Test: Time Value Of Money - CA Foundation MCQ

10 Questions MCQ Test Quantitative Aptitude for CA Foundation - Test: Time Value Of Money

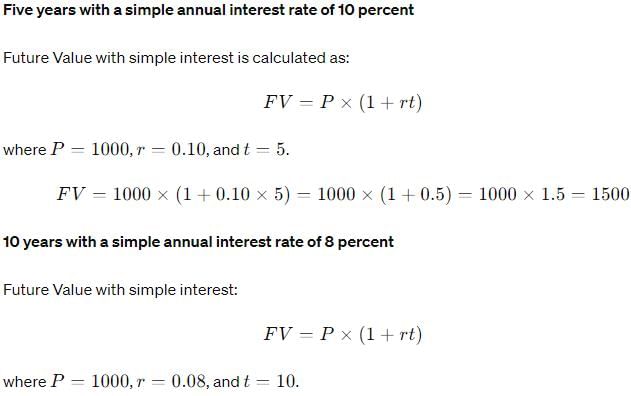

What is the total amount accumulated after three years if someone invests $1,000 today with a simple annual interest rate of 5 percent? With a compound annual interest rate of 5 percent?

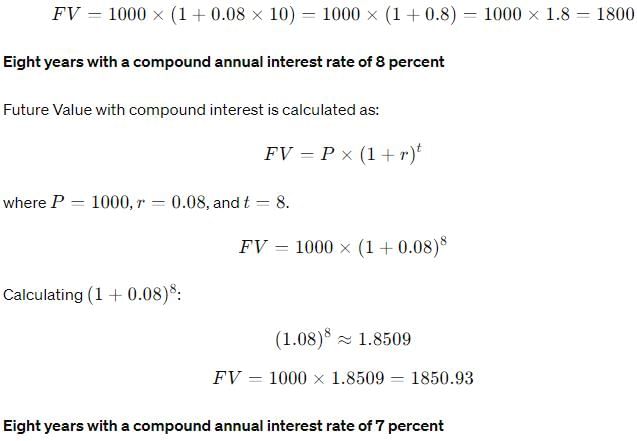

Which of the following has the largest future value if $1,000 is invested today?

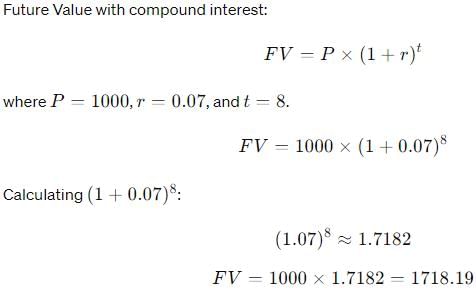

Suppose an investor wants to have $10 million to retire 45 years from now. How much would she have to invest today with an annual rate of return equal to 15 percent?

Maggie deposits $10,000 today and is promised a return of $17,000 in eight years. What is the implied annual rate of return?

To triple $1 million, Mika invested today at an annual rate of return of 9 percent. How long will it take Mika to achieve his goal?

Jan plans to invest an equal amount of $2,000 in an equity fund every year-end beginning this year. The expected annual return on the fund is 15 percent. She plans to invest for 20 years. How much could she expect to have at the end of 20 years?

Jan plans to invest an equal amount of $2,000 in an equity fund every year-end beginning this year. The expected annual return on the fund is 15 percent. She plans to invest for 20 years.

What is the present value of Jan’s investments?

What is the present value of a perpetuity with an annual year-end payment of $1,500 and expected annual rate of return equal to 12 percent?

|

114 videos|164 docs|98 tests

|