Accountancy: CUET Mock Test - 4 - CUET MCQ

30 Questions MCQ Test - Accountancy: CUET Mock Test - 4

Which of the following is not included under the head non-current assets?

A and B were partners. They shared profits as A- 1/2 ; B- 1/3 and carried to reserve 1/6. B died. The balance of reserve on the date of death was Rs. 30,000. B’s share of reserve will be:

Amount received from the sale of furniture for ₹7000 (Book value ₹10,000). The amount to be shown in receipts and payments account will be:

Which of the following is classified as a liability in a company's balance sheet?

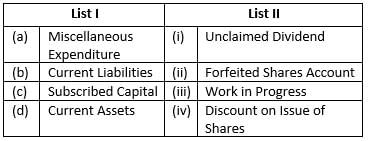

Match the items given in Column I with the headings/subheadings (Balance sheet) as define Schedule III of Companies Act, 2013.

Match the items of List - II with the items of List - I and indicate the code of correct matching. The items relate to the Balance Sheet of a Company.

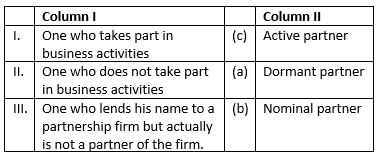

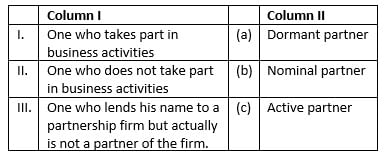

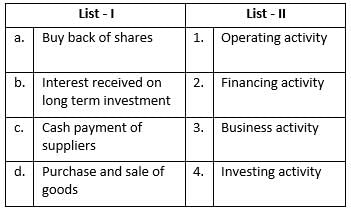

Match the following and suggest the correct codes.

Is the partnership deed required by the Partnership Act to be in writing?

If the partnership agreement is silent on a matter, what applies?

Does joint ownership of land make individuals partners?

What is necessary to call someone a partner in a business?

What does partnership specifically involve according to the passage?

If Rohit and Sachin are buying land for the purpose of selling it, what are they called?

Financial statements are useful for both short-term and long-term investors.

The financial statements provide basic input for industrial, taxation and other economic policies of the government.

What will be the amount shown under the head current assets when the following data is given?

Inventories = ₹ 2,30,000

Trade Receivables = ₹ 70,000

Cash and Cash Equivalents = ₹ 50,000

Current Investments = ₹ 50,000

Which of the following item can be presented on the asset side of the balance sheet of a company?

Which of the following is not included under ‘revenue from operations’ in the statement of profit and loss?

For a financial company, interest on loans given is shown in the statement of profit and loss as

Directions: There are two statements marked as Assertion (A) and Reason (R). Read the statements and choose the appropriate option from the options given below

Assertion (A): The management uses accounting information to arrive at various decisions like determination of selling price, cost controls, investment into new ventures, etc.

Reason (R): The management has the responsibility to safeguard the customer’s investment and increase its value by managing the business efficiently.

Which of the following are the objectives of financial statements?

(i) To provide information about economic resources and obligations of a business.

(ii) To provide information about the earning capacity of the business.

(iii) To provide information about cash flows.

(iv) To judge the effectiveness of management.