Test: Reconstitution of a Partnership Firm: Admission of a Partner- Case Based Type Questions - Commerce MCQ

12 Questions MCQ Test Online MCQ Tests for Commerce - Test: Reconstitution of a Partnership Firm: Admission of a Partner- Case Based Type Questions

Based on the below information, answer the given questions:

Aditi and Parul are partners in a firm with capitals of ₹35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in ₹40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :

(a) The firm had a Workmen Compensation Reserve of ₹ 60,000 against which there was a claim of ₹ 20,000.

(b) Creditors of ₹ 8,000 were paid by Aditi privately for which she is not to be reimbursed.

(c) There was no change in the value of other assets and liabilities.

In which account will the gain on the creditor's account be transferred?

Read the following hypothetical text and answer the given questions:

Amit and Mahesh were partners in a fast-food corner sharing profits and losses in ratio 3:2. They sold fast food items across the counter and did home delivery too. Their initial fixed capital contribution was ₹1,20,000 and ₹80,000 respectively. At the end of first year their profit was ₹1,20,000 before allowing the remuneration of ₹3,000 per quarter to Amit and ₹2,000 per half year to Ranju. Such a promising performance for the first year was encouraging, therefore, they decided to expand the area of operations.

For this purpose, they needed a delivery van, a few Scotties and an additional person to support. Six months into the accounting year they decided to admit Sundram as a new partner and offered him 20% as a share of profits along with a monthly remuneration of ₹2,500. Sundram was asked to introduce ₹1,30,000 for capital and ₹70,000 as premium for goodwill. Besides this Sundram was required to provide ₹1,00,000 as loan for two years. Sundram readily accepted the offer. The terms of the offer were duly executed and he was admitted as a partner.

Upon the admission of Sundram, the sacrifice for providing his share of profits would be done:

Based on the below information, answer the given questions:

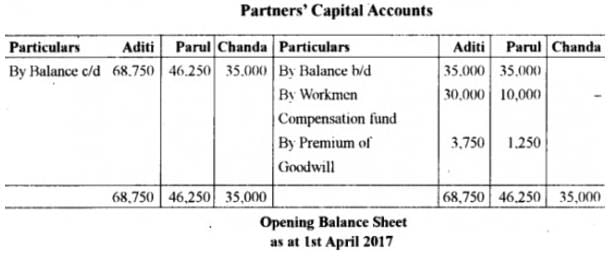

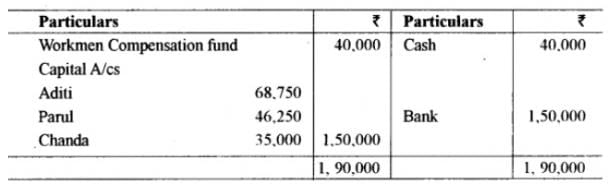

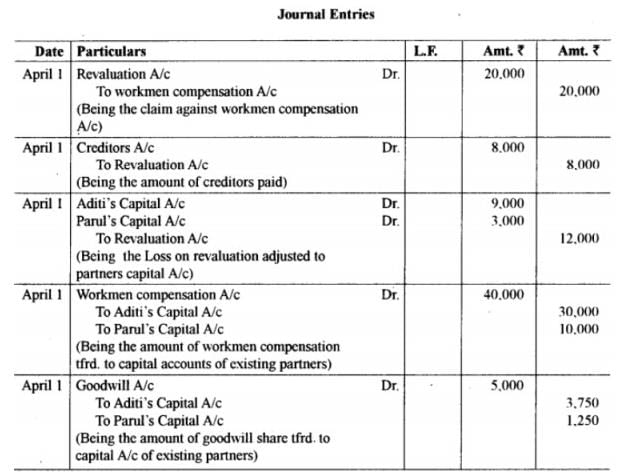

Aditi and Parul are partners in a firm with capitals of ₹ 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in ₹40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :

(a) The firm had a Workmen Compensation Reserve of ₹ 60,000 against which there was a claim of ₹ 20,000.

(b) Creditors of ₹ 8,000 were paid by Aditi privately for which she is not to be reimbursed.

(c) There was no change in the value of other assets and liabilities.

What is the amount of goodwill to be transferred to Aditi’s Capital Account?

Based on the below information, you are required to answer the given questions:

Sterling Enterprises is a partnership business with Ryan, Williams and Sania as partners engaged in production and sales of electrical items and equipment. Their capital contributions were ₹50,00,000, ₹ 50,00,000 and ₹80,00,000 respectively with the profit sharing ratio of 5:5:8. As they are now looking forward to expanding their business, it was decided that they would bring in sufficient cash to double their respective capitals. This was duly followed by Ryan and Williams but due to unavoidable reasons Sania could not do so and ultimately it was agreed that to bridge the shortfall in the required capital a new partner should be admitted who would bring in the amount that Sania could not bring and that the new partner would get share of profits equal to half of Sania’s share which would be sacrificed by Sania only.

Consequent to this agreement Ejaz was admitted and he brought in the required capital and ` 30,00,000 as premium for goodwill.

What is the amount of capital brought in by the new partner Ejaz?

Based on the below information, answer the given questions:

Aditi and Parul are partners in a firm with capitals of ₹ 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in ₹40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :

(a) The firm had a Workmen Compensation Reserve of ₹ 60,000 against which there was a claim of ₹ 20,000.

(b) Creditors of ₹ 8,000 were paid by Aditi privately for which she is not to be reimbursed.

(c) There was no change in the value of other assets and liabilities.

What is the value of goodwill to be contributed by Chanda?

Based on the below information, you are required to answer the given questions:

Sterling Enterprises is a partnership business with Ryan, Williams and Sania as partners engaged in production and sales of electrical items and equipment. Their capital contributions were ₹50,00,000, ₹ 50,00,000 and ₹80,00,000 respectively with the profit sharing ratio of 5:5:8. As they are now looking forward to expanding their business, it was decided that they would bring in sufficient cash to double their respective capitals. This was duly followed by Ryan and Williams but due to unavoidable reasons Sania could not do so and ultimately it was agreed that to bridge the shortfall in the required capital a new partner should be admitted who would bring in the amount that Sania could not bring and that the new partner would get share of profits equal to half of Sania’s share which would be sacrificed by Sania only.

Consequent to this agreement Ejaz was admitted and he brought in the required capital and ` 30,00,000 as premium for goodwill.

What is the amount of capital brought in by the new partner Ejaz?

Based on the below information, answer the given questions:

Aditi and Parul are partners in a firm with capitals of ₹ 35,000 each. They shared profits and losses in the ratio of 3 : 1. On 1st April, 2017, they admitted Chanda into their partnership with 1/5th share in the profits. Chanda brings in ₹40,000 as her capital and her share of goodwill in cash. Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm. At the time of Chanda’s admission :

(a) The firm had a Workmen Compensation Reserve of ₹ 60,000 against which there was a claim of ₹ 20,000.

(b) Creditors of ₹ 8,000 were paid by Aditi privately for which she is not to be reimbursed.

(c) There was no change in the value of other assets and liabilities.

How much amount of the workmen compensation reserve will be transferred to Parul’s Capital Account?

Read the following hypothetical text and answer the given questions:

Amit and Mahesh were partners in a fast-food corner sharing profits and losses in ratio 3:2. They sold fast food items across the counter and did home delivery too. Their initial fixed capital contribution was ₹1,20,000 and ₹80,000 respectively. At the end of first year their profit was ₹1,20,000 before allowing the remuneration of ₹3,000 per quarter to Amit and ₹2,000 per half year to Ranju. Such a promising performance for the first year was encouraging, therefore, they decided to expand the area of operations.

For this purpose, they needed a delivery van, a few Scotties and an additional person to support. Six months into the accounting year they decided to admit Sundram as a new partner and offered him 20% as a share of profits along with a monthly remuneration of ₹2,500. Sundram was asked to introduce ₹1,30,000 for capital and ₹70,000 as premium for goodwill. Besides this Sundram was required to provide ₹1,00,000 as loan for two years. Sundram readily accepted the offer. The terms of the offer were duly executed and he was admitted as a partner.

Remuneration will be transferred to ________ of Amit and Mahesh at the end of the accounting period.

Based on the below information, you are required to answer the given questions:

Sterling Enterprises is a partnership business with Ryan, Williams and Sania as partners engaged in production and sales of electrical items and equipment. Their capital contributions were ₹50,00,000, ₹ 50,00,000 and ₹80,00,000 respectively with the profit sharing ratio of 5:5:8. As they are now looking forward to expanding their business, it was decided that they would bring in sufficient cash to double their respective capitals. This was duly followed by Ryan and Williams but due to unavoidable reasons Sania could not do so and ultimately it was agreed that to bridge the shortfall in the required capital a new partner should be admitted who would bring in the amount that Sania could not bring and that the new partner would get share of profits equal to half of Sania’s share which would be sacrificed by Sania only.

Consequent to this agreement Ejaz was admitted and he brought in the required capital and ` 30,00,000 as premium for goodwill.

What will be the new profit-sharing ratio of Ryan, Williams, Sania and Ejaz?

Read the following hypothetical text and answer the given questions:

Amit and Mahesh were partners in a fast-food corner sharing profits and losses in ratio 3:2. They sold fast food items across the counter and did home delivery too. Their initial fixed capital contribution was ₹1,20,000 and ₹80,000 respectively. At the end of first year their profit was ₹1,20,000 before allowing the remuneration of ₹3,000 per quarter to Amit and ₹2,000 per half year to Ranju. Such a promising performance for the first year was encouraging, therefore, they decided to expand the area of operations.

For this purpose, they needed a delivery van, a few Scotties and an additional person to support. Six months into the accounting year they decided to admit Sundram as a new partner and offered him 20% as a share of profits along with a monthly remuneration of ₹2,500. Sundram was asked to introduce ₹1,30,000 for capital and ₹70,000 as premium for goodwill. Besides this Sundram was required to provide ₹1,00,000 as loan for two years. Sundram readily accepted the offer. The terms of the offer were duly executed and he was admitted as a partner.

While taking up the accounting procedure for this reconstitution the accountant of the firm Mr. Suraj Marwah faced a difficulty. Solve it by answering the following: For the amount of loan that Sundram has agreed to provide, he is entitled to interest thereon at the rate of____________.

Based on the below information, you are required to answer the given questions:

Sterling Enterprises is a partnership business with Ryan, Williams and Sania as partners engaged in production and sales of electrical items and equipment. Their capital contributions were ₹50,00,000, ₹ 50,00,000 and ₹80,00,000 respectively with the profit sharing ratio of 5:5:8. As they are now looking forward to expanding their business, it was decided that they would bring in sufficient cash to double their respective capitals. This was duly followed by Ryan and Williams but due to unavoidable reasons Sania could not do so and ultimately it was agreed that to bridge the shortfall in the required capital a new partner should be admitted who would bring in the amount that Sania could not bring and that the new partner would get share of profits equal to half of Sania’s share which would be sacrificed by Sania only.

Consequent to this agreement Ejaz was admitted and he brought in the required capital and ` 30,00,000 as premium for goodwill.

What will be the correct journal entry for the distribution of Premium for Goodwill brought in by Ejaz?

Read the following hypothetical text and answer the given questions:

Amit and Mahesh were partners in a fast-food corner sharing profits and losses in ratio 3:2. They sold fast food items across the counter and did home delivery too. Their initial fixed capital contribution was ₹1,20,000 and ₹80,000 respectively. At the end of first year their profit was ₹1,20,000 before allowing the remuneration of ₹3,000 per quarter to Amit and ₹2,000 per half year to Ranju. Such a promising performance for the first year was encouraging, therefore, they decided to expand the area of operations.

For this purpose, they needed a delivery van, a few Scotties and an additional person to support. Six months into the accounting year they decided to admit Sundram as a new partner and offered him 20% as a share of profits along with a monthly remuneration of ₹2,500. Sundram was asked to introduce ₹1,30,000 for capital and ₹70,000 as premium for goodwill. Besides this Sundram was required to provide ₹1,00,000 as loan for two years. Sundram readily accepted the offer. The terms of the offer were duly executed and he was admitted as a partner.

Sundram will be entitled to a remuneration of _______at the end of the year.

|

705 tests

|