Test: Accounting As A Measurement Discipline - 2 - CA Foundation MCQ

8 Questions MCQ Test Accounting for CA Foundation - Test: Accounting As A Measurement Discipline - 2

Measurement discipline deals with

All of the following are valuation principles except

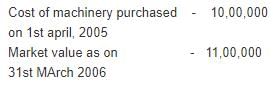

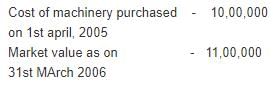

As on 31st March, 2006, if the company values the machinery

At Rs. 11,00,000, which of the following valuation principle is being followed?

The debts, which are to be repaid within a short period (year or less) are known as

Mohan purchased a machinery amounting Rs. 10,00,000 on 1st April, 2000. On 31st March, 2006 The similar machinery could be purchased for Rs. 20,00,000 but the realizable value of the machinery (purchased on 1.4.2000) was estimated at Rs. 15,00,000. The present discounted value of the future net cash inflows that the machinery was expected to generate in the normal course of business, was calculated as Rs. 12,00,000.

Q. The current cost of the machinery is

Mohan purchased a machinery amounting Rs. 10,00,000 on 1st April, 2000. On 31st March, 2006 The similar machinery could be purchased for Rs. 20,00,000 but the realizable value of the machinery (purchased on 1.4.2000) was estimated at Rs. 15,00,000. The present discounted value of the future net cash inflows that the machinery was expected to generate in the normal course of business, was calculated as Rs. 12,00,000.

Q.The present value of machinery is

Mohan purchased a machinery amounting Rs. 10,00,000 on 1st April, 2000. On 31st March, 2006 The similar machinery could be purchased for Rs. 20,00,000 but the realizable value of the machinery (purchased on 1.4.2000) was estimated at Rs. 15,00,000. The present discounted value of the future net cash inflows that the machinery was expected to generate in the normal course of business, was calculated as Rs. 12,00,000.

Q.

The historical cost of machinery is

Mohan purchased a machinery amounting Rs. 10,00,000 on 1st April, 2000. On 31st March, 2006 The similar machinery could be purchased for Rs. 20,00,000 but the realizable value of the machinery (purchased on 1.4.2000) was estimated at Rs. 15,00,000. The present discounted value of the future net cash inflows that the machinery was expected to generate in the normal course of business, was calculated as Rs. 12,00,000.

Q.

The realizable value of machinery is

|

68 videos|160 docs|83 tests

|