Accountancy: CUET Mock Test - 8 - CUET MCQ

30 Questions MCQ Test CUET Mock Test Series - Accountancy: CUET Mock Test - 8

Following are the essential elements of a partnership firm except:

The data storage system that is hidden from the user and satisfies their requests to the extent that they are allowed access is referred to as .

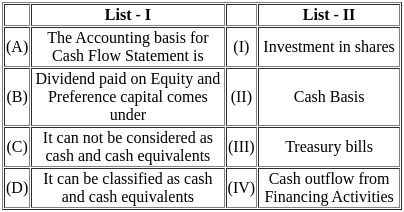

Match List - I with List - II.

Choose the correct answer from the options given below :

According to Indian Partnership Act, 1932, when the firm is dissolved, cash received on sale of assets are applied in following order:

(A) Paying to each partner proportionately what is due to him/her on account of capital

(B) In paying the secured debts of the firm to the third parties

(C) In paying each partner proportionately what is due to him/her from the firm for advances as distinguished from capital

(D) The residue, if any shall be divided among the partner's in their profit sharing ratio

(E) In paying unsecured debt of firm to third parties

Choose the correct answer from the options given below:

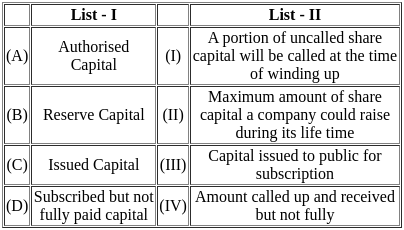

Match List - I with List - II.

Choose the correct answer from the options given below :

On retirement, the retiring partner's capital account will be credited with :

(A) His/Her Capital Balance

(B) His/Her share of goodwill

(C) Share of goodwill of remaining partners

(D) his/her share of Reserve

(E) his/her drawings

Choose the correct answer from the options given below :

The relationship between persons who have agreed to share the profit of a business carried on by all or any of them acting for all is known as________.

Every partner is bound to attend diligently to his ______ in the conduct of the business.

‘Salary Rs. 5,000 paid to partner’ The above item will appear in _________.

Three partners A , B , C start a business . B's Capital is four times C's capital and twice A's capital is equal to thrice B's capital . If the total profit is Rs 16500 at the end of a year ,Find out B's share in it.

What would be the profit sharing ratio if the partnership act is complied with?

Is rent paid to a partner is appropriation of profits?

Insurance Premium paid by the firm on the life Insurance policy of a partner is

Following are the differences between Capital Account and Current Account except:

Which Section of the Partnership Act defines partnership as the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all?

In the absence of partnership deed profit sharing ratio will be:

It is better to have the agreement in writing to avoid any ___

The persons who have entered into a partnership business with one another are individually called

If partners are running a business without a partnership deed how much interest on their capitals will be given?

Which of the following is not a content of partnership deed?

|

39 docs|148 tests

|