Index

All Exams >

CA Intermediate >

Taxation for CA Intermediate >

All Videos

All videos of Taxation for CA Intermediate

Basic Concepts

Residence and Scope of Total Income

38 videos|118 docs|12 tests | Join course for free |

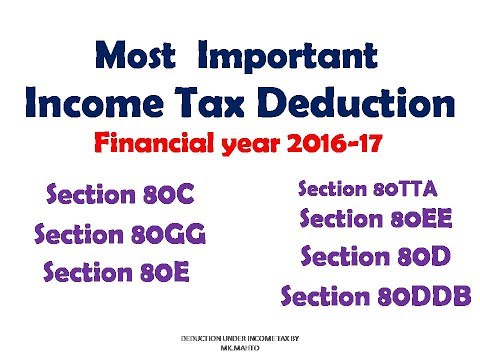

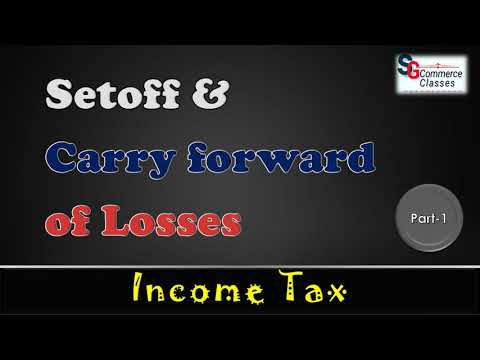

Aggregation of Income, Set-off and Carry Forward of Losses

Advance Tax, Tax Deduction at Source and Introduction to Tax Collection at Source

Provisions for filing Return of Income and Self-assessment

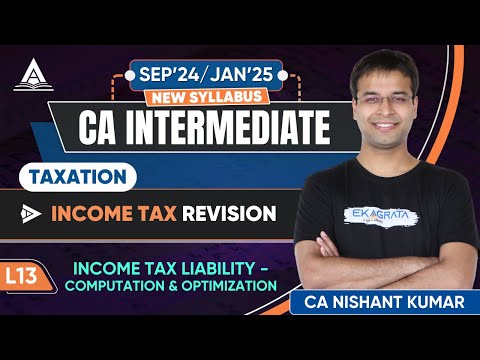

Income Tax Liability- Computation and Optimisation

Incomes which do not form part of Total Income (Old Scheme)

Place of Supply

Tax Deduction at Source and Collection of Tax at Source

Video lectures for Taxation for CA Intermediate 2025 is part of CA Intermediate exam preparation. The videos have been prepared according to the CA Intermediate exam syllabus. The Video lectures, notes, tests & MCQs are made for CA Intermediate 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Video lectures of Taxation for CA Intermediate in English & Hindi are available as part of CA Intermediate exam.

Download more important topics, notes, lectures and mock test series for CA Intermediate Exam by signing up for free.

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup on EduRev and stay on top of your study goals

10M+ students crushing their study goals daily