Test: Admission Of New Partner - 3 - Commerce MCQ

23 Questions MCQ Test - Test: Admission Of New Partner - 3

A and B are partners sharing profits and losses in the ratio 5:3. They admitted C and agreed to give him 3/10th of the profit. What is the new ratio after C’s admission?

A and B are partners sharing profits in the ratio 5:3, they admitted C giving him 3/10th share of profit. If C acquires 1/5th share from A and 1/10th from B, new profit sharing ratio will be:

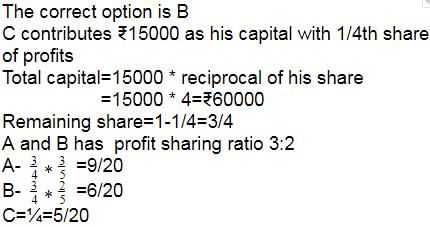

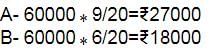

C was admitted in a firm with 1/4th share of the profits of the firm. C contributes Rs. 15,000 as his capital, A and B are other partners with the profit sharing ratio as 3:2. Find the required capital of A and B, if capital should be in profit sharing ratio taking C’s as base capital:

A, B and C are partners sharing profits and losses in the ratio 6:3:3, they agreed to take D into partnership for 1/8th share of profits. Find the new profit sharing ratio.

X and Y are partners sharing profits in the ratio 5:3. They admitted Z for 1/5th share of profits, for which he paid Rs. 1,20,000 against capital and Rs. 60,000 against goodwill.Find the capital balances for each partner taking Z’s capital as base capital.

A and B are partners sharing profits and losses in the ratio of 3:2 (A’s Capital is Rs. 30,000 and B’s Capital is Rs. 15,000). They admitted C agreed to give 1/5th share of profits to him.How much C should bring in towards his capital?

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who brings in Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. In what ratio will this amount will be shared among the old partners A & B.

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. C is able to bring Rs. 30,000 only. How this will be treated in the books of the firm.

Three partners A , B , C start a business . B's Capital is four times C's capital and twice A's capital is equal to thrice B's capital . If the total profit is Rs 16500 at the end of a year ,Find out B's share in it.

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. C bought cash for his share of Capital and agreed to compensate to A and B outside the firm. How this will be treated in the books of the firm.

Profit or loss on revaluation is shared among the partners in ……… ratio.

Amit and Anil are partners of a partnership firm sharing profits in the ratio of 5:3 respectively. Atul was admitted on the following terms: Atul would pay Rs. 50,000 as capital and Rs. 16,000 as Goodwill, for 1/5th share of profit. Machinery would be appreciated by 10% (book value Rs. 80,000) and building would be depreciated by 20% (Rs. 2,00,000). Unrecorded debtors of Rs. 1,250 would be bought into books now and a creditors amounting to Rs. 2,750 died and need not to pay anything to its estate. Find the distribution of profit/loss on revaluation between Amit, Anil and Atul.

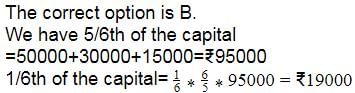

A and B, who share profits and losses in the ratio of 3:2 has the following balances: Capital of A Rs. 50,000; Capital of B Rs. 30,000; Reserve Fund Rs. 15,000. They admit C as a partner, who contributes to the firm Rs. 25,000 for 1/6th share in the partnership. If C is to purchase 1/6th share in the partnership from the existing partners A and B in the ratio of 3:2 for Rs. 25,000, find closing capital of C.

Amit and Anil are partners of a partnership firm sharing profits in the ratio of 5:3 with capital of Rs. 2,50,000 & Rs. 2,00,000 respectively. Atul was admitted on the following terms: Atul would pay Rs. 50,000 as capital and Rs. 16,000 as Goodwill, for 1/5th share of profit. Find the balance of capital accounts after admission of Atul.

A and B shares profit and losses equally. They admit C as an equal partner and assets were revalued as follow: Goodwill at Rs. 30,000 (book value NIL). Stock at Rs. 20,000 (book value Rs. 12,000); Machinery at Rs. 60,000 (book value Rs. 55,000). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. Find the profit/loss on revaluation to be shared among A, B and C.

A and B shares profit and losses equally. They admit C as an equal partner and goodwill was valued as Rs. 30,000 (book value NIL). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. What will be the final effect of goodwill in the partner’s capital account?

A and B shares profit and losses equally. They admit C as an equal partner and goodwill was valued as Rs. 30,000 (book value NIL). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. If profit on revaluation is Rs. 13,000, find the closing balance of the capital account.

Balance sheet prepared after the new partnership agreement, assets and liabilities are recorded at:

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. How much cash can P & Q withdraw from the firm (if any).

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. If profit on revaluation is Rs. 6,000 and opening capital of P is Rs. 40,000 and of Q is Rs. 30,000, find the closing balance of each capital.

Adam, Brain and Chris were equal partners of a firm with goodwill Rs. 1,20,000 shown in the balance sheet and they agreed to take Daniel as an equal partner on the term that he should bring Rs. 1,60,000 as his capital and goodwill, his share of goodwill was evaluated at Rs. 60,000 and the goodwill account is to be written off before admission. What will be the treatment for goodwill?

Which of the following asset is compulsory to revalue at the time of admission of a new partner:

X and Y are partners sharing profits in the ratio of 3 : 1. They admit Z as a partner who pays Rs. 4,000 as Goodwill the new profit sharing ratio being 2 : 1 : 1 among X, Y and Z respectively. The amount of goodwill will be credited to :