Test: Retirement Of A Partner - 1 - Commerce MCQ

20 Questions MCQ Test - Test: Retirement Of A Partner - 1

A, B and C are partners with profits sharing ratio 4:3:2. B retires and Goodwill Rs. 10,800 was shown in books of account. If A & C shares profits of B in 5:3, then find the value of goodwill shared between A and C.

What is the liability status of a retiring or outgoing partner in a partnership?

A, B, and C were partners in a firm sharing profits and losses in the ratio of 2:2:1, respectively, with capital balances of Rs. 50,000 for A and B, and Rs. 25,000 for C. B declared to retire from the firm, and the balance in reserve on that date was Rs. 15,000. If the goodwill of the firm was valued at Rs. 30,000 and the profit on revaluation was Rs. 7,050, what amount will be transferred to the loan account of B?

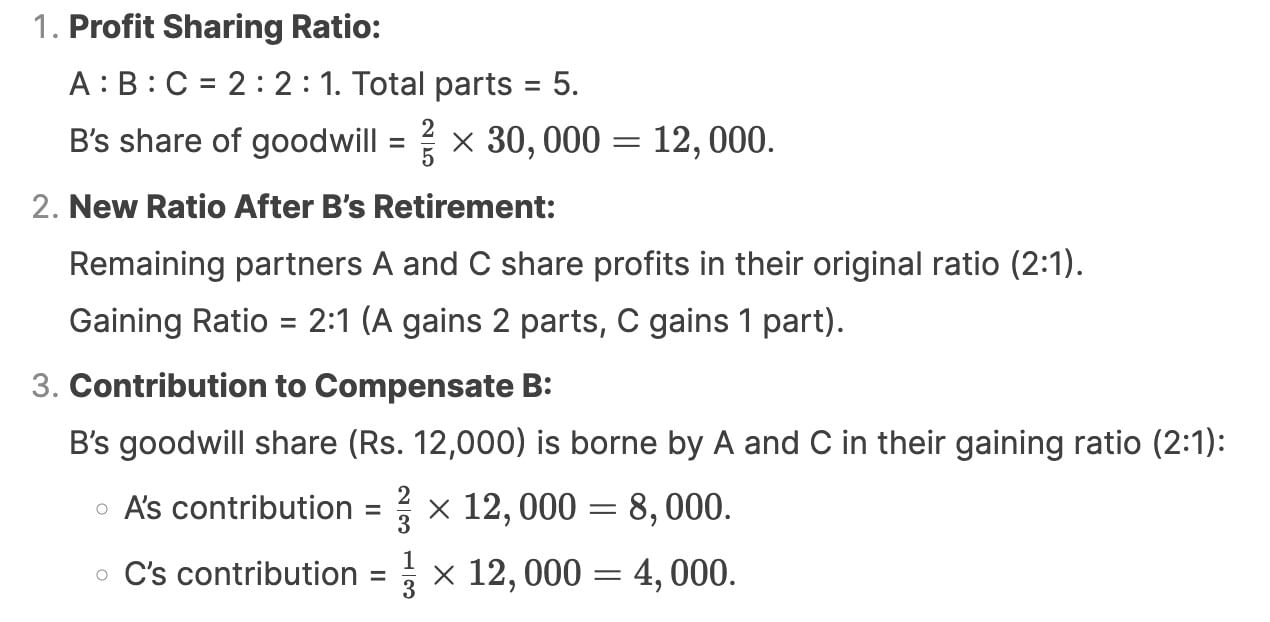

A, B and C are partners sharing profits in the ratio 2:2:1. On retirement of B, goodwill was valued as Rs. 30,000. Find the contribution of A and C to compensate B.

A, B, and C are partners with capitals of Rs. 1,00,000, Rs. 75,000 and Rs. 50,000. On C’s retirement his share is acquired by A and B in the ration of 6:4. Gaining ratio will be:

A, B, and C are partners with a profit-sharing ratio of 4:3:2. B retires. If A and C share B's profits in the ratio of 5:3, what is the new profit-sharing ratio among A and C?

Hari, Roy, and Prasad are partners in the ratio of 3:5:1 respectively. Roy wants to retire, and his share is being purchased by Prasad. What will be the new ratio of Hari and Prasad's shares respectively?

A, B, and C are partners sharing profits equally. A retires, and goodwill appearing in the books at Rs. 3,000 is valued at Rs. 6,000. How much will A get credited for goodwill?

A, B, and C are partners sharing profits in the ratio of 2:2:1. A's capital is Rs. 50,000, B's capital is Rs. 70,000, and C's capital is Rs. 35,000. B retires from the firm, and the balance in reserve on the date was Rs. 25,000. If the goodwill of the firm was valued at Rs. 30,000 and the profit on revaluation was Rs. 7,500, what is the total amount payable to B upon retirement?