SSC Selection Post Mock Test - 6 - SSC Exams MCQ

30 Questions MCQ Test - SSC Selection Post Mock Test - 6

If A + B means A is the mother of B;

A – B means A is the brother B;

A % B means A is the father of B and

A x B means A is the sister of B,

Q. Which of the following shows that P is the maternal uncle of Q?

A car accident occurred on a busy street intersection killing two people and injuring three others. In order to nab the culprits, the police took the statements of all the witnesses present at that intersection, when the accident happened.

Some of the witnesses were in a state of shock because of the horrific accident and were unable to correctly reproduce the details of the accident. The witnesses who were in a state of shock provided all incorrect details while the rest of the witnesses provide the correct information about the accident.

The following statements have been recorded by the police:

Witness 1: Three people were killed in the accident by a red car that ran over them.

Witness 2: The green car had a license plate with eight symbols on it, two of them being letters and the rest being digits.

Witness 3: The car was blue in colour and was being driven by a young man with two people sitting in the backseat, one of them being a woman.

Witness 4: Each of the last four digits on the license plate of the car was a power of the same number and they were in the ascending order.

Witness 5: There was a blue car involved in the accident and a yellow car was right behind it. The blue car injured two people and rushed away from the spot.

Witness 6: The car was a green Maruti with four people in it. The car hit five people injuring three of them.

Witness 7: If numbers are assigned to the two letters on the license plate of the car with A being 1, B being 2 and so on, then the sum of the two letters on the license plate was equal to the sum of the last four digits. The letters were from A-l with the letter with the lower value coming first. The last four digits were in the ascending order.

Q. Which of the following could have been the first letter in the license plate?

Some of the witnesses were in a state of shock because of the horrific accident and were unable to correctly reproduce the details of the accident. The witnesses who were in a state of shock provided all incorrect details while the rest of the witnesses provide the correct information about the accident.

Witness 2: The green car had a license plate with eight symbols on it, two of them being letters and the rest being digits.

Witness 3: The car was blue in colour and was being driven by a young man with two people sitting in the backseat, one of them being a woman.

Witness 4: Each of the last four digits on the license plate of the car was a power of the same number and they were in the ascending order.

Witness 5: There was a blue car involved in the accident and a yellow car was right behind it. The blue car injured two people and rushed away from the spot.

Witness 6: The car was a green Maruti with four people in it. The car hit five people injuring three of them.

Witness 7: If numbers are assigned to the two letters on the license plate of the car with A being 1, B being 2 and so on, then the sum of the two letters on the license plate was equal to the sum of the last four digits. The letters were from A-l with the letter with the lower value coming first. The last four digits were in the ascending order.

In this following question, four words have been given, out of which three are alike in some manner and the fourth one is different. Choose out the odd one out.

In this following question, four words have been given, out of which three are alike in some manner and the fourth one is different. Choose out the odd one out.

Directions to Solve

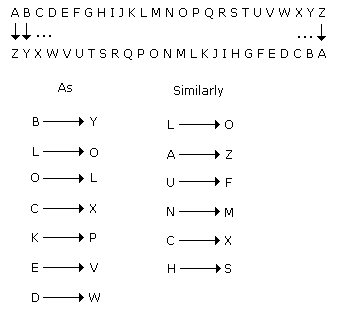

In each of the following questions find out the alternative which will replace the question mark.

Question -

BLOCKED : YOLXPVW :: ? : OZFMXS

Two matrices are shown in the figure below. Their rows and columns are labelled as (0,1,2,3,4) and (5,6,7,8,9) in the manner shown. Find the correct row-column pairs out of the following matrices that decode to the word - ICON

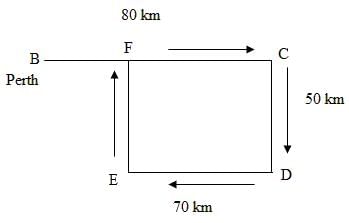

Dave drives his car from Perth to Brisbane. After 80 kilometres, he turns to his right and goes 50 kilometres. Then, he gain turns to his right and drives another 70 kilometres. He then turns to his right again and halts after driving a distance of 50 kilometres. At what distance is Dave now from Perth?

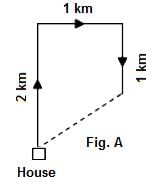

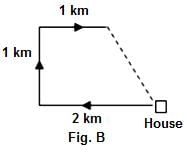

I start from my home and go 2 km straight. Then, I turn towards my right and go 1 km. I turn again towards my right and go 1 km. If now I am north-west from my home, then in which direction did I start in the beginning?

Direction: In each question below is given a statement followed by two conclusions numbered I and II. You have to assume everything in the statement to be true, then consider the two conclusions together and decide which of them logically follows beyond a reasonable doubt from the information given in the statement.

Statements: Use "Kraft" colours. They add colour to our life. - An advertisement.

Conclusions:

- Catchy slogans do not attract people.

- People like dark colours.

DEER = 12215 and HIGH = 5654, how will you code HEEL?

In what time will Rs. 500 give Rs. 50 as interest at the rate of 5% per annum simple interest?

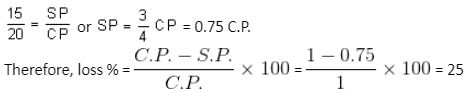

If the cost price of 15 tables is equal to the selling price of 20 tables, then the loss percentage in the transaction is

Read the each sentence to find out whether there is any grammatical error in it. The error, if any will be in one part of the sentence. The letter of that part is the answer. If there is no error, the answer is 'D'. (Ignore the errors of punctuation, if any).

In the following questions four alternatives are given for the idiom/phrase italicised and underlined in the sentence. Choose the alternative which best expresses the meaning of idiom/phrase.

Q. It is no longer easy to strike gold in Shakespeare's research since much work has already been done on him.

Recently discovered gravitational lensing around certain proximate stars stronglysuggests that the nine planets of our solar system are a common phenomenonin the universe rather than developing incidentally from a unique galactic phenomenon several billion years ago.

Choose the correct active voice for the given passive voice sentence:

Passive Voice: The letter will be sent by Jane.

Directions: Read the passage carefully and answer the questions that follow:

There is now no denying that the new government takes office amid a clear economic slowdown. The first macro data set released showed an under-performing economy with GDP growth falling to 5.8% in the fourth quarter of 2018-19 and pulling down the overall growth for the fiscal to a five-year low of 6.8%. Growth in gross value added (GVA), which is GDP minus taxes and subsidies, fell to 6.6% in 2018-19, pointing to a serious slowdown. If further confirmation were needed, the growth in core sector output — a set of eight major industrial sectors — fell to 2.6% in April, compared to 4.7% in the same month last year. And finally, unemployment data, controversially suppressed by the Union government so far, showed that joblessness was at a 45-year high of 6.1% in 2017-18. These numbers highlight the challenges ahead in drafting the Budget for 2019-20. The economy is beset by a consumption slowdown as reflected in the falling sales of everything from automobiles to consumer durables, even fast-moving consumer goods. Private investment is not taking off, while government spending, which kept the economy afloat during the last NDA government, was cut back in the last quarter of 2018-19 to meet the fiscal deficit target of 3.4%.

The good news is that inflation is undershooting the target and oil prices are on the retreat again. But the rural economy remains in distress, as seen by the 2.9% growth in agriculture last fiscal; the sector needs a good monsoon this year to bounce back. Overall economic growth in the first quarter of this fiscal is likely to remain subdued, and any improvement is unlikely until the late second quarter or the early third. There are not too many options before the new Finance Minister. In the near term, she has to boost consumption, which means putting more money in the hands of people. That, in turn, means cutting taxes, which is not easy given the commitment to rein in the fiscal deficit. In the medium term, Ms. Sitharaman has to take measures to boost private investment even as she opens up public spending again. These call for major reforms, starting with land acquisition and labour, corporate taxes by reducing exemptions and dropping rates, and nursing banks back to health. On the table will be options such as further recapitalisation of the ailing banks, and consolidation. The question, though, is where the money will come from. With tax revenues likely to be subdued owing to the slowdown, the Centre will have to look at alternative sources such as disinvestment. There may be little choice but to go big on privatisation. A rate cut by the Reserve Bank of India, widely expected this week, would certainly help boost sentiment. But it is the Budget that will really set the tone for the economy

Q. As per the passage, which of the following reforms has NOT been mentioned in the passage to improve the investment climate?

Directions: Read the passage carefully and answer the questions that follow:

There is now no denying that the new government takes office amid a clear economic slowdown. The first macro data set released showed an under-performing economy with GDP growth falling to 5.8% in the fourth quarter of 2018-19 and pulling down the overall growth for the fiscal to a five-year low of 6.8%. Growth in gross value added (GVA), which is GDP minus taxes and subsidies, fell to 6.6% in 2018-19, pointing to a serious slowdown. If further confirmation were needed, the growth in core sector output — a set of eight major industrial sectors — fell to 2.6% in April, compared to 4.7% in the same month last year. And finally, unemployment data, controversially suppressed by the Union government so far, showed that joblessness was at a 45-year high of 6.1% in 2017-18. These numbers highlight the challenges ahead in drafting the Budget for 2019-20. The economy is beset by a consumption slowdown as reflected in the falling sales of everything from automobiles to consumer durables, even fast-moving consumer goods. Private investment is not taking off, while government spending, which kept the economy afloat during the last NDA government, was cut back in the last quarter of 2018-19 to meet the fiscal deficit target of 3.4%.

The good news is that inflation is undershooting the target and oil prices are on the retreat again. But the rural economy remains in distress, as seen by the 2.9% growth in agriculture last fiscal; the sector needs a good monsoon this year to bounce back. Overall economic growth in the first quarter of this fiscal is likely to remain subdued, and any improvement is unlikely until the late second quarter or the early third. There are not too many options before the new Finance Minister. In the near term, she has to boost consumption, which means putting more money in the hands of people. That, in turn, means cutting taxes, which is not easy given the commitment to rein in the fiscal deficit. In the medium term, Ms. Sitharaman has to take measures to boost private investment even as she opens up public spending again. These call for major reforms, starting with land acquisition and labour, corporate taxes by reducing exemptions and dropping rates, and nursing banks back to health. On the table will be options such as further recapitalisation of the ailing banks, and consolidation. The question, though, is where the money will come from. With tax revenues likely to be subdued owing to the slowdown, the Centre will have to look at alternative sources such as disinvestment. There may be little choice but to go big on privatisation. A rate cut by the Reserve Bank of India, widely expected this week, would certainly help boost sentiment. But it is the Budget that will really set the tone for the economy

Q. Which of the following, as per the passage, indicate a slowdown in the Indian economy?

I. Fall in sale levels of consumer durables

II. Negative growth in the core sector output

III. Fall in inflations levels

Directions: Read the passage carefully and answer the questions that follow:

There is now no denying that the new government takes office amid a clear economic slowdown. The first macro data set released showed an under-performing economy with GDP growth falling to 5.8% in the fourth quarter of 2018-19 and pulling down the overall growth for the fiscal to a five-year low of 6.8%. Growth in gross value added (GVA), which is GDP minus taxes and subsidies, fell to 6.6% in 2018-19, pointing to a serious slowdown. If further confirmation were needed, the growth in core sector output — a set of eight major industrial sectors — fell to 2.6% in April, compared to 4.7% in the same month last year. And finally, unemployment data, controversially suppressed by the Union government so far, showed that joblessness was at a 45-year high of 6.1% in 2017-18. These numbers highlight the challenges ahead in drafting the Budget for 2019-20. The economy is beset by a consumption slowdown as reflected in the falling sales of everything from automobiles to consumer durables, even fast-moving consumer goods. Private investment is not taking off, while government spending, which kept the economy afloat during the last NDA government, was cut back in the last quarter of 2018-19 to meet the fiscal deficit target of 3.4%.

The good news is that inflation is undershooting the target and oil prices are on the retreat again. But the rural economy remains in distress, as seen by the 2.9% growth in agriculture last fiscal; the sector needs a good monsoon this year to bounce back. Overall economic growth in the first quarter of this fiscal is likely to remain subdued, and any improvement is unlikely until the late second quarter or the early third. There are not too many options before the new Finance Minister. In the near term, she has to boost consumption, which means putting more money in the hands of people. That, in turn, means cutting taxes, which is not easy given the commitment to rein in the fiscal deficit. In the medium term, Ms. Sitharaman has to take measures to boost private investment even as she opens up public spending again. These call for major reforms, starting with land acquisition and labour, corporate taxes by reducing exemptions and dropping rates, and nursing banks back to health. On the table will be options such as further recapitalisation of the ailing banks, and consolidation. The question, though, is where the money will come from. With tax revenues likely to be subdued owing to the slowdown, the Centre will have to look at alternative sources such as disinvestment. There may be little choice but to go big on privatisation. A rate cut by the Reserve Bank of India, widely expected this week, would certainly help boost sentiment. But it is the Budget that will really set the tone for the economy

Q. Which of the following is / are true as per the passage?

I. There is going to be a definite rate cut by the RBI in the coming week.

II. The rural economy is in better shape than the urban economy.

III. Government spending has increased in the last quarter of 2018-19.

Which of the following parties were founded by Dr. B. R. Ambedkar?

- The Peasants and Workers Party of India.

- All India Scheduled Castes Federation.

- The Independent Labour Party.

Select the correct answer using the codes given below:

Which one of the following glands produces the growth hormone (somatotrophin)?

The mountain range which divides the North and the South India is–

Which authority recommends the principles gov erring the grantsin-aid of the revenues of the States out of the Consolidated Fund of India?

With reference to Investor Education and Protection Fund (IEPF), consider the following statements:

1. It is set up under the Companies Act, 2013 to increase awareness of investors and protect their interests.

2. It consists of only unclaimed amount from shares and bonds and no grant from the government is provided.

Which of the statements given above is/are correct?

What is the theme of the 7th edition of the India Mobile Congress (IMC 2023)?

Which cooperative banks had their licenses cancelled by the Reserve Bank of India (RBI)?

Which regulatory body introduced new disclosure norms for listed companies?