Accountancy: CUET Mock Test - 4 - CUET MCQ

30 Questions MCQ Test CUET Mock Test Series - Accountancy: CUET Mock Test - 4

Which of the following is not included under the head non-current assets?

A and B were partners. They shared profits as A- 1/2 ; B- 1/3 and carried to reserve 1/6. B died. The balance of reserve on the date of death was Rs. 30,000. B’s share of reserve will be:

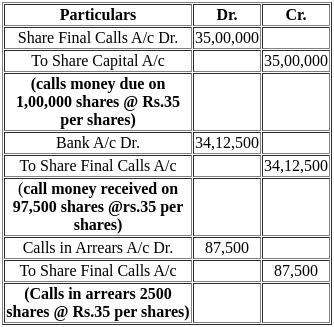

The subscribed share capital of Mukand Ltd is Rs. 1,00,00,000 of Rs. 100 each. There was no call in arrears till the final call was made. The final call made was paid on 97,500 shares. The calls in arrears amounted to Rs. 87,500. The call-in arrears on final call was:

XYZ Ltd. acquired assets worth Rs. 7,50,000 from ABC Ltd. by the issue of shares of Rs 100 at a premium of 25%. The number of shares to be issued by XYZ Ltd. to settle the purchase consideration should be?

A, B & C were sharing profits & losses in the ratio of 3 : 2 : 1. They decided to share profits & losses equally in future. General reserve was appearing in their books at ₹60,000. Goodwill was valued at ₹1,20,000. The partners do not want to disturb the general reserve.

The adjusting entry will be:

The key combination which collapses the ribbon is:

Financial statements are useful for both short-term and long-term investors.

The financial statements provide basic input for industrial, taxation and other economic policies of the government.

What will be the amount shown under the head current assets when the following data is given?

Inventories = ₹ 2,30,000

Trade Receivables = ₹ 70,000

Cash and Cash Equivalents = ₹ 50,000

Current Investments = ₹ 50,000

Which of the following item can be presented on the asset side of the balance sheet of a company?

________ reserve can be used freely for any purpose.

Which of the following is not included under ‘revenue from operations’ in the statement of profit and loss?

For a financial company, interest on loans given is shown in the statement of profit and loss as

Which of the following points out the importance of financial statements?

Directions: There are two statements marked as Assertion (A) and Reason (R). Read the statements and choose the appropriate option from the options given below

Assertion (A): The management uses accounting information to arrive at various decisions like determination of selling price, cost controls, investment into new ventures, etc.

Reason (R): The management has the responsibility to safeguard the customer’s investment and increase its value by managing the business efficiently.

Direction: Read the following case study and answer the question on the basis of the same.

XYZ Ltd. is a financial company. For the year 2020-21 interest on loans given amounted to ₹4,00,000 and fees received for arranging loans amounted to ₹ 1,00,000. Its miscellaneous income amounted to ₹ 50,000. Further, a building was sold during the year on which XYZ Ltd. earned a profit of ₹ 70,000. Moreover, it earned a profit of ₹ 75,000 on the sale of investments during the year.

Profit on sale of investments will be shown as in the statement of profit and loss.

Which of the following are the objectives of financial statements?

(i) To provide information about economic resources and obligations of a business.

(ii) To provide information about the earning capacity of the business.

(iii) To provide information about cash flows.

(iv) To judge effectiveness of management.

Bank overdraft and cash credit are treated as ‘short-term borrowings’ in the balance sheet of a company.

Which of the following is not included under the head shareholder’s fund?

Calls-in-advance are shown under the head ‘current liabilities’ and sub-head ‘other current liabilities’ in the balance sheet of a company.

Which of the following is not presented under ‘current liabilities’ in the balance sheet of a company?

Preliminary expenses of ₹ 35,000 are shown in the balance sheet under which of the following the head?

How are financial statements beneficial to owners of a company?

(i) Financial statements report the performance of the management to the shareholders.

(ii) The gaps between the management performance and ownership expectations can be understood with the help of financial statements.

Public deposits appear under which of the following head in a company’s balance sheet?

Unclaimed dividend will be shown under the head ______

|

8 docs|148 tests

|