MH SET Paper 2 Mock Test - 9 (Commerce) - MAHA TET MCQ

30 Questions MCQ Test MH SET Mock Test Series 2025 - MH SET Paper 2 Mock Test - 9 (Commerce)

Goods and Service tax came into effect from?

For the purpose of extending rural banking and agro finance, the NABARD :

The Fortune at the Bottom of Pyramid : Eradicating Poverty’ has been written by

The seasonal products like a raincoat, umbrella, etc. enjoy demand at peak only during a certain season. Under which marketing concept does this exempt classify?

The budgets are classified on the basis of:

The accounting principle that states companies and owners should be accounted for separately is:

Capital deficiency of an insolvent partner at the time of the dissolution is to be distributed in the:

Direction: In the following question, a given questions is followed by information in two statements. You have to find out the data in which statement (s) is sufficient to answer the question and mark your answer accordingly.

Statement I: Matrix organisation aims to combine the benefits of decentralisation with those of coordination.

Statement II: A divisional structure is common in organisations that have outgrown the entrepreneurial structure.

Choose the correct option from the following:

Which of the following statements is/are true with respect to Income Tax?

- Income tax is levied on the income of individuals.

- In India, the nature of the income tax is progressive.

- The first income tax is generally attributed to Egypt.

- Income tax generally is computed as the product of a tax rate times taxable income.

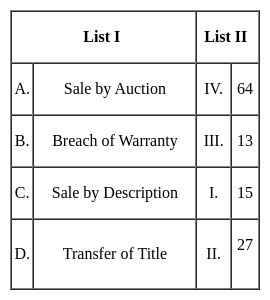

Match List I with List II:

Choose the correct answer from the options given below:

Which act was created from the sections of the Indian Contract Act 1872?

Direction: For the Assertion (A) and Reason (R) given below, choose the correct alternative.

Statement (A): The demand for the product of a firm under Oligopoly is at prices higher than the prevailing market prices.

Reason (R): The Oligopolistic firm faces a kinked demand curve.

An exception report for management is an example of which of the following?

Which one of the following MIS systems is designed to capture, collect or enter the data to process in a certain specified manner for further processing ?

With reference to Inflation accounting, which of the following is not correct?

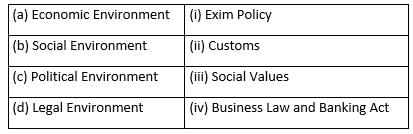

Direction: Match the following components of the business environment.

Which of the following can be inferred from below statement?

‘Given the complexity of the legacy taxes that GST subsumed and replaced and the teething troubles of operating a new tax system, ensuring optimal outcomes has proved an abiding challenge’?

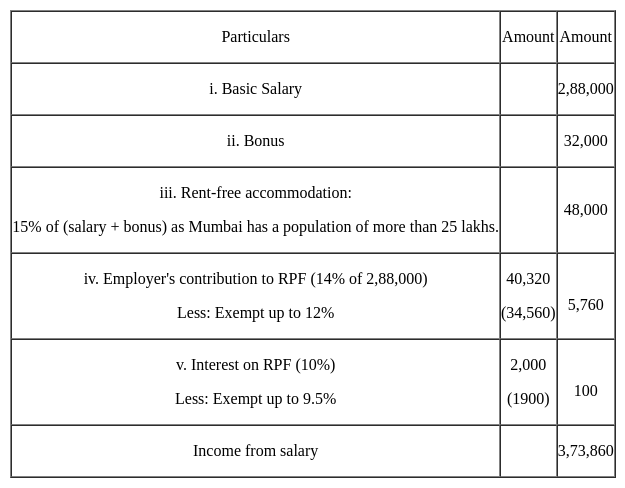

An individual received a salary of Rs. 2,88,000 and bonus of Rs. 32,000. He contributed 15% of the salary to RPF to which his employer contributed 14 percent. He is provided with a rent-free house in Mumbai. The interest credited to his RPF is Rs. 2,000 @ 10% per annum. His income from salary for the A.Y. 2015-16 will be:

Identify the correct statement from the following.

Which one among the following grew along with insurance business in India?

Which of the following is not the objective of Competition act 2002?

When a partnership dissolves, the balance of a partner's capital account on the assets side of a balance sheet is transferred to:

|

60 tests

|