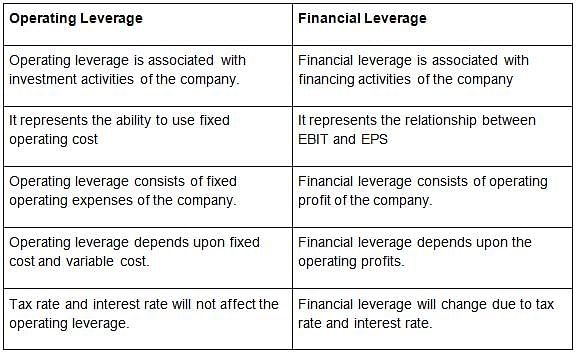

Which of the following statement/s is/are incorrect regarding the difference between operating leverage and financial leverage?

I. Tax rate and interest rate will affect both operating leverage and financial leverage

II. Operating leverage is associated with investment activities of the company. Financial leverage is associated with financing activities of the company.

III. Operating leverage represents the ability to use fixed operating costs. Financial leverage represents the relationship between EBIT and EPS

IV. Operating leverage depends upon the operating profits.Financial leverage depends upon fixed cost and variable cost

RBI comes to the rescue of a bank that is solvent but faces temporary liquidity problems by supplying it with much needed liquidity when no one else is willing to extend credit to that bank.

Q. Which of the following functions of RBI is highlighted in the above statement?

Which of the following is the primary purpose of project appraisal?

Which of the following is the correct treatment regarding rebates on bills discounted?

I. It is debited from Interest earned in the profit and loss account and is shown under Schedule 13

II. It is shown under the Asset side of the Balance Sheet under Schedule 5

Which of the following statement/s is/are correct regarding distinction between Journal and Ledger?

I. The Journal, as a book of source entry, gets greater importance as legal evidence than the ledger.

II. The Journal is the book of original entry; the ledger is the book of second entry

III. The Journal is the book for analytical record; the ledger is the book for chronological record

_______ is an instrument which involves buying/selling of securities like government bond from or to the public and banks.

From the following calculate the net purchase.

Cash purchase = 235000

Credit purchase = 85000

Purchase return = 4000

Which principle has an important bearing on the capital-revenue classification?

(I) The analysis also known as Scenario analysis

(II) It is a technique in which the profit (NPV) in relation to change in a particular factor is determine

(III) The objectives of this analysis is to ascertain profitability (NPV) under different situation

Q. Which kind of analysis is being referred to here.? And the above three statements about this analysis are true or false?

Which of the following statement/s is/are correct regarding depreciation?.

I. It is a decline in the market value of fixed assets.

II. It is an expired cost

III. It is a non-cash expense.

Direction: Current ratio of X Ltd. is 4.5:1. It is found that the working capital of the company is Rs 81,000.

Q. Calculate the amount of current liabilities?

Complete the following information.

Ind AS-16 _________.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below.

Assertion (A): The Statement of profit and loss is prepared for a specific period to determine the operational results of an undertaking

Reason (R): It is a statement of revenue earned and the expenses incurred for earning the revenue.

The profit and loss account of the banking company is prepared in __ as per the third schedule of the Banking Regulation Act, 1949

_____________ is a measure of the annual income generated by the bond as a percentage of its current market price.

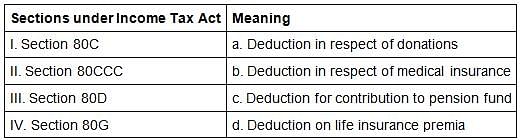

Match the following sections of Income tax Act in column I with their respective tax deduction in column II.