Test: Redemption Of Preference Shares - 3 - Commerce MCQ

18 Questions MCQ Test - Test: Redemption Of Preference Shares - 3

Which of the following statements is false?

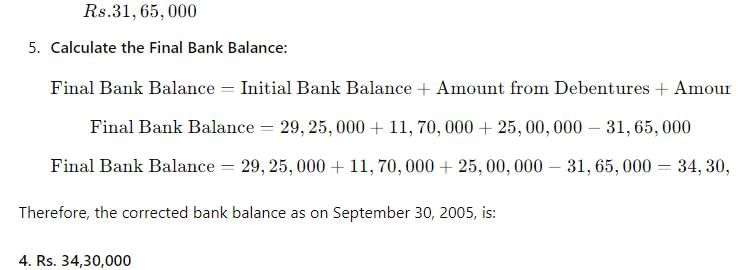

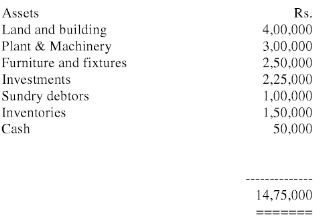

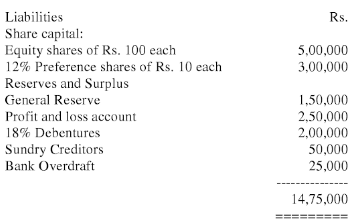

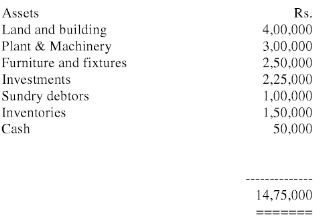

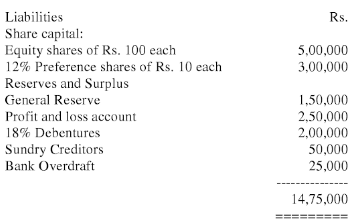

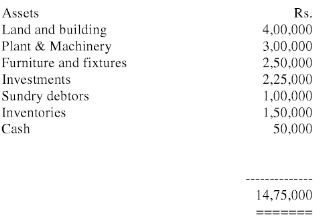

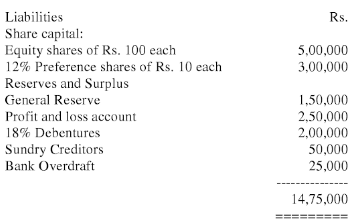

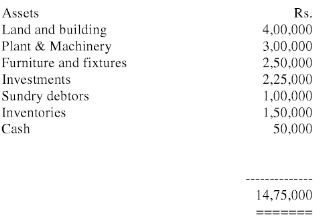

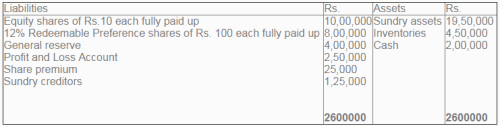

The balance sheet of A Ltd. as on March 31, 2006 is as under

The 12% preference shares are redeemable at a premium of 10%. The company wishes to maintain the cash balance at Rs. 25,000. For the purpose of redemption of preference shares, it proposed to sell the investments for Rs. 2,00,000. The company proposes to issue sufficient number of equity shares of Rs. 100 each at a premium of 5% to raise required cash resources.

Cash required to effect the above decisions is __________.

The 12% preference shares are redeemable at a premium of 10%. The company wishes to maintain the cash balance at Rs. 25,000. For the purpose of redemption of preference shares, it proposed to sell the investments for Rs. 2,00,000. The company proposes to issue sufficient number of equity shares of Rs. 100 each at a premium of 5% to raise required cash resources.

Cash required to effect the above decisions is __________.

The balance sheet of A Ltd. as on March 31, 2006 is as under

The 12% preference shares are redeemable at a premium of 10%. The company wishes to maintain the cash balance at Rs. 25,000. For the purpose of redemption of preference shares, it proposed to sell the investments for Rs. 2,00,000. The company proposes to issue sufficient number of equity shares of Rs. 100 each at a premium of 5% to raise required cash resources.

Number of equity shares to be issued is __________.

The 12% preference shares are redeemable at a premium of 10%. The company wishes to maintain the cash balance at Rs. 25,000. For the purpose of redemption of preference shares, it proposed to sell the investments for Rs. 2,00,000. The company proposes to issue sufficient number of equity shares of Rs. 100 each at a premium of 5% to raise required cash resources.

Number of equity shares to be issued is __________.

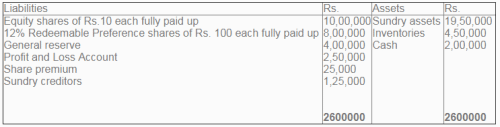

The following is the balance sheet of G Ltd. as on March 31, 2006:

The Board of Directors of the company decided to redeem the preference shares at a premium of 10%. In order to facilitate the redemption, the Board has taken the following decisions:

? To sell the investments for Rs. 4,00,000

? To issue sufficient equity shares at a premium of Rs. 2 per share to raise the balance of funds needed

&lowest; To maintain minimum bank balance of Rs. 50,000

The Board of Directors initiated the above course of action during the month of April, 2006 and redeemed all the preference shares.

Premium on issue of fresh equity shares =?

The following is the balance sheet of G Ltd. as on March 31, 2006:

The Board of Directors of the company decided to redeem the preference shares at a premium of 10%. In order to facilitate the redemption, the Board has taken the following decisions:

? To sell the investments for Rs. 4,00,000

? To issue sufficient equity shares at a premium of Rs. 2 per share to raise the balance of funds needed

&lowest; To maintain minimum bank balance of Rs. 50,000

The Board of Directors initiated the above course of action during the month of April, 2006 and redeemed all the preference shares.

The amount to be transferred to Capital Redemption Reserve =?

S Ltd. issued 2,000, 10% Preference shares of Rs.100 each at par, which are redeemable at a premium of 10%. For the purpose of redemption, the company issued 1,500 Equity Shares of Rs.100 each at a premium of 20 % per share. At the time of redemption of Preference Shares, the amount to be transferred by the company to the Capital Redemption Reserve Account = ?

During the year 2000-2001, T Ltd. issued 20,000, 12% Preference shares of Rs.10 each at a premium of 5%, which are redeemable after 4 years at par. During the year 2005-2006, as the company did not have sufficient cash resources to redeem the preference shares, it issued 10,000, 14% debentures of Rs.10 each at a premium of 10%. At the time of redemption of 12% preference shares, the amount to be transferred to capital redemption reserve = ?

According to section 78 of the Companies Act, the amount in the Securities Premium A/ c cannot be used for the purpose of

Which of the following can be utilized for redemption of preference shares?

Which of the following can be utilized for redemption of preference shares?

Which of the following statements is false?

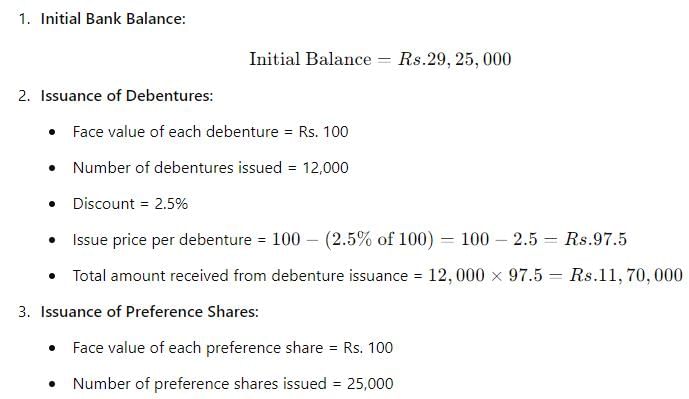

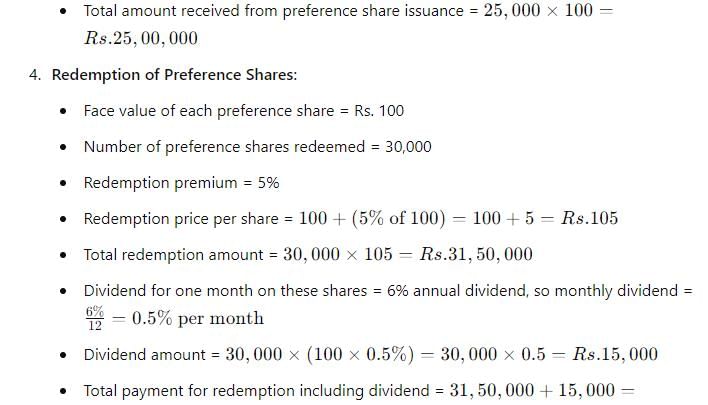

Consider the following information pertaining to E Ltd.

On September 4, 2005, the company issued 12,000 7% Debentures having a face value of Rs.100 each at a discount of 2.5%. On September 12, the company issued 25,000, 8% Preference share of Rs.100 each. On September 29,the company redeemed 30,000, 6% Preference shares of Rs.100 each at a premium of 5% together with one month dividend thereon. Bank balance as on August 31, 2005 was Rs.29,25,000.

After effecting the above transactions, the Bank balance as on September 30, 2005 = ?

O Ltd has redeemed its 12% preference shares of Rs. 2,00,000 at a premium of 4% . To meet the redemption it has issued Rs. 1,98,084 worth of shares of Rs. 20 each at a premium of 5%. The balance outstanding to the credit of share premium account after adjusting premium on redemption of preference shares = ?

Which of the following accounts can be transferred to capital redemption reserve account?

Preference shares amounting to Rs.2,00,000 are redeemed at a premium of 5%, by issue of shares amounting to Rs.1,00,000 at a premium of 10%. The amount to be transferred to capital redemption reserve = ?

Share premium cannot be used to _______.

A company cannot issue redeemable preference shares for a period exceeding _____________.

Which of the following cannot be used for the purpose of creation of capital redemption reserve account?