Commerce Exam > Commerce Questions > Distinguish between issue capital and called ...

Start Learning for Free

Distinguish between issue capital and called up capital?

Most Upvoted Answer

Distinguish between issue capital and called up capital?

Community Answer

Distinguish between issue capital and called up capital?

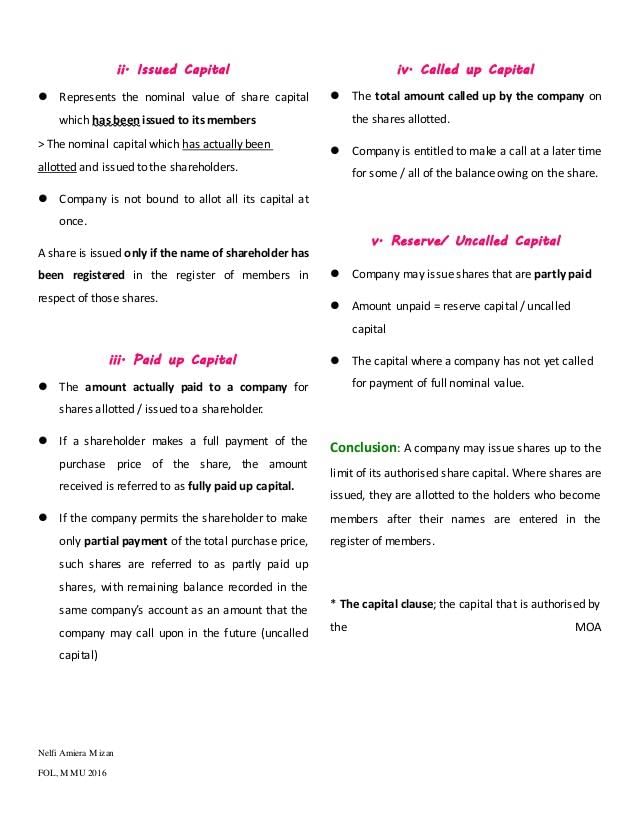

Issue Capital:

Issue capital refers to the total amount of capital that a company is authorized to issue or offer to investors. It represents the total value of shares that a company can sell to raise funds for its operations and expansion. Issue capital is typically determined and specified in the company's articles of association or memorandum of association.

Called up Capital:

Called up capital, on the other hand, represents the portion of the issued capital that has been demanded or called by the company from its shareholders. It refers to the amount of money that the shareholders are required to pay on their shares as per the terms of the share issue. The company may call up the capital in one or more installments, depending on its financial requirements and the terms of the share issue.

Key Differences:

1. Authorization vs. Demand:

- Issue capital is the total capital that a company is authorized to issue, whereas called up capital is the portion of the issued capital that has been demanded or called by the company from its shareholders.

2. Shareholder Liability:

- Shareholders are generally liable to pay the called up capital on their shares when demanded by the company. If they fail to do so, they may face legal consequences or loss of their shares.

- Shareholders are not liable to pay the remaining un-called portion of the issue capital, as it represents the authorized but not yet demanded capital.

3. Flexibility:

- Issue capital provides flexibility to the company as it can issue or offer shares up to the authorized limit without immediately demanding the entire capital from shareholders.

- Called up capital provides flexibility to the company in terms of when and how much capital to demand from shareholders based on the company's financial needs and shareholder agreements.

4. Capital Utilization:

- The company can utilize the entire issue capital for its operations and expansion, even if not all of it has been called up.

- The company can only utilize the portion of the called up capital that has been paid by shareholders.

5. Disclosure and Reporting:

- The company needs to disclose the details of the issue capital in its financial statements, share prospectus, and other relevant documents to provide transparency to investors and stakeholders.

- The company needs to disclose the details of the called up capital, including the amount called, paid, and unpaid, to maintain accurate records and comply with legal and regulatory requirements.

In conclusion, issue capital represents the total authorized capital of a company, while called up capital represents the portion of the issued capital that has been demanded or called by the company from its shareholders. The key differences lie in the authorization vs. demand nature, shareholder liability, flexibility, capital utilization, and disclosure and reporting requirements.

Issue capital refers to the total amount of capital that a company is authorized to issue or offer to investors. It represents the total value of shares that a company can sell to raise funds for its operations and expansion. Issue capital is typically determined and specified in the company's articles of association or memorandum of association.

Called up Capital:

Called up capital, on the other hand, represents the portion of the issued capital that has been demanded or called by the company from its shareholders. It refers to the amount of money that the shareholders are required to pay on their shares as per the terms of the share issue. The company may call up the capital in one or more installments, depending on its financial requirements and the terms of the share issue.

Key Differences:

1. Authorization vs. Demand:

- Issue capital is the total capital that a company is authorized to issue, whereas called up capital is the portion of the issued capital that has been demanded or called by the company from its shareholders.

2. Shareholder Liability:

- Shareholders are generally liable to pay the called up capital on their shares when demanded by the company. If they fail to do so, they may face legal consequences or loss of their shares.

- Shareholders are not liable to pay the remaining un-called portion of the issue capital, as it represents the authorized but not yet demanded capital.

3. Flexibility:

- Issue capital provides flexibility to the company as it can issue or offer shares up to the authorized limit without immediately demanding the entire capital from shareholders.

- Called up capital provides flexibility to the company in terms of when and how much capital to demand from shareholders based on the company's financial needs and shareholder agreements.

4. Capital Utilization:

- The company can utilize the entire issue capital for its operations and expansion, even if not all of it has been called up.

- The company can only utilize the portion of the called up capital that has been paid by shareholders.

5. Disclosure and Reporting:

- The company needs to disclose the details of the issue capital in its financial statements, share prospectus, and other relevant documents to provide transparency to investors and stakeholders.

- The company needs to disclose the details of the called up capital, including the amount called, paid, and unpaid, to maintain accurate records and comply with legal and regulatory requirements.

In conclusion, issue capital represents the total authorized capital of a company, while called up capital represents the portion of the issued capital that has been demanded or called by the company from its shareholders. The key differences lie in the authorization vs. demand nature, shareholder liability, flexibility, capital utilization, and disclosure and reporting requirements.

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

Distinguish between issue capital and called up capital?

Question Description

Distinguish between issue capital and called up capital? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Distinguish between issue capital and called up capital? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Distinguish between issue capital and called up capital?.

Distinguish between issue capital and called up capital? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Distinguish between issue capital and called up capital? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Distinguish between issue capital and called up capital?.

Solutions for Distinguish between issue capital and called up capital? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Distinguish between issue capital and called up capital? defined & explained in the simplest way possible. Besides giving the explanation of

Distinguish between issue capital and called up capital?, a detailed solution for Distinguish between issue capital and called up capital? has been provided alongside types of Distinguish between issue capital and called up capital? theory, EduRev gives you an

ample number of questions to practice Distinguish between issue capital and called up capital? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.