MH SET Paper 2 Mock Test - 7 (Commerce) - MAHA TET MCQ

30 Questions MCQ Test - MH SET Paper 2 Mock Test - 7 (Commerce)

Statement I: Data material held in any electronic form is 'information' under RTI Act, 2005.

Statement II: IT Act, 2000 came into force on 10th October, 2000.

Choose the correct code:

Which of the following firms has often followed a market challenger (second-mover) Strategy?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Choose the correct code for the following statements being correct or incorrect.

Statement I : Intellectual Property (IP) is a category of property that includes intangible creations of the human intellect.

Statement II : IPR does not include trade secrets and moral rights.

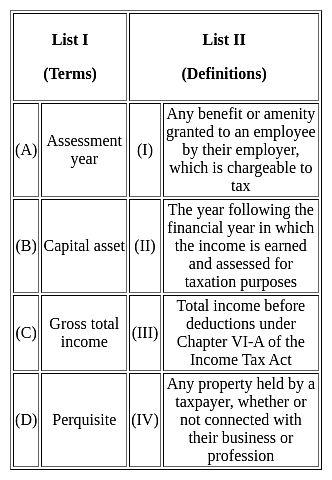

Match the following terms used in the Income Tax Act 1961 with their respective definitions:

Investment in which of the following is most risky?

Which of the following is/are the characteristic(s) of Business Economics ?

i. Business economics is micro economic in character.

ii. It is positive in nature.

iii. It is both conceptual and metrical.

iv. Its contents are based mainly on the theory of firm.

Which of the following statement(s) is/are correct with respect to the role of RBI in the Indian economy?

I. It is the controller of money supply.

II. RBI acts as a banker to the Government of India.

Which Act was replaced with the introduction of Competition Act, 2002?

The process of gathering, sorting, analyzing, and disseminating marketing information for businesses to make daily business decisions is called?

Duties of bailor include

A. Take care of goods

B. Bear extraordinary expenses

C. Return accretion to the goods

D. Indemnify the bailee

E. Disclose known faults

Choose the correct answer from the options given below:

When a business is purchased, any amount paid in excess of total assets is called:

If the purchase consideration is calculated by adding the various payments to be made, the method is called:

The nature of cross-price elasticity of demand in case of complementary products will be:

Committees promoting worker's participation in management are usually set up only at _______.

Assertion: Economic policies in India always foster a conducive business environment.

Reasoning: Well-conceived policies can hinder long-term planning for businesses.

Managers conduct a ________ to know the company’s weakness and strengths relative to those of various peers.