Test: Bank Reconciliation Statement - 3 - Commerce MCQ

10 Questions MCQ Test - Test: Bank Reconciliation Statement - 3

Which of these types of errors are not detected during Bank Reconciliation’:

Bank column of a cash book of a trader shows a credit balance of Rs. 7,900 and the bank statement shows a debit balance of Rs. 10,300 on a particular date after payments made by the bank as per the standing orders. In the statement of affairs, the bank balance will be shown on:

If we take balance as per Pass book which of the following will be deducted to get balance as per cash book:

The payment side of Cash Book is under cast by Rs. 250. If the starting point of BRS is the Overdraft Balance as per Pass Book, then what would be the treatment to reach to Overdraft Balance of Cash Book?

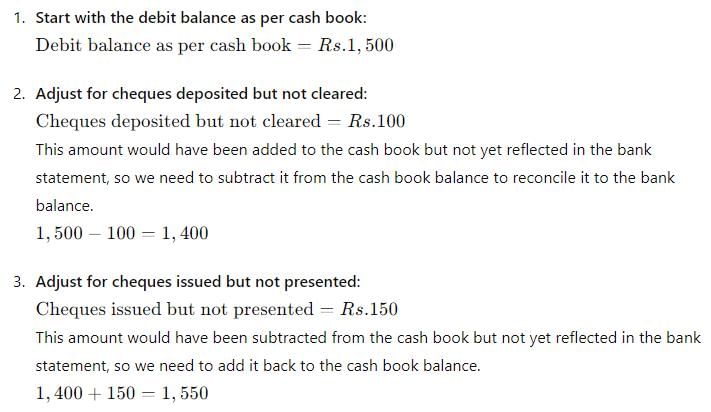

Debit balance as per cash book of ABC Enterprises as on 31st March, 2012 was Rs. 1,500. Cheques deposited but not cleared amount to Rs. 100. Cheques issued but not presented amount to Rs. 150. The bank allowed interest amounting to Rs. 50 and collected dividend Rs. 50 on behalf of ABC Enterprises. Balance as per Pass Book as on 31st March 2012, should be:

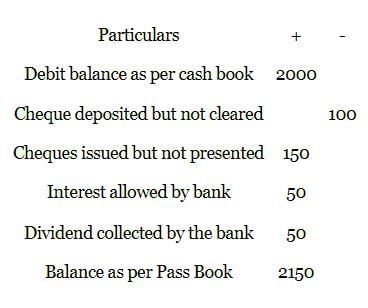

Debit balance as per cash book Rs.2000

Cheques deposited but not cleared Rs. 100

Cheques issued but not presented Rs. 150

Bank allowed interest Rs. 50

Bank collected dividend Rs. 50

Balance as per Pass Book will be:

When balance as per Cash Book is the starting point, uncollected cheques are:

A debit balance in the depositor’s Cash Book will be shown as: