Test: Dissolution of a Partnership Firm- Case Based Type Questions - Commerce MCQ

12 Questions MCQ Test Online MCQ Tests for Commerce - Test: Dissolution of a Partnership Firm- Case Based Type Questions

Read the following information and answer the questions that follow:

Raina and Meena were partners in a firm sharing profits and losses equally. They dissolved their firm on 31st March, 2018.

On this date, the Balance Sheet of the firm, apart from realizable assets and outside liabilities showed the following:

₹

Raina's Capital 40,000 (Cr.)

Meena's Capital 20,000 (Dr.)

Profit & Loss Account 10,000 (Dr.)

Raina’s loan to the firm 15,000

Contingency Reserve 7,000

On the date of dissolution of the firm:

(a) Raina’s loan was repaid by the firm along with interest of ₹ 500.

(b) The dissolution expenses of ₹ 1,000 were paid by the firm on behalf of Raina who had to bear these expenses.

(c) An unrecorded asset of ₹ 2,000 was taken over by Meena while Raina discharged an unrecorded liability of ₹ 3,000.

(d) The dissolution resulted in a loss of 60,000 from the realization of assets and settlement of liabilities.

Q. How much loan amount will be paid to Raina?

Read the following information and answer the questions that follow:

Raina and Meena were partners in a firm sharing profits and losses equally. They dissolved their firm on 31st March, 2018.

On this date, the Balance Sheet of the firm, apart from realizable assets and outside liabilities showed the following:

₹

Raina's Capital 40,000 (Cr.)

Meena's Capital 20,000 (Dr.)

Profit & Loss Account 10,000 (Dr.)

Raina’s loan to the firm 15,000

Contingency Reserve 7,000

On the date of dissolution of the firm:

(a) Raina’s loan was repaid by the firm along with interest of ₹ 500.

(b) The dissolution expenses of ₹ 1,000 were paid by the firm on behalf of Raina who had to bear these expenses.

(c) An unrecorded asset of ₹ 2,000 was taken over by Meena while Raina discharged an unrecorded liability of ₹ 3,000.

(d) The dissolution resulted in a loss of 60,000 from the realization of assets and settlement of liabilities.

Q. The contingency fund will be debited or credited to which account?

Read the following information and answer the questions that follow:

Raina and Meena were partners in a firm sharing profits and losses equally. They dissolved their firm on 31st March, 2018.

On this date, the Balance Sheet of the firm, apart from realizable assets and outside liabilities showed the following:

₹

Raina's Capital 40,000 (Cr.)

Meena's Capital 20,000 (Dr.)

Profit & Loss Account 10,000 (Dr.)

Raina’s loan to the firm 15,000

Contingency Reserve 7,000

On the date of dissolution of the firm:

(a) Raina’s loan was repaid by the firm along with interest of ₹ 500.

(b) The dissolution expenses of ₹ 1,000 were paid by the firm on behalf of Raina who had to bear these expenses.

(c) An unrecorded asset of ₹ 2,000 was taken over by Meena while Raina discharged an unrecorded liability of ₹ 3,000.

(d) The dissolution resulted in a loss of 60,000 from the realization of assets and settlement of liabilities.

Q. The amount of Profit and Loss Account to be transferred to the Partner’s Capital Account is:

Read the following information and answer the questions that follow:

Raina and Meena were partners in a firm sharing profits and losses equally. They dissolved their firm on 31st March, 2018.

On this date, the Balance Sheet of the firm, apart from realizable assets and outside liabilities showed the following:

₹

Raina's Capital 40,000 (Cr.)

Meena's Capital 20,000 (Dr.)

Profit & Loss Account 10,000 (Dr.)

Raina’s loan to the firm 15,000

Contingency Reserve 7,000

On the date of dissolution of the firm:

(a) Raina’s loan was repaid by the firm along with interest of ₹ 500.

(b) The dissolution expenses of ₹ 1,000 were paid by the firm on behalf of Raina who had to bear these expenses.

(c) An unrecorded asset of ₹ 2,000 was taken over by Meena while Raina discharged an unrecorded liability of ₹ 3,000.

(d) The dissolution resulted in a loss of 60,000 from the realization of assets and settlement of liabilities.

Q. The unrecorded asset taken by Meena will be:

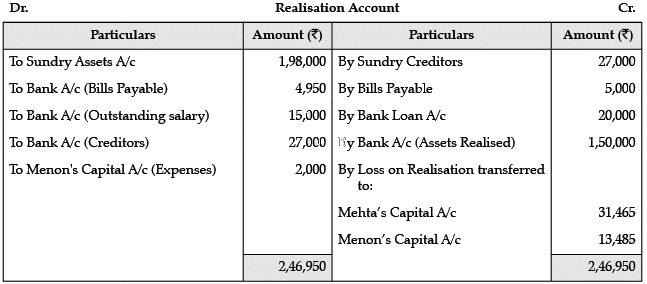

Read the following information and answer the questions that follows: Mehta and Menon were partners in a firm sharing profits and losses in the ratio of 7 : 3. They decided to dissolve firm on 31st March, 2016 on that date, their books showed the following ledger account balances :

₹

Sundry Creditors 27,000

Profit & Loss A/c (Dr.) 8,000

Cash in hand 6,000

Bank Loan 20,000

Bills Payable 5,000

Sundry Assets 1,98,000

Capital A/cs :

Mehta 1,12,000

Menon 48,000

Additional information :

(i) Bills payable falling due on 31st May, 2016 retired on the date of dissolution of the firm at a rebate of 6% per annum.

(ii) The bankers accepted the furniture (included in sundry assets) having a book value of ₹18,000 in full settlement of the loan given by them.

(iii) Remaining assets were sold for ₹ 1,50,000.

(iv) Liability on account of outstanding salary not recorded in the books, amounting to ₹15,000 was met.

(v) Menon agreed to take over the responsibility of completing the dissolution work to bear all expenses of realization at an agreed remuneration of ₹2,000. The actual realization expenses were ₹1,500 which were paid by the firm on behalf of Menon.

Q. The loss on the realisation transferred to Menon’s Capital Account is:

Read the following information and answer the questions that follows: Mehta and Menon were partners in a firm sharing profits and losses in the ratio of 7 : 3. They decided to dissolve firm on 31st March, 2016 on that date, their books showed the following ledger account balances :

₹

Sundry Creditors 27,000

Profit & Loss A/c (Dr.) 8,000

Cash in hand 6,000

Bank Loan 20,000

Bills Payable 5,000

Sundry Assets 1,98,000

Capital A/cs :

Mehta 1,12,000

Menon 48,000

Additional information :

(i) Bills payable falling due on 31st May, 2016 retired on the date of dissolution of the firm at a rebate of 6% per annum.

(ii) The bankers accepted the furniture (included in sundry assets) having a book value of ₹18,000 in full settlement of the loan given by them.

(iii) Remaining assets were sold for ₹ 1,50,000.

(iv) Liability on account of outstanding salary not recorded in the books, amounting to ₹15,000 was met.

(v) Menon agreed to take over the responsibility of completing the dissolution work to bear all expenses of realization at an agreed remuneration of ₹2,000. The actual realization expenses were ₹1,500 which were paid by the firm on behalf of Menon.

Q. The amount of Bills payable paid is:

Read the following information and answer the questions that follows: Mehta and Menon were partners in a firm sharing profits and losses in the ratio of 7 : 3. They decided to dissolve firm on 31st March, 2016 on that date, their books showed the following ledger account balances :

₹

Sundry Creditors 27,000

Profit & Loss A/c (Dr.) 8,000

Cash in hand 6,000

Bank Loan 20,000

Bills Payable 5,000

Sundry Assets 1,98,000

Capital A/cs :

Mehta 1,12,000

Menon 48,000

Additional information :

(i) Bills payable falling due on 31st May, 2016 retired on the date of dissolution of the firm at a rebate of 6% per annum.

(ii) The bankers accepted the furniture (included in sundry assets) having a book value of ₹18,000 in full settlement of the loan given by them.

(iii) Remaining assets were sold for ₹ 1,50,000.

(iv) Liability on account of outstanding salary not recorded in the books, amounting to ₹15,000 was met.

(v) Menon agreed to take over the responsibility of completing the dissolution work to bear all expenses of realization at an agreed remuneration of ₹2,000. The actual realization expenses were ₹1,500 which were paid by the firm on behalf of Menon.

Consider the following Accounts:

(i) Mehta’s Capital Account

(ii) Menon’s Capital Account

(iii) Realisation Account

(iv) Profit and Loss Account

Q. Which account will be affected by the realisation expenses paid by Menon?

Read the following information and answer the questions that follows: Mehta and Menon were partners in a firm sharing profits and losses in the ratio of 7 : 3. They decided to dissolve firm on 31st March, 2016 on that date, their books showed the following ledger account balances :

₹

Sundry Creditors 27,000

Profit & Loss A/c (Dr.) 8,000

Cash in hand 6,000

Bank Loan 20,000

Bills Payable 5,000

Sundry Assets 1,98,000

Capital A/cs :

Mehta 1,12,000

Menon 48,000

Additional information :

(i) Bills payable falling due on 31st May, 2016 retired on the date of dissolution of the firm at a rebate of 6% per annum.

(ii) The bankers accepted the furniture (included in sundry assets) having a book value of ₹18,000 in full settlement of the loan given by them.

(iii) Remaining assets were sold for ₹ 1,50,000.

(iv) Liability on account of outstanding salary not recorded in the books, amounting to ₹15,000 was met.

(v) Menon agreed to take over the responsibility of completing the dissolution work to bear all expenses of realization at an agreed remuneration of ₹2,000. The actual realization expenses were ₹1,500 which were paid by the firm on behalf of Menon.

Q. What will be the amount of past loss transferred to Mehta’s Account?

A partner paid 700 for the firm's realization expenses when the firm was dissolved.

Read the following information and answer the given questions:

Vibhuti, Tiwari and Happu were partners in a partnership firm sharing profits and losses in their capital ratio, i.e., 1 : 2 : 3. On 31st March 2020, they decided to dissolve the partnership firm. The following information is given to you on the dissolution of the firm: The firm had total assets of ₹ 12,00,000 that realized ₹ 10,80,000. The creditors were settled at 90% by paying them ₹54,000. There was an unrecorded asset in the books of the firm which was taken by Vibhuti for ₹ 12,000. Realisation expenses amounted to ₹ 2,000 and were paid by Tiwari on behalf of the firm. There was a general reserve in the books of the company of ₹ 21,000. The capitals of the partners were in the proportion of their profit sharing ratio. Their balance sheet also showed a cash balance of ₹ 81,000.

Q. What will be the final amount to be paid to Happu?

Read the following information and answer the given questions:

Vibhuti, Tiwari and Happu were partners in a partnership firm sharing profits and losses in their capital ratio, i.e., 1 : 2 : 3. On 31st March 2020, they decided to dissolve the partnership firm. The following information is given to you on the dissolution of the firm: The firm had total assets of ₹ 12,00,000 that realized ₹ 10,80,000. The creditors were settled at 90% by paying them ₹54,000. There was an unrecorded asset in the books of the firm which was taken by Vibhuti for ₹ 12,000. Realisation expenses amounted to ₹ 2,000 and were paid by Tiwari on behalf of the firm. There was a general reserve in the books of the company of ₹ 21,000. The capitals of the partners were in the proportion of their profit sharing ratio. Their balance sheet also showed a cash balance of ₹ 81,000.

Q. What was the capital of Tiwari before the dissolution of the firm?

Read the following information and answer the given questions:

Vibhuti, Tiwari and Happu were partners in a partnership firm sharing profits and losses in their capital ratio, i.e., 1 : 2 : 3. On 31st March 2020, they decided to dissolve the partnership firm. The following information is given to you on the dissolution of the firm: The firm had total assets of ₹ 12,00,000 that realized ₹ 10,80,000. The creditors were settled at 90% by paying them ₹54,000. There was an unrecorded asset in the books of the firm which was taken by Vibhuti for ₹ 12,000. Realisation expenses amounted to ₹ 2,000 and were paid by Tiwari on behalf of the firm. There was a general reserve in the books of the company of ₹ 21,000. The capitals of the partners were in the proportion of their profit sharing ratio. Their balance sheet also showed a cash balance of ₹ 81,000.

Q. __________ account will be debited for the treatment of unrecorded assets given in case study.

|

691 tests

|