Executive Assessment Mock Test - 7 - GMAT MCQ

30 Questions MCQ Test - Executive Assessment Mock Test - 7

This table provides the standard interest rates offered by Central Bank for CDs, listed according to term offering and purchase amount. The interest rates listed are annual rates, compounded yearly, to be paid when the CD comes to term. No bonuses or other adjustments are included.

General memo to employees of Central Bank: January 15th In order to improve and stabilize our bank’s investment opportunities, we are seeking to shift the balance of our customers’ CD accounts towards those with longer maturity terms. We have begun testing two incentive programs. All CDs purchased with terms of at least 5 years now receive, as a bonus, an additional 0.1% interest during the first year to be added to the standard rate. Preferred customers (those who have previously bought CDs of any term length in amounts of $10,000 or more) will, when they purchase a 5-year or 10-year CD of $10,000 or more, instead receive a bonus of 0.2% during the first year. Other CDs continue at the standard rates.

We have also instituted a new system of early withdrawal penalties, applicable to all new CDs. The penalties are as follows: For any CD, early withdrawal less than a year after the CD is purchased results in a loss of all interest. For 2-year CDs, early withdrawal after the first year results in the loss of one year of interest. For 5-year and 10-year CDs, withdrawal after the first year results in the loss of two years of interest and of any accrued bonus interest.

Q. Consider each of the following statements. Does the information in the memo and the table support the inference as stated?

Prior to the policy changes described, there were no penalties for early CD withdrawals.

This table provides the standard interest rates offered by Central Bank for CDs, listed according to term offering and purchase amount. The interest rates listed are annual rates, compounded yearly, to be paid when the CD comes to term. No bonuses or other adjustments are included.

General memo to employees of Central Bank: January 15th In order to improve and stabilize our bank’s investment opportunities, we are seeking to shift the balance of our customers’ CD accounts towards those with longer maturity terms. We have begun testing two incentive programs. All CDs purchased with terms of at least 5 years now receive, as a bonus, an additional 0.1% interest during the first year to be added to the standard rate. Preferred customers (those who have previously bought CDs of any term length in amounts of $10,000 or more) will, when they purchase a 5-year or 10-year CD of $10,000 or more, instead receive a bonus of 0.2% during the first year. Other CDs continue at the standard rates.

We have also instituted a new system of early withdrawal penalties, applicable to all new CDs. The penalties are as follows: For any CD, early withdrawal less than a year after the CD is purchased results in a loss of all interest. For 2-year CDs, early withdrawal after the first year results in the loss of one year of interest. For 5-year and 10-year CDs, withdrawal after the first year results in the loss of two years of interest and of any accrued bonus interest.

Q. Consider each of the following statements. Does the information in the memo and the table support the inference as stated?

Certain bank policies are designed to reward preferred customers for their loyalty.

This table provides the standard interest rates offered by Central Bank for CDs, listed according to term offering and purchase amount. The interest rates listed are annual rates, compounded yearly, to be paid when the CD comes to term. No bonuses or other adjustments are included.

General memo to employees of Central Bank: January 15th In order to improve and stabilize our bank’s investment opportunities, we are seeking to shift the balance of our customers’ CD accounts towards those with longer maturity terms. We have begun testing two incentive programs. All CDs purchased with terms of at least 5 years now receive, as a bonus, an additional 0.1% interest during the first year to be added to the standard rate. Preferred customers (those who have previously bought CDs of any term length in amounts of $10,000 or more) will, when they purchase a 5-year or 10-year CD of $10,000 or more, instead receive a bonus of 0.2% during the first year. Other CDs continue at the standard rates.

We have also instituted a new system of early withdrawal penalties, applicable to all new CDs. The penalties are as follows: For any CD, early withdrawal less than a year after the CD is purchased results in a loss of all interest. For 2-year CDs, early withdrawal after the first year results in the loss of one year of interest. For 5-year and 10-year CDs, withdrawal after the first year results in the loss of two years of interest and of any accrued bonus interest.

Q. Consider each of the following statements. Does the information in the memo and the table support the inference as stated?

If the bank accomplishes its stated intentions, it will likely pay a higher aver age interest rate to customers than if it does not.

This table provides the standard interest rates offered by Central Bank for CDs, listed according to term offering and purchase amount. The interest rates listed are annual rates, compounded yearly, to be paid when the CD comes to term. No bonuses or other adjustments are included.

General memo to employees of Central Bank: January 15th In order to improve and stabilize our bank’s investment opportunities, we are seeking to shift the balance of our customers’ CD accounts towards those with longer maturity terms. We have begun testing two incentive programs. All CDs purchased with terms of at least 5 years now receive, as a bonus, an additional 0.1% interest during the first year to be added to the standard rate. Preferred customers (those who have previously bought CDs of any term length in amounts of $10,000 or more) will, when they purchase a 5-year or 10-year CD of $10,000 or more, instead receive a bonus of 0.2% during the first year. Other CDs continue at the standard rates.

We have also instituted a new system of early withdrawal penalties, applicable to all new CDs. The penalties are as follows: For any CD, early withdrawal less than a year after the CD is purchased results in a loss of all interest. For 2-year CDs, early withdrawal after the first year results in the loss of one year of interest. For 5-year and 10-year CDs, withdrawal after the first year results in the loss of two years of interest and of any accrued bonus interest.

Q. Consider each of the following statements. Does the information in the memo and the table support the inference as stated?

Part of the purpose of the policy changes is to increase the proportion of CD investments that result in early withdrawal.

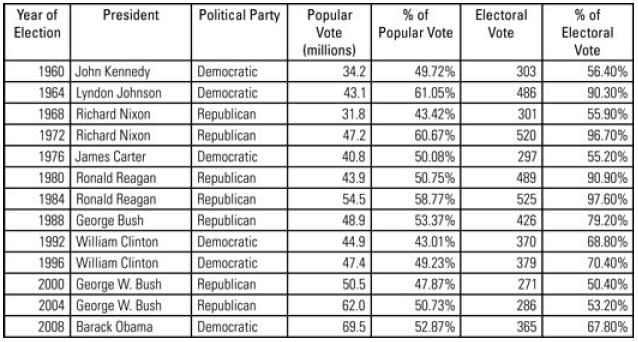

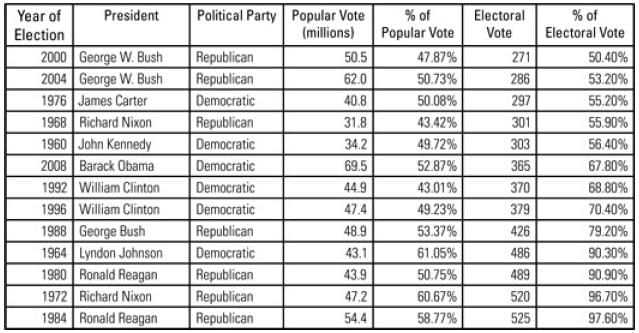

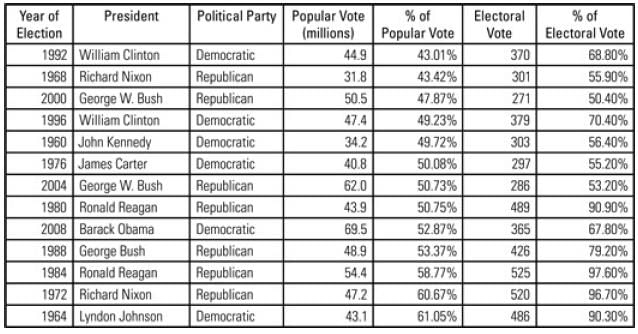

The table above gives information about the voting patterns in United States presidential elections from 1960 to 2008. In addition to giving the name and the political party of the President elected in each year, the table provides the total popular vote and electoral vote that the winner received in that election, as well as the percentage of the total vote that each figure represents.

Each column of the table can be sorted in ascending order by clicking on the word “Select” above the table and choosing, from the dropdown menu, the heading of the column on which you want the table to be sorted.

Alternate Sort 1: Electoral Vote

Alternate Sort 2: Percent of Popular Vote

Q. Consider each of the following statements. Does the information contained in the two emails and the memorandum support the inference as stated?

The same President was elected in the two election years in which the winner’s percentage of the popular vote and percent age of the electoral vote were most nearly equal.

MEMORANDUM

To: Regional Office Managers

From: Chief Operations Officer

RE: Travel planning

Once again, our annual management retreat will be held in Bloomsbury. In preparation for this year’s retreat, all Regional Office Managers (ROMs) will be responsible for arranging the travel reservations for all Level 2 managers within his or her Region. You may delegate that task should you wish.

ROMs will receive a research memorandum from the Logistics Division providing the average airfare from the 6 Regions to Bloomsbury. While ROMs should use that average airfare as a guide, we anticipate that there may be some variation in ticket prices based upon the specifics of travel arrangements. As such, Regional offices will be reimbursed for the full cost of any plane ticket priced within 1 (one) standard deviation of the average airfare from its region to Bloomsbury, inclusive. For any ticket priced more than 1 (one) standard deviation above the mean, regional offices will be reimbursed up to the average airfare from your region to Bloomsbury. For any ticket priced more than 1 (one) standard deviation below the average, in addition to full reimbursement of the ticket cost, regional offices will receive a “Budget Bonus” of 50% of the difference between the ticket price and the average airfare from your region to Bloomsbury.

MEMORANDUM

To: Regional Office Managers

From: Logistics Division

RE: Airfare Research

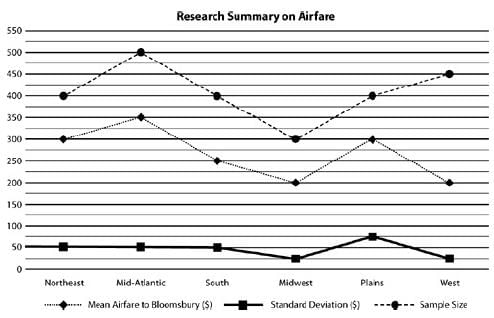

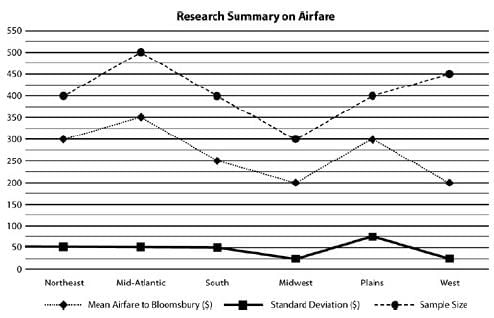

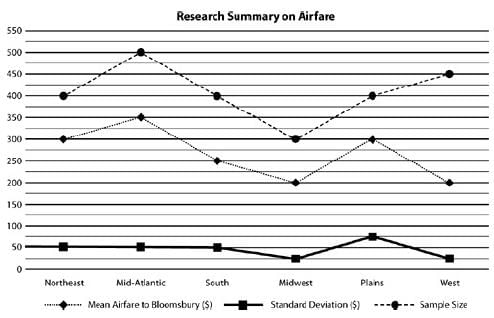

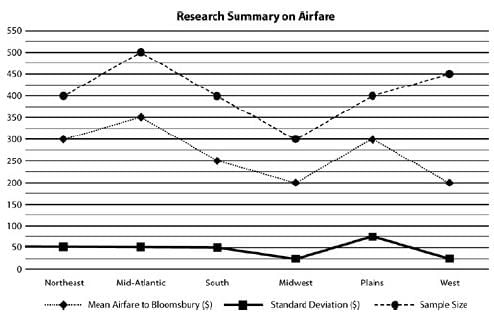

The attached chart lists the average (arithmetic mean) airfare from the listed Regions to Bloomsbury. The mean airfare was calculated based upon taking a normally distributed sample of airfares. The standard deviation and size of each sample is also listed in the chart.

Email from Marco Roland, Human Resources Manager, West Region to Marisa Cortland, Regional Office Manager, West Region

Dear Marisa,

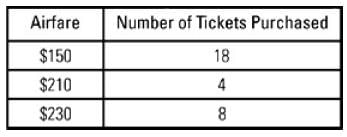

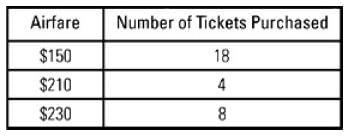

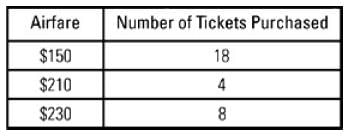

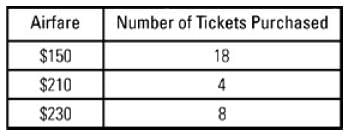

Tickets have been purchased for all of the Level 2 Managers in the West Region. Below is a summary

Best,

Marco

Q. Consider each of the following statements. Does the information contained in the two memoranda and the email support the stated inference?

The management retreat is held at Bloomsbury most years.

MEMORANDUM

To: Regional Office Managers

From: Chief Operations Officer

RE: Travel planning

Once again, our annual management retreat will be held in Bloomsbury. In preparation for this year’s retreat, all Regional Office Managers (ROMs) will be responsible for arranging the travel reservations for all Level 2 managers within his or her Region. You may delegate that task should you wish.

ROMs will receive a research memorandum from the Logistics Division providing the average airfare from the 6 Regions to Bloomsbury. While ROMs should use that average airfare as a guide, we anticipate that there may be some variation in ticket prices based upon the specifics of travel arrangements. As such, Regional offices will be reimbursed for the full cost of any plane ticket priced within 1 (one) standard deviation of the average airfare from its region to Bloomsbury, inclusive. For any ticket priced more than 1 (one) standard deviation above the mean, regional offices will be reimbursed up to the average airfare from your region to Bloomsbury. For any ticket priced more than 1 (one) standard deviation below the average, in addition to full reimbursement of the ticket cost, regional offices will receive a “Budget Bonus” of 50% of the difference between the ticket price and the average airfare from your region to Bloomsbury.

MEMORANDUM

To: Regional Office Managers

From: Logistics Division

RE: Airfare Research

The attached chart lists the average (arithmetic mean) airfare from the listed Regions to Bloomsbury. The mean airfare was calculated based upon taking a normally distributed sample of airfares. The standard deviation and size of each sample is also listed in the chart.

Email from Marco Roland, Human Resources Manager, West Region to Marisa Cortland, Regional Office Manager, West Region

Dear Marisa,

Tickets have been purchased for all of the Level 2 Managers in the West Region. Below is a summary

Best,

Marco

Q. Consider each of the following statements. Does the information contained in the two memoranda and the email support the stated inference?

No region had a lower average (arithmetic mean) airfare to Bloomsbury than the Midwest.

MEMORANDUM

To: Regional Office Managers

From: Chief Operations Officer

RE: Travel planning

Once again, our annual management retreat will be held in Bloomsbury. In preparation for this year’s retreat, all Regional Office Managers (ROMs) will be responsible for arranging the travel reservations for all Level 2 managers within his or her Region. You may delegate that task should you wish.

ROMs will receive a research memorandum from the Logistics Division providing the average airfare from the 6 Regions to Bloomsbury. While ROMs should use that average airfare as a guide, we anticipate that there may be some variation in ticket prices based upon the specifics of travel arrangements. As such, Regional offices will be reimbursed for the full cost of any plane ticket priced within 1 (one) standard deviation of the average airfare from its region to Bloomsbury, inclusive. For any ticket priced more than 1 (one) standard deviation above the mean, regional offices will be reimbursed up to the average airfare from your region to Bloomsbury. For any ticket priced more than 1 (one) standard deviation below the average, in addition to full reimbursement of the ticket cost, regional offices will receive a “Budget Bonus” of 50% of the difference between the ticket price and the average airfare from your region to Bloomsbury.

MEMORANDUM

To: Regional Office Managers

From: Logistics Division

RE: Airfare Research

The attached chart lists the average (arithmetic mean) airfare from the listed Regions to Bloomsbury. The mean airfare was calculated based upon taking a normally distributed sample of airfares. The standard deviation and size of each sample is also listed in the chart.

Email from Marco Roland, Human Resources Manager, West Region to Marisa Cortland, Regional Office Manager, West Region

Dear Marisa,

Tickets have been purchased for all of the Level 2 Managers in the West Region. Below is a summary

Best,

Marco

Q. Consider each of the following statements. Does the information contained in the two memoranda and the email support the stated inference?

Only Level 2 managers will attend the management retreat.

MEMORANDUM

To: Regional Office Managers

From: Chief Operations Officer

RE: Travel planning

Once again, our annual management retreat will be held in Bloomsbury. In preparation for this year’s retreat, all Regional Office Managers (ROMs) will be responsible for arranging the travel reservations for all Level 2 managers within his or her Region. You may delegate that task should you wish.

ROMs will receive a research memorandum from the Logistics Division providing the average airfare from the 6 Regions to Bloomsbury. While ROMs should use that average airfare as a guide, we anticipate that there may be some variation in ticket prices based upon the specifics of travel arrangements. As such, Regional offices will be reimbursed for the full cost of any plane ticket priced within 1 (one) standard deviation of the average airfare from its region to Bloomsbury, inclusive. For any ticket priced more than 1 (one) standard deviation above the mean, regional offices will be reimbursed up to the average airfare from your region to Bloomsbury. For any ticket priced more than 1 (one) standard deviation below the average, in addition to full reimbursement of the ticket cost, regional offices will receive a “Budget Bonus” of 50% of the difference between the ticket price and the average airfare from your region to Bloomsbury.

MEMORANDUM

To: Regional Office Managers

From: Logistics Division

RE: Airfare Research

The attached chart lists the average (arithmetic mean) airfare from the listed Regions to Bloomsbury. The mean airfare was calculated based upon taking a normally distributed sample of airfares. The standard deviation and size of each sample is also listed in the chart.

Email from Marco Roland, Human Resources Manager, West Region to Marisa Cortland, Regional Office Manager, West Region

Dear Marisa,

Tickets have been purchased for all of the Level 2 Managers in the West Region. Below is a summary

Best,

Marco

Q. Consider each of the following statements. Does the information contained in the two memoranda and the email support the stated inference?

The Regional Office Manager need not make the reservations personally.

Directions: Read the passage carefully and answer the question as follow.

Federal efforts to aid minority businesses began in the

1960’s when the Small Business Administration (SBA)

began making federally guaranteed loans and govern-

ment-sponsored management and technical assistance

(5) available to minority business enterprises. While this

program enabled many minority entrepreneurs to

form new businesses, the results were disappointing,

since managerial inexperience, unfavorable locations,

and capital shortages led to high failure rates. Even 15

(10) years after the program was implemented, minority

business receipts were not quite two percent of the national

economy’s total receipts.

Recently federal policymakers have adopted an

approach intended to accelerate development of the

(15) minority business sector by moving away from directly

aiding small minority enterprises and toward supporting

larger, growth-oriented minority firms through interme-

diary companies. In this approach, large corporations

participate in the development of successful and stable

(20) minority businesses by making use of government-

sponsored venture capital. The capital is used by a

participating company to establish a Minority Enterprise

Small Business Investment Company or MESBIC. The

MESBIC then provides capital and guidance to minority

(25) businesses that have potential to become future suppliers

or customers of the sponsoring company.

MESBIC’s are the result of the belief that providing

established firms with easier access to relevant manage-

ment techniques and more job-specific experience, as

(30) well as substantial amounts of capital, gives those firms

a greater opportunity to develop sound business founda-

tions than does simply making general management

experience and small amounts of capital available.

Further, since potential markets for the minority busi-

(35) nesses already exist through the sponsoring companies,

the minority businesses face considerably less risk in

terms of location and market fluctuation. Following

early financial and operating problems, sponsoring

corporations began to capitalize MESBIC’s far above

(40) the legal minimum of $500,000 in order to generate

sufficient income and to sustain the quality of manage-

ment needed. MESBIC’c are now emerging as increas-

ingly important financing sources for minority enter-

prises.

(45) Ironically, MESBIC staffs, which usually consist of

Hispanic and Black professionals, tend to approach

investments in minority firms more pragmatically than

do many MESBIC directors, who are usually senior

managers from sponsoring corporations. The latter

(50) often still think mainly in terms of the “social responsi-

bility approach” and thus seem to prefer deals that are

riskier and less attractive than normal investment criteria

would warrant. Such differences in viewpoint have pro-

duced uneasiness among many minority staff members,

(55) who feel that minority entrepreneurs and businesses

should be judged by established business considerations.

These staff members believe their point of view is closer

to the original philosophy of MESBIC’s and they are

concerned that, unless a more prudent course is fol-

lowed, MESBIC directors may revert to policies likely

to re-create the disappointing results of the original SBA

approach.

Q. The author’s primary objective in the passage is to

Directions: Read the passage carefully and answer the question as follow.

Federal efforts to aid minority businesses began in the

1960’s when the Small Business Administration (SBA)

began making federally guaranteed loans and govern-

ment-sponsored management and technical assistance

(5) available to minority business enterprises. While this

program enabled many minority entrepreneurs to

form new businesses, the results were disappointing,

since managerial inexperience, unfavorable locations,

and capital shortages led to high failure rates. Even 15

(10) years after the program was implemented, minority

business receipts were not quite two percent of the national

economy’s total receipts.

Recently federal policymakers have adopted an

approach intended to accelerate development of the

(15) minority business sector by moving away from directly

aiding small minority enterprises and toward supporting

larger, growth-oriented minority firms through interme-

diary companies. In this approach, large corporations

participate in the development of successful and stable

(20) minority businesses by making use of government-

sponsored venture capital. The capital is used by a

participating company to establish a Minority Enterprise

Small Business Investment Company or MESBIC. The

MESBIC then provides capital and guidance to minority

(25) businesses that have potential to become future suppliers

or customers of the sponsoring company.

MESBIC’s are the result of the belief that providing

established firms with easier access to relevant manage-

ment techniques and more job-specific experience, as

(30) well as substantial amounts of capital, gives those firms

a greater opportunity to develop sound business founda-

tions than does simply making general management

experience and small amounts of capital available.

Further, since potential markets for the minority busi-

(35) nesses already exist through the sponsoring companies,

the minority businesses face considerably less risk in

terms of location and market fluctuation. Following

early financial and operating problems, sponsoring

corporations began to capitalize MESBIC’s far above

(40) the legal minimum of $500,000 in order to generate

sufficient income and to sustain the quality of manage-

ment needed. MESBIC’c are now emerging as increas-

ingly important financing sources for minority enter-

prises.

(45) Ironically, MESBIC staffs, which usually consist of

Hispanic and Black professionals, tend to approach

investments in minority firms more pragmatically than

do many MESBIC directors, who are usually senior

managers from sponsoring corporations. The latter

(50) often still think mainly in terms of the “social responsi-

bility approach” and thus seem to prefer deals that are

riskier and less attractive than normal investment criteria

would warrant. Such differences in viewpoint have pro-

duced uneasiness among many minority staff members,

(55) who feel that minority entrepreneurs and businesses

should be judged by established business considerations.

These staff members believe their point of view is closer

to the original philosophy of MESBIC’s and they are

concerned that, unless a more prudent course is fol-

lowed, MESBIC directors may revert to policies likely

to re-create the disappointing results of the original SBA

approach.

Q. Which of the following statements about the SBA program can be inferred from the passage?

Directions: Read the passage carefully and answer the question as follow.

Federal efforts to aid minority businesses began in the

1960’s when the Small Business Administration (SBA)

began making federally guaranteed loans and govern-

ment-sponsored management and technical assistance

(5) available to minority business enterprises. While this

program enabled many minority entrepreneurs to

form new businesses, the results were disappointing,

since managerial inexperience, unfavorable locations,

and capital shortages led to high failure rates. Even 15

(10) years after the program was implemented, minority

business receipts were not quite two percent of the national

economy’s total receipts.

Recently federal policymakers have adopted an

approach intended to accelerate development of the

(15) minority business sector by moving away from directly

aiding small minority enterprises and toward supporting

larger, growth-oriented minority firms through interme-

diary companies. In this approach, large corporations

participate in the development of successful and stable

(20) minority businesses by making use of government-

sponsored venture capital. The capital is used by a

participating company to establish a Minority Enterprise

Small Business Investment Company or MESBIC. The

MESBIC then provides capital and guidance to minority

(25) businesses that have potential to become future suppliers

or customers of the sponsoring company.

MESBIC’s are the result of the belief that providing

established firms with easier access to relevant manage-

ment techniques and more job-specific experience, as

(30) well as substantial amounts of capital, gives those firms

a greater opportunity to develop sound business founda-

tions than does simply making general management

experience and small amounts of capital available.

Further, since potential markets for the minority busi-

(35) nesses already exist through the sponsoring companies,

the minority businesses face considerably less risk in

terms of location and market fluctuation. Following

early financial and operating problems, sponsoring

corporations began to capitalize MESBIC’s far above

(40) the legal minimum of $500,000 in order to generate

sufficient income and to sustain the quality of manage-

ment needed. MESBIC’c are now emerging as increas-

ingly important financing sources for minority enter-

prises.

(45) Ironically, MESBIC staffs, which usually consist of

Hispanic and Black professionals, tend to approach

investments in minority firms more pragmatically than

do many MESBIC directors, who are usually senior

managers from sponsoring corporations. The latter

(50) often still think mainly in terms of the “social responsi-

bility approach” and thus seem to prefer deals that are

riskier and less attractive than normal investment criteria

would warrant. Such differences in viewpoint have pro-

duced uneasiness among many minority staff members,

(55) who feel that minority entrepreneurs and businesses

should be judged by established business considerations.

These staff members believe their point of view is closer

to the original philosophy of MESBIC’s and they are

concerned that, unless a more prudent course is fol-

lowed, MESBIC directors may revert to policies likely

to re-create the disappointing results of the original SBA

approach.

Q. Which of the following best states the central idea of the passage?

Directions: Read the passage carefully and answer the question as follow.

Federal efforts to aid minority businesses began in the

1960’s when the Small Business Administration (SBA)

began making federally guaranteed loans and govern-

ment-sponsored management and technical assistance

(5) available to minority business enterprises. While this

program enabled many minority entrepreneurs to

form new businesses, the results were disappointing,

since managerial inexperience, unfavorable locations,

and capital shortages led to high failure rates. Even 15

(10) years after the program was implemented, minority

business receipts were not quite two percent of the national

economy’s total receipts.

Recently federal policymakers have adopted an

approach intended to accelerate development of the

(15) minority business sector by moving away from directly

aiding small minority enterprises and toward supporting

larger, growth-oriented minority firms through interme-

diary companies. In this approach, large corporations

participate in the development of successful and stable

(20) minority businesses by making use of government-

sponsored venture capital. The capital is used by a

participating company to establish a Minority Enterprise

Small Business Investment Company or MESBIC. The

MESBIC then provides capital and guidance to minority

(25) businesses that have potential to become future suppliers

or customers of the sponsoring company.

MESBIC’s are the result of the belief that providing

established firms with easier access to relevant manage-

ment techniques and more job-specific experience, as

(30) well as substantial amounts of capital, gives those firms

a greater opportunity to develop sound business founda-

tions than does simply making general management

experience and small amounts of capital available.

Further, since potential markets for the minority busi-

(35) nesses already exist through the sponsoring companies,

the minority businesses face considerably less risk in

terms of location and market fluctuation. Following

early financial and operating problems, sponsoring

corporations began to capitalize MESBIC’s far above

(40) the legal minimum of $500,000 in order to generate

sufficient income and to sustain the quality of manage-

ment needed. MESBIC’c are now emerging as increas-

ingly important financing sources for minority enter-

prises.

(45) Ironically, MESBIC staffs, which usually consist of

Hispanic and Black professionals, tend to approach

investments in minority firms more pragmatically than

do many MESBIC directors, who are usually senior

managers from sponsoring corporations. The latter

(50) often still think mainly in terms of the “social responsi-

bility approach” and thus seem to prefer deals that are

riskier and less attractive than normal investment criteria

would warrant. Such differences in viewpoint have pro-

duced uneasiness among many minority staff members,

(55) who feel that minority entrepreneurs and businesses

should be judged by established business considerations.

These staff members believe their point of view is closer

to the original philosophy of MESBIC’s and they are

concerned that, unless a more prudent course is fol-

lowed, MESBIC directors may revert to policies likely

to re-create the disappointing results of the original SBA

approach.

Q. The author refers to the “financial and operating problems”(line 38 ) encountered by MESBIC’s primarily in order to

Authors writing detective stories frequently include a brilliant detective and an incompetent investigator who embark on separate paths in an attempt to solve a crime. The separate accounts frequently consist of the incompetent investigator becoming distracted by the criminals' well-planned attempts and the competent detective solving the case after a violent confrontation. Many literary analysts believe authors often choose this storyline in an attempt to provide readers additional complexity and challenge in solving the investigation.

Q. Which of the following most logically follows from the statements above?

Eating beets significantly lowers the risk of cancer, according to an article in a nutritional magazine. The article refers to a study that found that people who consumed one or more beets per day were half as likely to be diagnosed with the disease as people who did not.

Q. Which of the following, if true, most weakens the argument in the magazine article?

Years ago, some in the government's intelligence community feared the work of telecommunications researchers at then-emerging private security firms. The government experts concluded that these private firms posed the biggest risk to successful government espionage. As the private security firms began publicly releasing and advertising encryption algorithms and other security products, these government experts saw support for their conclusion when an encryption algorithm that government experts could not break began appearing in countless emails.

Q. Which of the following, if true, most weakens the conclusion of the government experts referred to above?

In the twentieth century, the visual arts have embarked on major experimentation, from cubism to expressionism. While tastes always vary, there are certainly some people who find beautiful objects of each of the art movements of the first half of the twentieth century. In the latter half of the twentieth century, though, most works are so abstract or shocking that neither the critic nor the general public uses the word "beautiful" to describe them: indeed, sometimes late twentieth-century artists have, as one of their expressed goals, the creation of a work that no one could find beautiful. Whatever these artists are creating may be intellectually engaging at some level, but it is no longer art.

Q. Which of the following is an assumption that supports drawing the conclusion above from the reasons given for that conclusion?

In a few recent cases, some teenagers with advanced programming abilities used a new programming language, FANTOD, to hack into ETS and change their own SAT scores. All of the teenagers convicted of this crime were highly skilled in programming FANTOD. In light of these cases, some colleges have discounted the official SAT scores of applicants with a knowledge of FANTOD, and have required them to take special admission tests in supervised conditions on their own campuses.

Q. Which of following conclusions can most properly be drawn from the information above?

A minor league baseball franchise experienced a drop in attendance this week after they suffered three losses by margins of ten runs or more last week. Many spectators of those games wrote letters to the editors of the local sporting news, complaining of the poor play of the team in those three losses. Nevertheless, the front office of this baseball franchise maintains that the team's poor play in those three losses has nothing to do with this week's decline in attendance.

Q. Which of the following, if true, most strongly supports the position held by the front office of the baseball franchise?

Megalimpet is a nationwide owner of office space. They have major office buildings in the downtowns of several cities in the 48 lower states, and rent this space to individual companies. Megalimpet office spaces vary from small office to large suites, and every space has custom-designed wall-to-wall carpeting. The carpet in several Megalimpet facilities needed replacing. The winning bid for the nationwide carpet replacement was submitted by Bathyderm Carpet Company (BCC). The bid contract involves all delivery costs, all installation, and any ongoing maintenance and upkeep while the carpet is under the three-year warranty. Both BCC executives and independent consultants they hired felt BCC would be able to perform all these services for far less than their bid price; these circumstances would allow BCC to reap a considerable profit.

Q. Which of the following, if true, most calls in question the argument that BCC will make a large profit from this contract with Megalimpet?

Research has shown that impoverished people in this country buy unhealthy snack foods on a daily basis because this kind of food is generally less expensive than more nutritious food. Therefore, improving the quality of one’s diet is a crucial step for rising out of poverty.

Q. Which of the following choices uses reasoning that most clearly parallels the reasoning in the argument above?

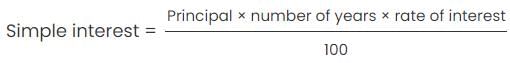

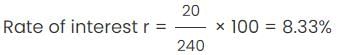

Peter invested a certain sum of money in a simple interest bond whose value grew to $300 at the end of 3 years and to $ 400 at the end of another 5 years. What was the rate of interest in which he invested his sum?

In a class 40% of the students enrolled for Math and 70% enrolled for Economics. If 15% of the students enrolled for both Math and Economics, what % of the students of the class did not enroll for either of the two subjects?

An analysis of the monthly incentives received by 5 salesmen : The mean and median of the incentives is $7000. The only mode among the observations is $12,000. Incentives paid to each salesman were in full thousands. What is the difference between the highest and the lowest incentive received by the 5 salesmen in the month?

What is the remainder when 1044 × 1047 × 1050 × 1053 is divided by 33?

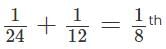

Ram, who is half as efficient as Krish, will take 24 days to complete a task if he worked alone. If Ram and Krish worked together, how long will they take to complete the task?

Is y = 3?

(1) (y - 3)(x - 4) = 0

(2) (x - 4) = 0

What is the standard deviation (SD) of the four numbers p, q, r, and s?

(1) The sum of p, q, r, and s is 24.

(2) The sum of the squares of p, q, r, and s is 224.

How is Bill related to Betty?

(1) Cindy, the wife of Bill's only brother Chris does not have any siblings.

(2) Betty is Cindy's brother in law's wife.

of the task in a day.

of the task in a day.