Accountancy: CUET Mock Test - 9 - CUET MCQ

30 Questions MCQ Test - Accountancy: CUET Mock Test - 9

Premium brought by the new partner will be shared by the existing partners in:

Goodwill brought by Suraj will be distributed as :

Share of revaluation profit of Amrita and Kalyani is :

What is Amrita's share in workmen compensation fund?

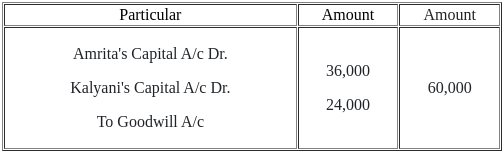

What journal entry will be passed for goodwill appearing in the books?

How would you describe the interpretation of ratio analysis?

Which of the following best describes the importance of ratio analysis?

Which of the following statements are correct?

(A) A new partner acquires the right to share the assets and profits of the firm upon admission.

(B) A new partner is always required to bring in capital in the form of cash or kind.

(C) The profit-sharing ratio between existing partners remains unchanged when a new partner is admitted.

(D) The sacrificing ratio is used to determine how much of the old partners' profit share is given up for the new partner.

(E) The old partners' profit-sharing ratio does not change when a new partner is admitted.

Choose the correct answer from the options below:

Which of the following statements are correct?

(A) Goodwill is always brought by the new partner in cash when admitted.

(B) The value of goodwill is decided based on the super profits method when the firm has excess profits.

(C) The valuation of goodwill is not necessary when the firm earns normal profits.

(D) The revaluation of assets and reassessment of liabilities are mandatory when a new partner is admitted.

(E) Goodwill must be shared between existing partners based on their sacrificing ratio when a new partner is admitted.

Choose the correct answer from the options below:

Which of the following statements are correct?

(A) The new partner's share of goodwill is always compensated by the existing partners in their sacrificing ratio.

(B) The capital of each partner is always equal to the amount of capital brought in by the new partner.

(C) A change in the profit-sharing ratio among existing partners may occur when a new partner is admitted.

(D) Sacrificing ratio is calculated by subtracting the old profit-sharing ratio from the new profit-sharing ratio of the partners.

(E) A new partner does not affect the capital accounts of the existing partners unless there is a change in the profit-sharing ratio.

Choose the correct answer from the options below:

Which of the following statements are correct?

(A) Goodwill is considered an intangible asset in the context of partnership accounting.

(B) Goodwill is only created when the firm is earning normal profits.

(C) A new partner’s contribution of goodwill is always in cash.

(D) The capital account of the new partner includes the amount paid for goodwill.

(E) If goodwill exists in the books, it must be written off when a new partner is admitted.

Choose the correct answer from the options below:

Which of the following statements are correct?

(A) The capital of a new partner is always calculated based on their share in profits.

(B) If goodwill is not brought in by the new partner, the sacrificing partners must adjust it in their capital accounts.

(C) A new partner’s capital is always equal to the goodwill they bring.

(D) The revaluation of assets does not affect the capital accounts of the existing partners.

(E) When a new partner is admitted, a revaluation account is prepared to adjust the values of assets and liabilities.

Choose the correct answer from the options below:

According to section 31(1) of _____ new partner can be admitted only with consent of all existing partners

Ways in which incoming partner may acquire his share except:

X and Y are partners sharing profits in the ratio of 3:2. Z is admitted for 1/5 share. All partners have decided to share future profits equally. The profit of new partnership firm was Rs.30,000. This profit will be shared by all the partners in _______