Accountancy: CUET Mock Test - 2 - CUET MCQ

30 Questions MCQ Test CUET Mock Test Series - Accountancy: CUET Mock Test - 2

At the time of admission of a new partner in the firm, the new partner compensates the old partners for their loss of share in the super-profits of the firm for which he brings in an additional amount which is known as

In case of dissolution of Partnership firm, the final balance of capital accounts are transferred to :

A,B and C are partners sharing profits in the ratio of 3:2:1. They agree to admit D into the firm. A, B and C agreed to give 1/3rd,1/6,1/9th share of their profit. The share of Profit of D will be:

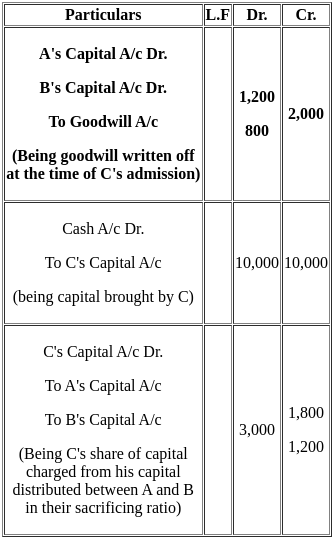

th share of profits and brings in Rs. 10,000 as his capital but is not able to bring in cash for his share of goodwill of Rs. 3,000. Which of the following accounting treatment is correct for writing off goodwill appearing in the books?

th share of profits and brings in Rs. 10,000 as his capital but is not able to bring in cash for his share of goodwill of Rs. 3,000. Which of the following accounting treatment is correct for writing off goodwill appearing in the books?

Find the correct sequence of procedure of issue of shares :

(A) Receipt of Applications

(B) Issue of prospectus

(C) Allotment of Shares

(D) Making call money due

(E) Receiving Call money

Choose the correct answer from the options given below :

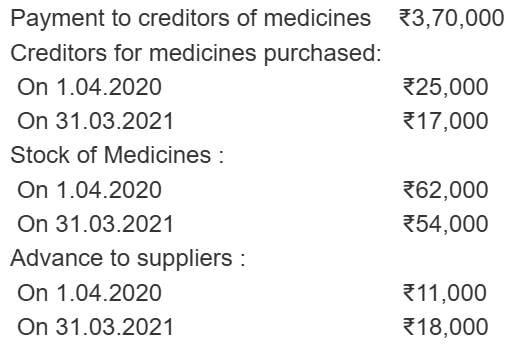

Find out cost of medicine consumed during 2020-21.

At the time of admission of partners, it is presumed that the new partner acquires his sharing in profits from the old partners in ______ ratio.

The ‘share of premium for goodwill’ brought in by the new partner is divided in which ratio?

______ goodwill is the excess of desired total capital of firm over the actual combined capital of all partners.

X and Y are sharing profits and losses in the ratio of 3 : 2. Z is admitted with 1/5th share in profits of the firm which he gets entirely from X. Find out the new profit sharing ratio.

Which of the following is not a right of newly admitted partner?

Taxation fund should never be distributed among the old partners at the time of admission of partners.

On the admission of a new partner, old partnership continues.

According to AS -10, value of goodwill should be adjusted through the capital accounts of the partners.

When the existing goodwill in books is written-off at the time of admission of new partner, the new partners’ capital account is not debited.

Contingency reserve, profit and loss account (credit) balance and deferred revenue expenditure account are credited to capital accounts of old partner in old ratio at the time of admission of new partners.

Goodwill of the firm of X and Y is valued at ₹ 45,000. It is appearing in the books at ₹18,000. Z is admitted in the firm. What amount is she supposed to bring an account of goodwill?

Direction: There are two statements marked as Assertion (A) and Reason (R). Read the statements and choose the appropriate option from the options given below

Assertion (A): In certain cases, the premium for goodwill paid by the incoming partner is not recorded in the books of accounts.

Reason (R): Sometimes, the incoming partner pays his share of goodwill privately to the sacrificing partners, outside the business.

Which of the following capitals is shown in the company’s balance sheet?

Which document is prepared by the company as an invitation to the public to subscribe for company’s shares?

A company, for the purpose of raising funds, may issue _______

A company issued 25,000 shares and received applications for 50,000 shares. Company wants to allot shares to everyone who has applied. What will be the ratio for allotment?

Capital of a company is divided in units which is called

First call amount received in advance from the shareholders before it is actually called up by the directors is

|

8 docs|148 tests

|