MH SET Paper 2 Mock Test - 9 (Commerce) - MAHA TET MCQ

30 Questions MCQ Test - MH SET Paper 2 Mock Test - 9 (Commerce)

The budgets are classified on the basis of:

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

A ‘Holder in due course’ of a Negotiable Instrument:

The accounting principle that states companies and owners should be accounted for separately is:

Which of the following liabilities are taken into account for acid-test ratio?

(i) Trade Creditors

(ii) Bank Overdraft

(iii) Bills Payable

(iv) Outstanding Expenses

(v) Redeemable Debentures

Identify the principles of trade policy framework from the followings under the WTO:

(A) Reciprocity and transparent

(B) Benefactory and resilient

(C) Non-discriminatory

(D) Binding and enforceable commitments

(E) Protective and benevolent

Choose the correct answer from the options given below:

Direction: Choose the correct option out of the following.

When a population is heterogeneous, it is divided into groups so that there is homogeneity within the group and heterogeneity between the groups and some items are selected at random from each group. It is a case of

Direction: In the following question, a given questions is followed by information in two statements. You have to find out the data in which statement (s) is sufficient to answer the question and mark your answer accordingly.

Statement I: Matrix organisation aims to combine the benefits of decentralisation with those of coordination.

Statement II: A divisional structure is common in organisations that have outgrown the entrepreneurial structure.

Choose the correct option from the following:

Which of the following statements is/are true with respect to Income Tax?

- Income tax is levied on the income of individuals.

- In India, the nature of the income tax is progressive.

- The first income tax is generally attributed to Egypt.

- Income tax generally is computed as the product of a tax rate times taxable income.

Following are the information for a House Property:

Municipal value Rs. 4,50,000

Fair rental value Rs. 5,00,000

Standard rent Rs. 4,80,000

Actual rent Rs. 4,90,000

What is the Gross Annual Value of the House Property?

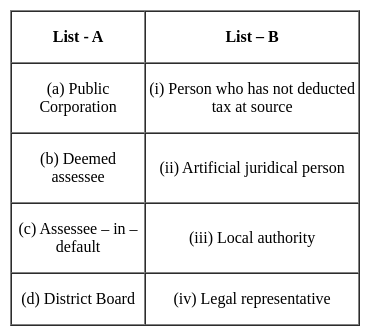

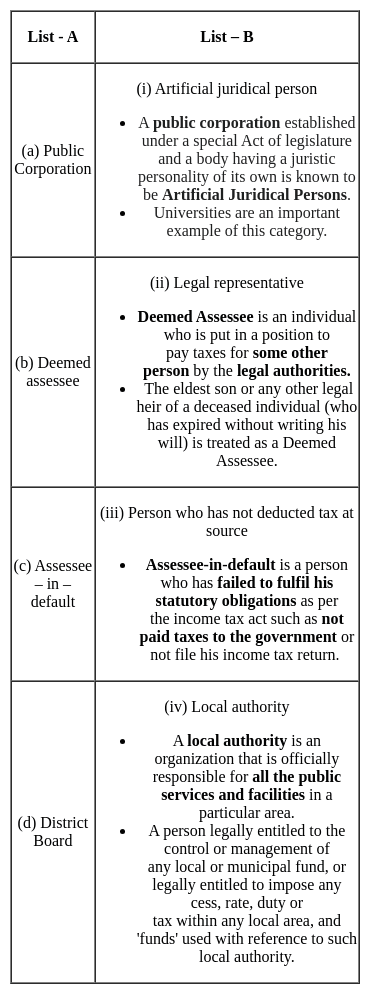

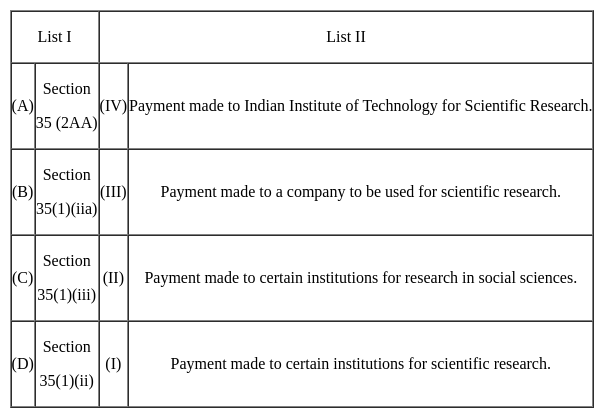

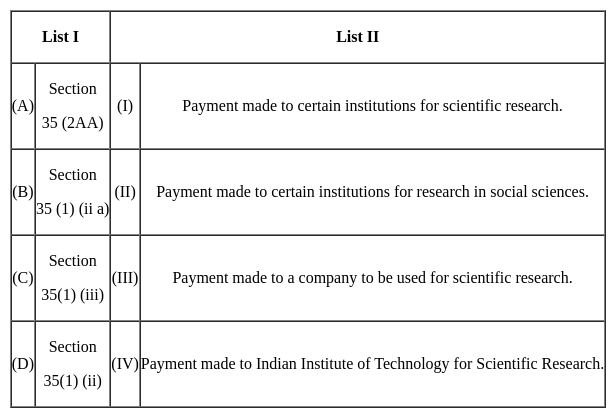

Match List I with List II:

Choose the correct answer from the options given below:

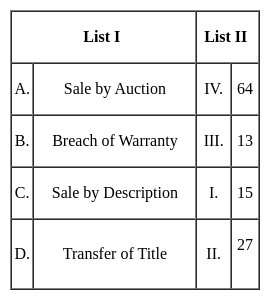

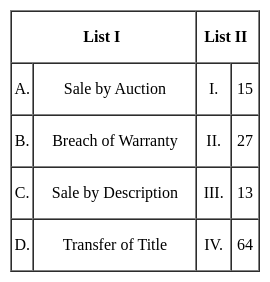

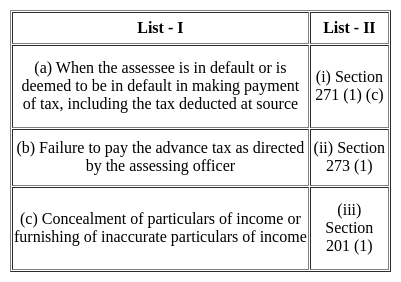

Match List I with List II:

Match the given lists and select the correct code for the answer.

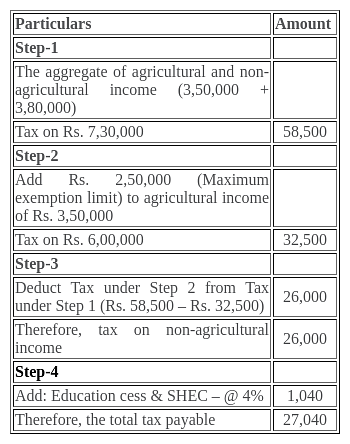

The Gross Total income of A aged 31 years as computed under the income-tax Act for the AY 2023-24 is Rs.4,00,000. He deposits Rs.20,000 in a PPF account. Compute the tax payable by A assuming that he has an agricultural income of Rs. 3,50,000.

Match the following theories of international trade in List-I with their propounders in List-II:

Which one of the following MIS systems is designed to capture, collect or enter the data to process in a certain specified manner for further processing ?

With reference to Inflation accounting, which of the following is not correct?

Directions: Read the given statements carefully and choose the correct alternative.

Statements:

(i) The objective of finance function is wealth maximisation.

(ii) The objective of finance function is profit maximisation.

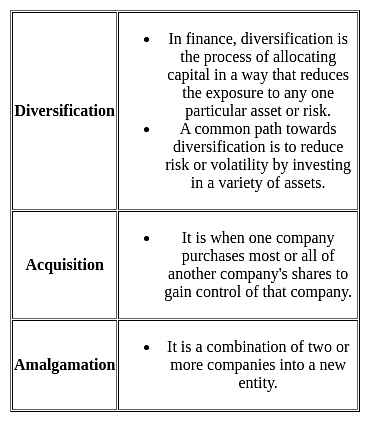

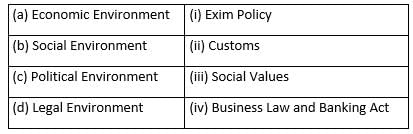

Direction: Match the following components of the business environment.

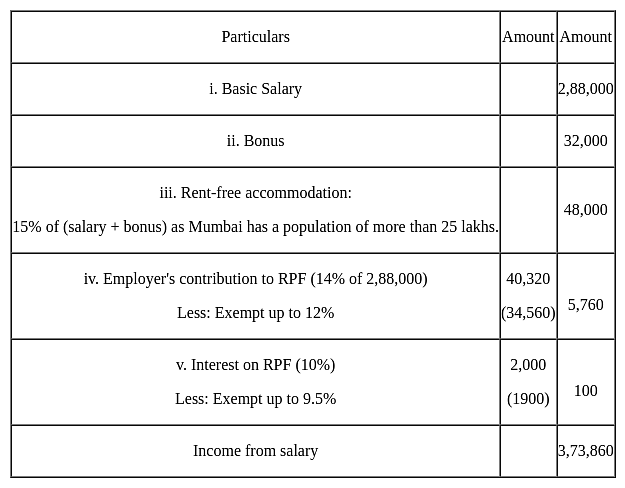

An individual received a salary of Rs. 2,88,000 and bonus of Rs. 32,000. He contributed 15% of the salary to RPF to which his employer contributed 14 percent. He is provided with a rent-free house in Mumbai. The interest credited to his RPF is Rs. 2,000 @ 10% per annum. His income from salary for the A.Y. 2015-16 will be:

Mainly to avoid _______ we conduct audit in the business concern.