MH SET Paper 2 Mock Test - 10 (Commerce) - MAHA TET MCQ

30 Questions MCQ Test MH SET Mock Test Series 2025 - MH SET Paper 2 Mock Test - 10 (Commerce)

Which of the following incomes are exempt from tax?

1. Dividend received from the foreign company.

2. Agricultural income.

3. Remuneration received by an individual who is not a citizen of India

4. Long term Capital gain income (Below 1 lakh).

5. Dividend received from an Indian company.

6. Rental income of house property.

Codes:

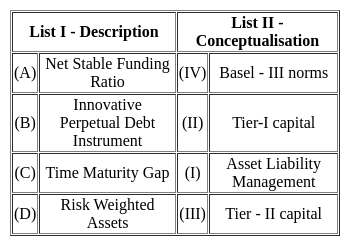

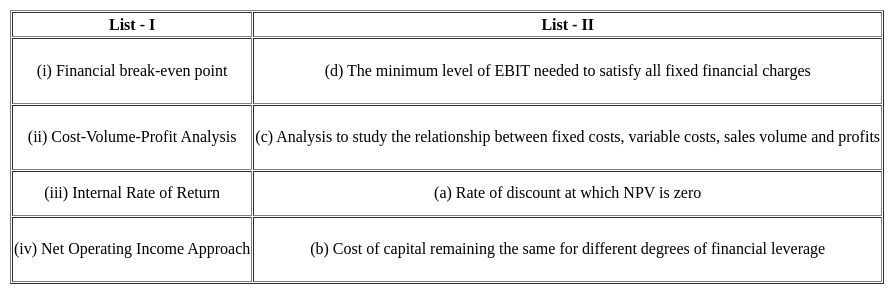

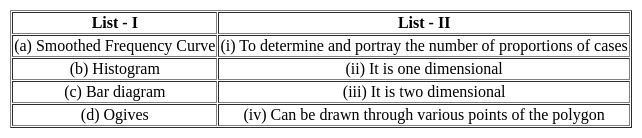

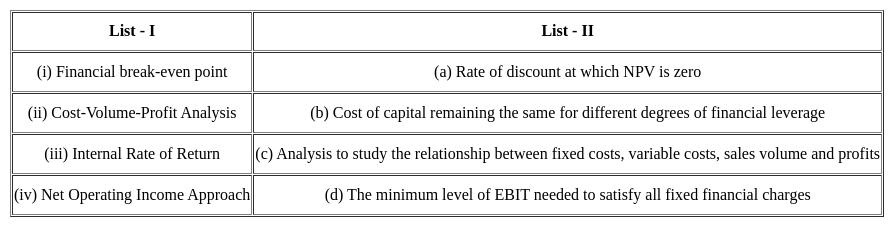

Match List I with List II:

Choose the correct answer from the options given below:

Assertion (A): Both tax planning and tax

Reasoning (R): Tax planning follows the

Codes:

Which of the following tests are not recommended for the top-level positions?

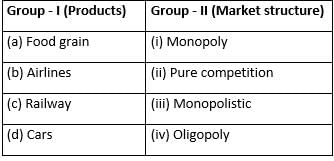

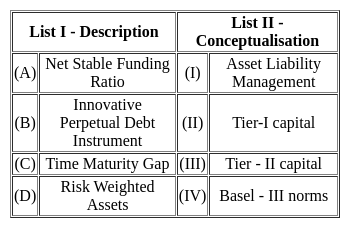

Match the given lists and select the correct code for the answer:

With reference to the concept of accounting standards, consider the following statements :

(I) An accounting standard is a guideline for financial accounting, such as how a firm prepares and presents its business income, expenses, assets, and liabilities.

(II) Accounting standards lay down the terms and conditions of accounting policies and practices.

(III ) Accounting standards do not facilitate intra-firm and inter-firm comparison.

(IV) Accounting standards relate to all aspects of an entity's finances including assets, liabilities, revenue, expenditures, and equity.

Which of the following statements are correct?

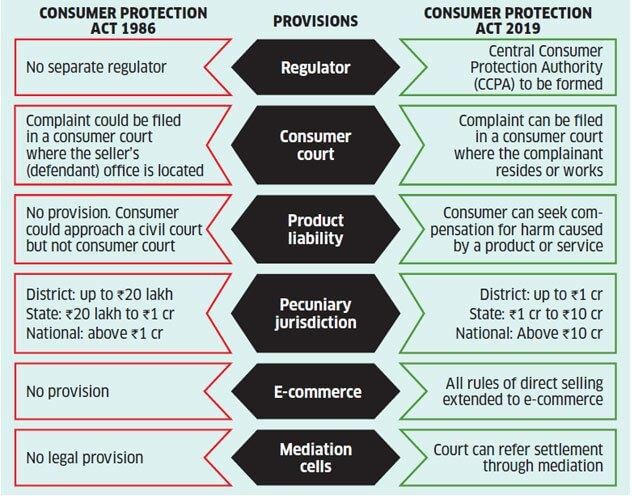

The Consumer Protection Act, of 2019, provides for which of the following?

1. The Central Consumer Protection Authority (CCPA).

2. The Central Consumer Protection Council at the national, state, and district levels.

3. The Consumer Disputes Redressal Commission at the national level only.

4. The Consumer Mediation Cell is to be attached to each of the District Commissions and the State Commissions.

Select the correct answer using the code given below:

Which of the following is not an example of probability sampling?

Which of the following is correct with respect to GST in India?

I. GST The Act was passed by the Parliament in 2016.

II. GST The law came into force from July 2016.

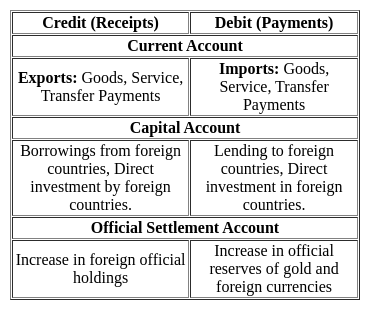

In the balance of payment account, the transfer payments are included in which one of the following?

In India a scheduled commercial bank is one which is

With reference to the foreign exchange market, consider the following statements :

(I) The foreign exchange market is a global decentralized market for the trading of currencies.

(II) This includes all aspects of buying, selling, and exchanging currencies at current or determined prices.

(III) The foreign exchange market works through financial institutions.

(IV) The foreign exchange market determines the relative values of different currencies.

Which of the following statements are correct?

Which of the following should be achieved by a business firm at the earliest?

The primary responsibility of the 'Segmentation' stage of STP is

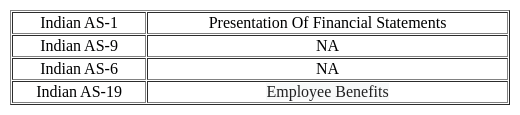

Employee benefits provided by the employer during an accounting period are recognized as per ____ .

With reference to the applicability of Ind AS, which of the following is not correct?

Which of the following years was the first income tax imposed by Great Britain?

Which of the following was the battle cry of the American Revolution?

Which of the following tells why the nobles revolted against King John?

Which of the following economies accrue all the firm in an industry?

|

60 tests

|