Accountancy: CUET Mock Test - 5 - CUET MCQ

30 Questions MCQ Test - Accountancy: CUET Mock Test - 5

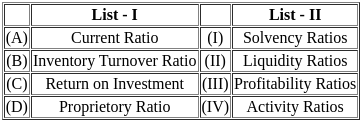

Ratio analysis can help know about the potential areas which can be improved with the effort in the desired direction.

Comparison of financial statements highlights the trend of the :

When all the debentures are redeemed, the balance left in the debenture sinking fund account is transferable to

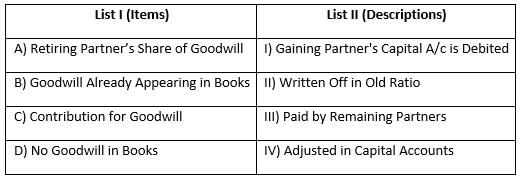

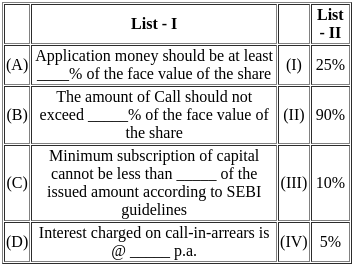

Match List - I with List - II.

Choose the correct answer from the options given below :

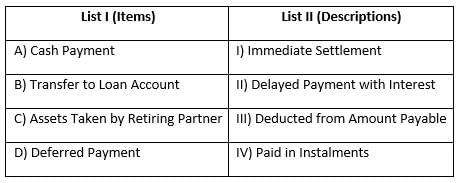

Match List - I with List - II.

Choose the correct answer from the options given below :

Debentures issued for consideration other than cash includes, debentures:

(A) Issued to bank as additional security

(B) Issued to vendor

(C) Issued to Public

(D) Issued to creditor

(E) Issued for cash

Choose the correct answer from the options given below :

The working capital of IAN Ltd. is ₹ 2,00,000 and its current assets are ₹ 6,00,000. What is its current ratio?

Working capital is the excess of current assets over current liabilities.

Purchase of goods ₹ 40,000 for cash will increase the operating ratio.

A ratio reflects quantitative as well as qualitative aspects of results.

Current ratio of Vidur Pvt. Ltd. is 3:2. Accountant wants to maintain it at 2:1. Following options are available

(i) He can repay bills payable.

(ii) He can take short-term loan.

(iii) He can purchase goods on credit.

Choose the correct option.

What will be the effect on current ratio if a bills payable is discharged on maturity?

Ratios are comparable even if different accounting policies and procedures are followed by different firms.

Which of the following ratios measure the long-term solvency of an organisation?

Which of the following is/are not the component(s) of quick assets?

The Current Assets of APE Ltd. are ₹ 6,00,000; Current Liabilities are ₹ 2,00,000; Inventories are ₹ 1,50,000; Prepaid Expenses are ₹ 50,000 and Cash and Cash Equivalents are ₹ 1,00,000. What is its quick ratio?

Generally, a lower current ratio is considered better.

Purchase of machinery for cash will _____ the quick ratio.

What is the debt to equity ratio when the following information is available Total Assets ₹ 35,00,000; Total Debts ₹ 25,00,000; Current Liabilities ₹ 8,00,000.

ARYA Ltd has a term Loan of ₹ 10,00,000. Interest on Loan for the year is ₹ 1,25,000 and its PBIT is ₹ 5,00,000. Its interest coverage ratio is

If P Ltd obtains a Bank Loan of ₹ 30,00,000 payable after 5 years, then its proprietary ratio will

Purchase returns amounting to ₹ 20,000 will deteriorate the inventory turnover ratio