Test: Admission Of New Partner - 2 - Commerce MCQ

30 Questions MCQ Test - Test: Admission Of New Partner - 2

A, B, C are partners sharing profits in the ratio of 4:3:2. D is admitted for 2/9th share of profits and brings Rs. 30,000 as capital and 10,000 for his share of goodwill. The new profit sharing ratio between partners will be 3:2:2:2. Goodwill amount will be credited in the capital accounts of :

X and Y are partners sharing profits equally. Z was admitted for 1/7th share. Calculate New Profit Sharing Ratio.

When balance sheet prepared after the new partnership agreement, Assets and liabilities are recorded at :

X and Y are partners sharing profits in the ratio 5:3. They admitted Z for 1/5th share of profits, for which he paid Rs. 1,20,000 against capital and Rs. 60,000 as goodwill. Find the capital balances for each partner taking Z’s capital as base capital :

At the time of admission of a partner in a firm, the journal entry for an unrecorded investment of Rs. 30,000 will be:

A and B are partners sharing profits and losses in the ratio of 3 : 2. They admit C into the partnership for one-fourth share of the profits while A and B as between themselves are sharing profits & losses equally. The new profit sharing ratio will be _______.

Which asset is compulsorily revalued at the time of admission of a partner?

A and B are partners sharing profits and losses in the ratio of 3:2. A’s Capital is Rs. 60,000 and B’s Capital is Rs. 30,000. They admit C for 1/5th share of profits. How much C should bring in towards his capital?

A and B are partners sharing profits in the ratio of 5:3. They admitted C for 1/5th share of profits for which he paid Rs. 1,20,000 against capital and Rs. 60,000 against goodwill. Find the capital balances for each partner taking C’s Capital as base capital:

A, B, C are equal partners, they wanted to change the profit sharing ratio into 4:3:2. They raised the goodwill to Rs. 90,000 but want to write it off immediately. The effected accounts will be :

A firm has an unrecorded investment of Rs. 5,000. Entry in the firm’s journal on admission of a partners will:

X and Y share profits and losses in the ratio of 4:3. They admit Z in the firm with 3/7 share which he gets 2/7 from X and 1/7 form Y. The new profit sharing ratio will be:

A and B are partners sharing profits and losses in ratio of 3:2.A’s Capital is Rs. 30,000B’s Capital is Rs. 15,000They admit C and agreed to give 1/5th share of profits to himHow much C should being in towards his Capital ?

A and B share profits equally. They admit C with 1/7th share. The new profit sharing ratio of A and B is

A and B are partners sharing profits in the ratio of 7:3. C is admitted as a new partner. ‘A’ surrenders 1/7 of his share and ‘B’ surrenders 1/3rd of his share in favour of C. The new profit sharing ratio will be:

A, B and C are partners sharing profits and losses in the ratio 6:3:3, they agreed to take D into partnership for 1/8th share of profits. Find the new profit sharing ratio.

A and B are partners sharing profits and losses in the ratio of 3:2 (A’s Capital is Rs. 30,000 and B’s Capital is Rs. 15,000). They admitted C agreed to give 1/5th share of profits to him. How much C should bring in towards his capital?

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. C is able to bring Rs. 30,000 only. How this will be treated in the books of the firm.

A and B shares profit and losses equally. They admit C as an equal partner and goodwill was valued as Rs. 30,000 (book value NIL). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. What will be the final effect of goodwill in the partner’s capital account?

The written agreement of partnership is most commonly referred to as:

Amit and Anil are partners of a partnership firm sharing profits in the ratio of 5:3 with capital of Rs. 2,50,000 & Rs. 2,00,000 respectively. Atul was admitted on the following terms: Atul would pay Rs. 50,000 as capital and Rs. 16,000 as Goodwill, for 1/5th share of profit. Find the balance of capital accounts after admission of Atul

A and B share profits in the ratio of 3:2. A’s capital is Rs. 48,000 B’s capital is Rs. 32,000. C is admitted for 1/5th share in profits. What is the amount of capital which C should bring?

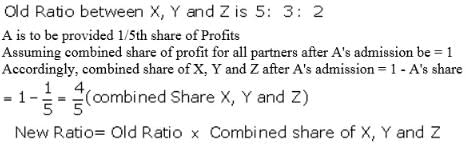

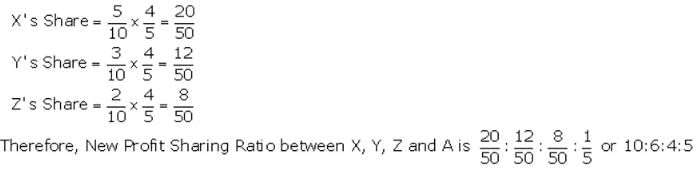

X, Y and Z are partners sharing profits and losses in the ratio of 5 : 3 : 2 . They admit A into partnership and give him 1/5th share of profits. Find the new profit-sharing ratio.

Balance sheet prepared after the new partnership agreement, assets and liabilities are recorded at:

A and B are partners sharing profits in the ratio 5:3, they admitted C giving him 3/10th share of profit. If C acquires 1/5th share from A and 1/10th from B, new profit sharing ratio will be:

Which of the following asset is compulsory to revalue at the time of admission of a new partner:

Amit and Anil are partners of a partners of a partnership firm sharing profits in the ratio of 5:3 respectively. Atul was admitted on the following terms: Atul would pay Rs. 50,000 as capital and Rs. 16,000 as Goodwill, for 1/5th share of profit. Machinery would be appreciated by 10% (book value Rs. 80,000) and building would be depreciated by 20% (Rs.2,00,000). Unrecorded debtors of Rs. 1,250 would be brought into books now and a trade payables amounting to Rs.2,750 died and need not to pay anything to its estate. Find the distribution of profit/loss on revaluation between Amit, Anil and Atul.

A and B share profits in the ratio of 3 : 4 C was admitted for 1/5th share. Calculate the new profit sharing ratio.

On account of admission, the assets are revalued and liabilities are reassessed in _________Account.

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. If profit on revaluation is Rs. 6,000 and opening capital of P is Rs. 40,000 and of Q is Rs. 30,000, find the closing balance of each capital.