Test: Accounting for Bonus Issue and Right Share - CA Foundation MCQ

20 Questions MCQ Test - Test: Accounting for Bonus Issue and Right Share

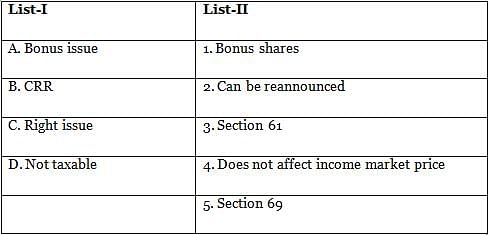

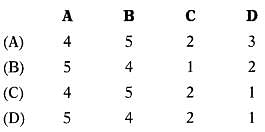

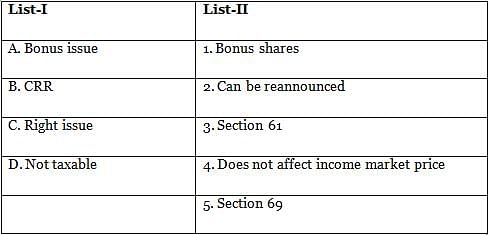

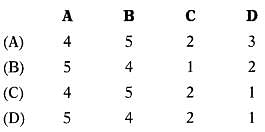

Match the following:

Select the correct answer from the options given below

Right shares can be offered by the companies to persons other than existing shareholders or employees by passing a:

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Notice relating to an offering for right issue shall be dispatched through

The notice relating to offer for the right issue shall be dispatched through registered post or speed post or through electronic mode to all the existing shareholders at least before the opening of the issue.

Which of the following statement is true if the company issues bonus shares?

Which of the following can be utilized for the issue of bonus shares?

- Balance of profits & loss account

- Capital Reserve

- Dividend Equalization Fund

- Development Rebate Reserve

- Profit Prior to Incorporation

Select the correct answer from the options given below

Which of the following condition of Section 63 is required to be complied with by the company before making the bonus issue?

Which of the following is a correct journal entry for the issue of bonus shares?

Following was the Balance Sheet of BCC Ltd. as of 31st December 2019:Equity Shares of ₹10 each ₹ 8,00,000 Securities Premium ₹ 2,80,000General Reserve ₹ 1,40,000Profit & Loss Account ₹ 2,40,000Sundry Creditors ₹ 1,80,000The company issued 3 bonus shares for every 4 fully paid-up shares. Securities premium account will be utilized first and then General Reserve. To issue bonus shares Profit & Loss A/c will be debited by

Following are the extracts from the draft Balance Sheet of OMG Ltd.:

Equity shares Capital (₹10 8,00,000 each)

Securities premium 1,00,000

General reserve 2,50,000

Profit & loss account 1,50,000

A resolution was passed declaring 3 bonus shares for 5 shares held. Use minimum securities premium balance. To issue bonus shares Securities Premium A/c will be debited by

A company cannot issue fully paid-up bonus shares to its members out of:

If a company makes bonus issue at 2:3 then it means

Which of the following can be used for issuing bonus shares?

Which of the following statement is false?

For which one or more of the following reasons could a balance in the securities premium be applied?

(a) To issue bonus shares.

(b) For distribution to shareholders as dividend.

(c) To write down the value of assets, particularly when they are impaired.

(d) To write off expenses of and commission on issuing the same shares

Select the correct answer from the options given below

A company has decided to increase its existing share capital by making rights issues to the existing shareholders in the proportion of 1 new share for every 2 old shares held. You are required to calculate the value of the right if the market value of the share at the time of announcement of the right issue is ₹ 576. The company has decided to give one share of ₹ 100 each at a premium of ₹ 188 each.

An Ltd. has 20,000 Equity Shares of ₹ 10 each. The Balance of the Profit & Loss Account is ₹ 1,40,000. It has issued 6% Debentures in the past of ₹ 1,20,000.

At the annual general meeting, it was resolved that:

(i) To pay a dividend of 10% in cash. The corporate dividend tax rate is 17%.

(ii) To issue 1 bonus share for every 4 shares held after 1 month of right issue.

(iii) To give existing shareholders the right to purchase one ₹ 10 shares for every 4 shares prior to bonus issue.

(iv) To repay debentures at a premium of 596.

Balance of Profit & Loss A/c after giving effect to the above transactions will be