Test: Resource Mobilization- 2 - Commerce MCQ

15 Questions MCQ Test - Test: Resource Mobilization- 2

Susan and Joseph are partners in a firm of car manufacturing. They are planning to merge their firm SJ Ltd. with a retain car seller in order to expand their business and maximize the profits. For this merger, SJ Ltd. need a short-term loan. They have chosen Trade credit to finance them for this merger to take place. State whether trade credit being a short-term funding way is true or false.

During an interview, the HR of MultiCorp. Ltd. asked one of the candidates if the set-up finance is the capital required by an entrepreneur to conduct research at pre-commercialization stage. He responded by agreeing to the statement. Mention whether the candidate’s response was true or false.

Suhani used to sell vegetables in a cart with her sister. They were able to earn profit of ` 300 per day. Even though the amount was sufficient for their living, but they wanted to earn more. In order to expand the business and arrange funds, Suhani contacted an angel investor in her locality. Suhnai contacted Angel Investor because as per the view of Suhani, Angel investors provide funds to small businesses. State whether her view point is true or false.

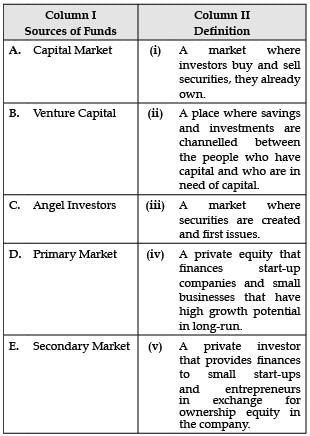

Given below are the sources of funds in Column 1 and their definition in Column 2. Match the correct source with its definition.

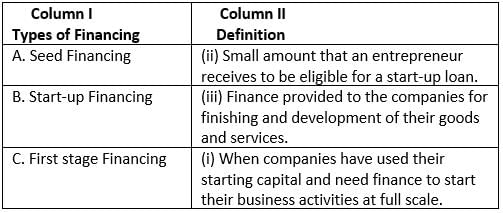

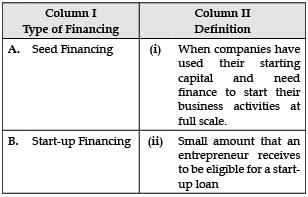

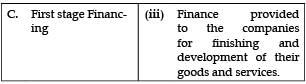

Given below are the type of financing in Column 1 and their definition in Column 2. Match these accordingly.

State Whether the Following Statements are True or False.

Q. In March, 1996 the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India.

State Whether the Following Statements are True or False.

Q. Capital Markets play a very vital role of a financial intermediary.

State Whether the Following Statements are True or False.

Q. Volume is nothing but quantity of shares.

State Whether the Following Statements are True or False.

Q. Startup finance is the capital required by an entrepreneur for conducting research at pre commercialization stage.

State Whether the Following Statements are True or False.

Q. Secondary capital market deals with buying and selling of new securities.

State Whether the Following Statements are True or False.

Q. Seed capital finance refers to the capital required by an entrepreneur for conducting research at precommercialization stage.

State Whether the Following Statements are True or False.

Q. Angel investor’s objective is to create great companies by providing value creation.

State Whether the Following Statements are True or False.

Q. Venture capital is a subset of public equity.

State Whether the Following Statements are True or False.

Q. Angel investors expect a low return on investment.

State Whether the Following Statements are True or False.

Q. Venture capital has been used as a tool for economic development in a variety of developing regions.