SIDBI Assistant Manager Mock Test - 7 - Banking Exams MCQ

30 Questions MCQ Test - SIDBI Assistant Manager Mock Test - 7

Study the following arrangement to answer the given questions 456 789 145 392 140 653 806

Q.

If the position of the first and second digit is interchanged then what will be the second lowest number ?

Directions to Solve: In each of the questions below consists of a question and two statements numbered I and II given below it. You have to decide whether the data provided in the statements are sufficient to answer the question. Read both the statements and

Give answer:

- (A) If the data in statement I alone are sufficient to answer the question, while the data in statement II alone are not sufficient to answer the question

- (B) If the data in statement II alone are sufficient to answer the question, while the data in statement I alone are not sufficient to answer the question

- (C) If the data either in statement I alone or in statement II alone are sufficient to answer the question

- (D) If the data given in both statements I and II together are not sufficient to answer the question and

- (E) If the data in both statements I and II together are necessary to answer the question.

Question: On which date in August was Kapil born ?

Statements:

I.Kapil's mother remembers that Kapil was born before nineteenth but after fifteenth.

II.Kapil's brother remembers that Kapil was born before seventeenth but after twelfth.

- (A) If the data in statement I alone are sufficient to answer the question, while the data in statement II alone are not sufficient to answer the question

- (B) If the data in statement II alone are sufficient to answer the question, while the data in statement I alone are not sufficient to answer the question

- (C) If the data either in statement I alone or in statement II alone are sufficient to answer the question

- (D) If the data given in both statements I and II together are not sufficient to answer the question and

- (E) If the data in both statements I and II together are necessary to answer the question.

Statements:

I.Kapil's mother remembers that Kapil was born before nineteenth but after fifteenth.

II.Kapil's brother remembers that Kapil was born before seventeenth but after twelfth.

A is the son of C; C and Q are sisters; Z is the mother of Q and P is the son of Z. Which of the following statements is true?

Directions: Study the given information carefully to answer the following question.

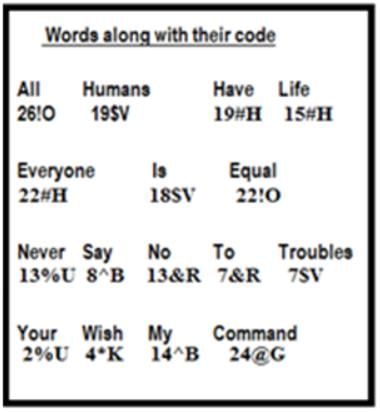

Below are the combination of sentences and their specific code in a certain language:

All Humans Have Life – 19$V 26!O 15#H 19#H

Everyone Is Equal – 22!O 22#H 18$V

Never Say No To Troubles – 13%U 7&R 8^B 13&R 7$V

Your Wish My Command – 4*K 14^B 2%U 24@G

Q. How will 'Incredible' be coded as according to this code language?

Direction: In each question below is given a statement followed by two conclusions numbered I and II. You have to assume everything in the statement to be true, then consider the two conclusions together and decide which of them logically follows beyond a reasonable doubt from the information given in the statement.

Statements: To cultivate interest in reading, the school has made it compulsory from June this year for each student to read two books per week and submit a weekly report on the books.

Conclusions:

- Interest in reading can be created by force.

- Some students will eventually develop interest in reading.

Direction: In each question below is given a statement followed by two conclusions numbered I and II. You have to assume everything in the statement to be true, then consider the two conclusions together and decide which of them logically follows beyond a reasonable doubt from the information given in the statement.

Statements: The percentage of the national income shared by the top 10 per cent of households in India is 35.

Conclusions:

- When an economy grows fast, concentration of wealth in certain pockets of population takes place.

- The national income is unevenly distributed in India.

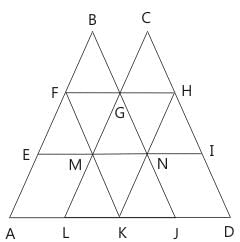

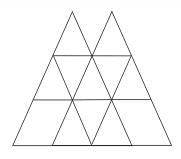

find the number of triangles in the given figure.

Directions: A word and number arrangement machine, when given an input line of words and numbers, rearranges them following a particular rule in each step. The following is an illustration of input and rearrangement.

Input: Fable 76 Quibble 24 Terrible 54 Able 82 Gamble 65

Step1:82 Fable 76 Quibble 24 Terrible 54 Gamble 65 Able

Step2:Fable 82 76 Quibble 24 Terrible 54 Gamble Able 65

Step3:76 Fable 82 Quibble 24 Terrible 54 Able 65 Gamble

Step4:Quibble 76 Fable 82 Terrible 54 Able 65 Gamble 24

Step5:54 Quibble 76 Fable 82 Able 65 Gamble 24 Terrible

Step 5 is the final output.

Find the different steps of output using the above mentioned logic for the following input.

Input: Scientific 29 Majaestic 34 Fantastic 58 Hectic 77 Genetic 84

Q. What is the position of '58' in step 1?

If a pipe A can fill a tank 3 times faster than pipe B. If both the pipes can fill the tank in 42 minutes, then the slower pipe alone will be able to fill the tank in?

Who is taller among A, B, C, D, and E?

I. D is shorter than B. A is shorter than only E.

II. B is taller than only D. E is taller than A and C.

How is Shubham related to Shivani?

I. Shubham is brother of Meenal. Shivani is niece of Preeti.

II. Neeraj is Meenal’s uncle and Preeti’s brother

How is ‘face’ written in that code?

I. In a certain code, ‘no one with face’ is written as ‘fo to om sop’ and ‘no one has face’ is written as ‘om sit fo sop’

II. In a certain code, ‘face of no light’ is written as ‘om mot fo kiz’ and ‘no one is smart’ is written as ‘sop fo sip lik’.

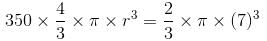

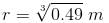

If 350 stones of spherical shape are dropped into a hemispherical cup containing some water, they get fully submerged. Diameter of the cup is 14 m. What will be the radius of the stone, if the water just spills off from the hemispherical cup?

What is the value of 'ab' in the following polynomial identity?

x6 + 1 = (x2 + 1)(x2 + ax + 1)(x2 + bx + 1)

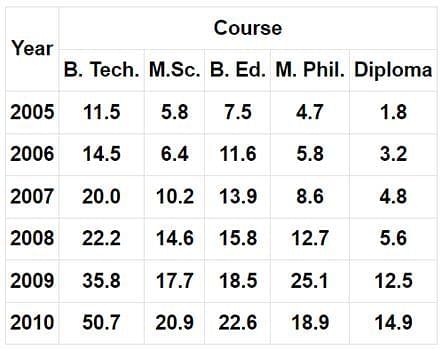

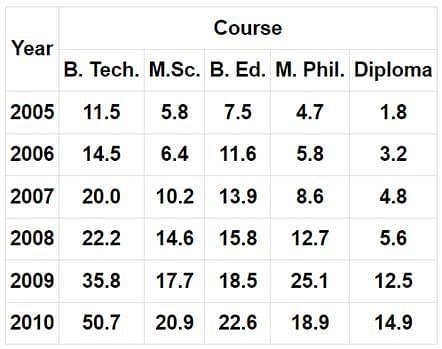

Directions: Study the following table carefully and answer the questions that follow:

Semester fees (In Rs. thousands) for five Different Courses in 6 different years.

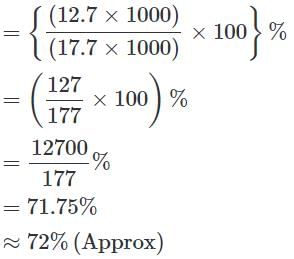

Q. The semester fee charged for M. Phil course in the year 2008 was approximately what percentage of the semester fee charged for M. Sc course in the year 2009?

Directions: Study the following table carefully and answer the questions that follow:

Semester fees (In Rs. thousands) for five Different Courses in 6 different years.

Q. What was the total semester fee charged for all the course together in the year 2006?

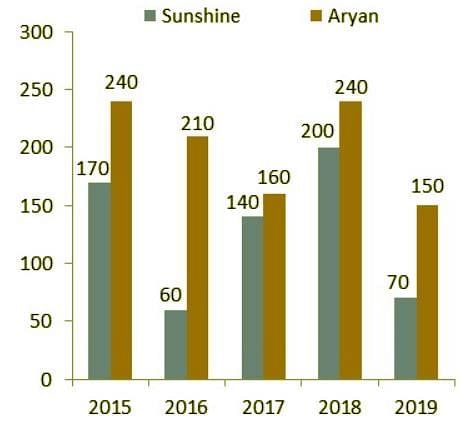

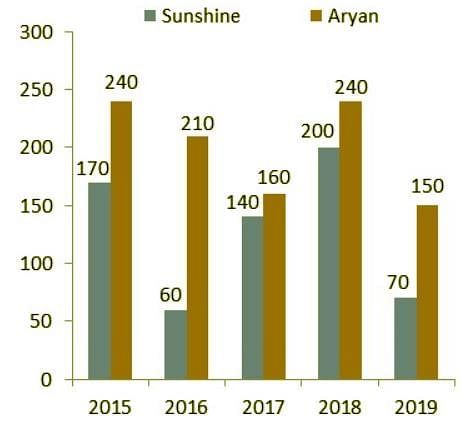

Directions: Study the following bar chart carefully and answer the questions given beside.

In the bar chart, the total numbers of students enrolled in different years from 2015 to 2019 in Sunshine and Aryan Summer camps are given.

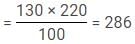

Q. If in the year 2020 there is 30% increase in total number of students enrolled as compared to 2019, find the total number of students enrolled in 2020?

Directions: Study the following bar chart carefully and answer the questions given beside.

In the bar chart, the total numbers of students enrolled in different years from 2015 to 2019 in Sunshine and Aryan Summer camps are given.

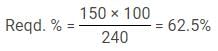

Q. Total students enrolled in Aryan in 2018 and 2019 together is what percentage more than students enrolled in Sunshine in 2015 and 2019 together?

Direction: Read the following information carefully and answer the questions given below it.

Natasha wants to pursue her B. Tech from Massachusetts Institute of Technology, United States, but to be able to afford it, she has to take an education loan. The loan agreement guaranteed to pay 80% of all her expenses. This way she only had to bear the remaining costs. As soon as she landed in the United States, she had to pay the rent for her new apartment. The apartment rent was $550 per month. She then paid her tuition fee for the current semester worth $25000. On an average she spent $340 on utilities and groceries per month. Given that, Natasha's course lasted a total of two years (comprising of 2 semesters per year) and the bank gave 80% of the total expenses of two years at the beginning of her course.

Q. Natasha gets an internship for a period of 3 months. The company where she'll be doing internship pays $12000 per month. The utilities and rent for these 3 months is what percentage of the total amount she earns from the internship?

Directions: Read the passage and answer the questions that follow:

The deadline for the completion of the resolution process under the Insolvency and Bankruptcy Code (IBC), 2016 for the first set of cases taken up has neared or even passed. The IBC provides for a time limit of 180 days (extendable by 90 days) once a case of default is brought and If no resolution plan drawn up under the supervision of a resolution professional can be agreed upon, liquidation must follow to recover whatever sums are possible. While the NCLT has considered a number of cases since its constitution, its role assumed importance when, on 13 June 2017, the Reserve Bank of India (RBI) mandated proceedings against 12 large defaulters, holding accounts with outstanding amounts of more than Rs 5,000 crore, of which at least 60% had been classified as non-performing as of 31 March 2016. These bad loans accounted for around 25% of the non-performing assets (NPAs) recognised at that time.

In most cases, the estimated value of assets on liquidation is low, and does not capture the true value of the company. Put simply, the aggregate of the individual value of a set of stripped assets tends to be much lower than the value of those assets when combined for production. So, if the IBC process and the intervention of the NCLT lead, through bidding, to an offer of a takeover by a third party which is acceptable to the creditors, the recovery against bad loans technically written off by financial creditors would be much higher. Since this was to occur in a time-bound fashion, it seemed to be a significant initiative to address the NPA problem in the banking system. The IBC was combined with legislative amendments that strengthened the powers of the RBI to order the launch of proceedings to recover the loans gone bad. These measures, it was argued, through enforced resolution or liquidation if necessary, offered a way in which the abysmal record of recovery could be corrected and the pressure on the government to bail out banks with taxpayers’ money could be reduced. In the case of 11 public sector banks out of a total of 21, of the loans technically written-off between April 2014 and December 2017, recovery rates varied from nil to just above 20%, and in the case of another three, the rate ranged between 23% and 29%. The average recovery rate for all 21 banks was a pathetic 10.8%. By facilitating and accelerating the recovery effort, the IBC process was expected to raise the rate significantly.

The context in which this new strategy was launched needs recalling. Unlike the period prior to the 1990s, the NPAs that accumulated in the books of banks in recent years were not equitably distributed across different categories of borrowers, big and small, priority and non-priority. Rather, because of a change in the lending strategy during the period of the credit boom after 2003, the NPAs are now concentrated in the hands of large borrowers, primarily corporate borrowers.

The initial experience with the first phase of this multistep process involving the recognition, technical write-off and provisioning, and recovery of NPAs, is revealing for a number of reasons. First, in cases where the assets on offer were of special interest to particular bidders, the rates of recovery have been rather high. This was true of the acquisition of Bhushan Steel by Tata Steel and of Electrosteel by Vedanta. Bhushan Steel owed its financial creditors around Rs 56,000 crore, whereas the Tata Steel bid returned Rs 35,200 crore upfront to the financial creditors, besides giving them a 12.3% stake in the company in lieu of returning the remaining debt. That was substantial relative to the estimated liquidation value of Rs 15,000 crore to Rs 20,000 crore, and far better than the average 10% recovery rate reported on aggregate write-offs in the recent past. The Tatas clearly had a special interest in the deal since its valuation of the company was far higher than that of JSW Group, the other keen bidder. The latter offered the creditors only Rs 29,700 crore.

The evidence that the assets were valuable despite the defaults emerged also from the battle between bidders who were often taken to the courts. Essar Steel, one of the largest defaulters with around Rs 44,000 crore in questionable debt, when put up for sale, elicited expressions of interest from five bidders. Interestingly, besides Tata Steel, Arcelor Mittal, Vedanta, Sumitomo, and Steel Authority of India, the interested parties include the Ruias, who are the original promoters of Essar Steel.

This effort of the defaulting promoters to regain control of the companies concerned at a discount did muddy the water. The original IBC bill did not prevent promoters from making bids for resolution at the NCLT. Some justified the Ruia bid on the grounds that extraneous factors may have led to distress for no fault of the original promoters. But, if the Committee of Creditors (CoC) has taken the firm to the NCLT, it is clearly because they saw the incumbent management as incapable of resolving the crisis faced by the firm. And, if promoters regain control, much of the debt their company owes will be forgiven, with the losses being carried by the financial and operational creditors. Recognising the travesty involved, the government was forced to amend the IBC bill to prohibit promoters from bidding under the NCLT process.

Q. Why was the IBC process combined with legal powers?

I. To enable carrying out resolution or liquidation as per the need of the situation.

II. To decrease the pressure on government to bail banks out.

III. To improve the recovery rates on loans.

Consider the following statements regarding the various measures of atmospheric humidity:

1. Generally Absolute humidity does not change with increase or decrease of temperature, if no additional vapour is added through additional evaporation.

2. Specific humidity is affected by changes in air pressure or air temperature because it is measured in units of weight (grams)

Q. Select the correct answer using the codes given below.

Which of the following metals form an amalgam with other metals?

Which wood will become useless soon after exposing in the open air -

Call money rate is the rate at which short-term funds are borrowed and lent in the money market overnight. When the money is borrowed or lent for exceeding 14 days to 365 days, then it is called ______________.

The RBI has established various trigger points for assessing, monitoring, controlling, and correcting weak and troubled banks. Which of the following are the trigger points established by the RBI?

What are the Advantages of the Automated Teller Machine (ATM)?

Which of the following is not one among the Types of ATMs found in India?

The Reserve Bank of India (RBI) has introduced the prompt corrective action (PCA) framework for non-banking financial companies (NBFCs). The PCA framework for NBFCs will come into effect from which month?

Who assumed the position of Additional Secretary in the Department of Military Affairs?

Who recently assumed charge as the Punjab Chief Secretary?