Economics: CUET Mock Test - 7 - CUET MCQ

30 Questions MCQ Test CUET UG Mock Test Series 2026 - Economics: CUET Mock Test - 7

Which of the following is not the components of current account in India?

Since 2014-15, India has consistently run trade surplus with which one among the following countries?

Which of the following is NOT part of Fiscal Policy?

Arrange the following statements relating to open market operations in the correct sequence.

(A) Thereby resulting in an increase in money supply

(B) Central bank pays for it by giving a cheque

(C) Central bank buys a government bond in the open market

(D) This increases the total amount of reserves in the economy

Choose the correct answer from the options given below:

Given AD =  , change in autonomous consumption will lead to :

, change in autonomous consumption will lead to :

(A) Change in equilibrium level of income

(B) Change in aggregate demand

(C) Change in Investment

(D) Change in aggregate demand and no change in equilibrium level of income

(E) Change in marginal propensity to consume

Choose the correct answer from the options given below:

What is the role of government in redistributing income?

Which of the following is an example of a public good?

What happens when the government provides public goods?

What is one of the challenges the government faces regarding its budget?

Why is managing the government’s deficit important?

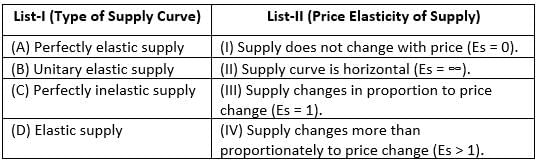

Match List-I with List-II :

Choose the correct answer from the options given below :

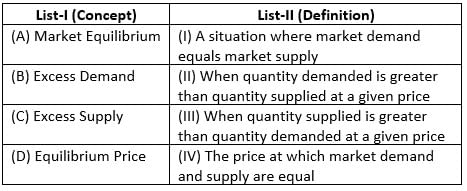

Match List-I with List-II :

Choose the correct answer from the options given below :

Which among the following is NOT a subsidiary of RBI?

All the state government imposed land ceiling in 1960 except

Which among the following is NOT a subsidiary of RBI?

The new agricultural strategy was adopted in India during the

The positive economic analysis deals with the variables

One of the characteristics of economic resource is scarcity. Which is the other?

_____________ is defined as the difference between what the consumer is willing to pay for a product and what he actually pays?

Read the following news report and answer the question that follow:

MUMBAI: Investors were relieved as the finance minister Nirmala Sitharaman avoided an increase in the long-term capital gains tax on equity investments and securities transaction tax in the Union Budget for 2021-22 announced today.

Heading into the Budget, most investors were concerned that the government may look at increasing the long-term capital gains tax or the securities transaction tax in order to boost its revenues, especially as the stock market has witnessed a breakneck rally since the beginning of April.

In her Budget speech in July 2019, the finance minister had reintroduced the long-term capital gains tax after 15 years. Currently, individuals who make capital gains of more than `1 lakh on their equity investment after a holding period of more than one year have to pay a tax of 10 per cent on the capital gains. However, the capital gains tax for individuals in the highest bracket of earnings comes around 15 per cent inclusive of a cess.

Money managers had said that the government needed to bring out an equity friendly budget, implying no changes in taxations related to the stock market, in order to ensure that its divestment plans went smoothly in the next fiscal year.

Q. The capital gains in the highest bracket of earning comes around ________.

|

39 docs|145 tests

|