Accountancy: CUET Mock Test - 6 - CUET MCQ

30 Questions MCQ Test - Accountancy: CUET Mock Test - 6

In which of these employee stock plans, the company grants an option to its employees to acquire shares at a future date?

Arrange the following ratios in the order in which they appear on a common-size income statement, from top to bottom:

A. Gross profit margin

B. Operating profit margin

C. Net profit margin

D. Earnings per share

B. Operating profit margin

C. Net profit margin

D. Earnings per share

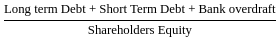

Which of the following is NOT typically found in the balance sheet?

Which of the following is NOT a part of financial statement analysis?

What technique is used in financial analysis to understand a firm's financial health?

In the absence of an agreement, partners are entitled to:

Interest on capital will be paid to the partners if provided for in the agreement but only from______.

If a firm prefers to show Partners' Capital Accounts at the amount introduced by the partners as capital, where are the entries for salary, drawings, interest on capital or drawings, and profits made?

A and B are partners in a firm sharing profits in the ratio of 2 : 1. They admit C as a new partner for 1/5 share. New Ratio will be 3 : 1 : 1. Sacrificing ratio will be:

A and B are partners in a firm sharing profits and losses in the ratio 1:2.They admitted C into the partnership and decided to give him 1/3rd share of the future profits. Find the new ratio of the partners.

A, B, and C were partners in a firm sharing profits and losses in the ratio of 2:2:1, respectively, with capital balances of Rs. 50,000 for A and B, and Rs. 25,000 for C. B declared to retire from the firm, and the balance in reserve on that date was Rs. 15,000. If the goodwill of the firm was valued at Rs. 30,000 and the profit on revaluation was Rs. 7,050, what amount will be transferred to the loan account of B?

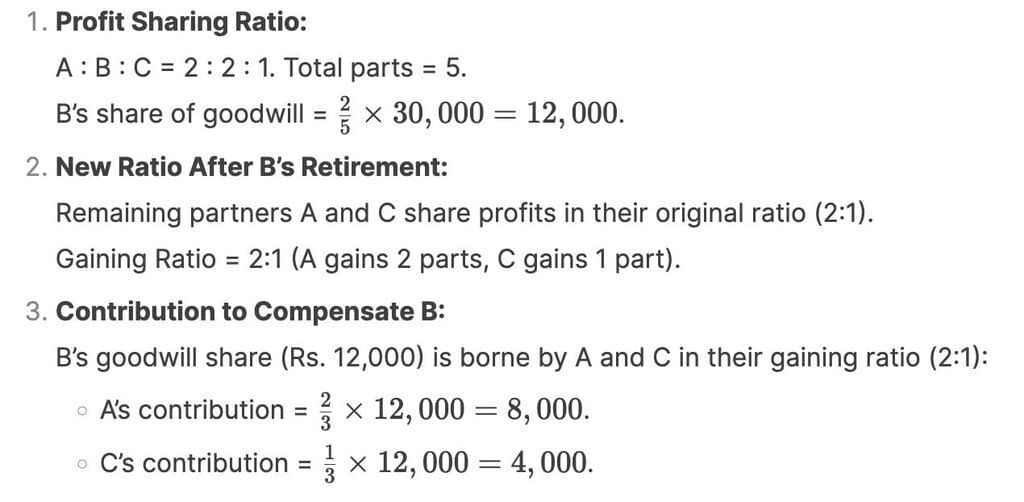

A, B and C are partners sharing profits in the ratio 2:2:1. On retirement of B, goodwill was valued as Rs. 30,000. Find the contribution of A and C to compensate B.

According to Company Act, 1956, Balance sheet of a company is prepared as per

Which of the following is/are true with respect to debentures?